Importing air conditioners to the U.S. is a smart move. Demand is high and everybody is looking for a way to stay frosty in the hot summer months. However, AC units imported into the USA must follow certain rules and standards. We can help you bring them into the country without hassle.

Key Takeaways

In this article, we’ll explore the details of importing air conditioners and show you how partnering with USA Customs Clearance can take the guesswork out of the complicated import process.

With the scorching summer temperatures, air conditioning has become a necessity, even in northern states. Whether you choose inexpensive window units, ultra-modern ductless systems, or tried-and-true central air, demand for these products is consistently high.

The U.S. imports more AC units than any other country in the world. From 2021 to 2022, the total value of exported air conditioners grew from $57.9 billion to $63.4 billion. Units imported into the United States accounted for $13.1 billion of that share, or approximately 21% of total revenue.

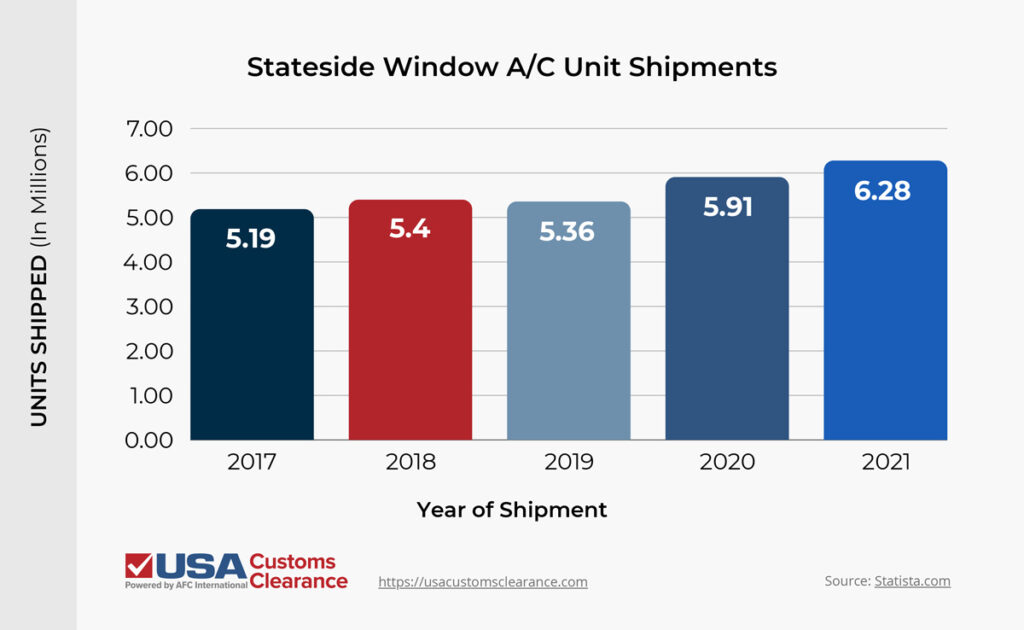

To further illustrate the growing demand for window AC units in the United States, I’ve listed five years worth of stateside window AC unit shipments in the table below.

If you want to capitalize on this demand, it’s a good idea to know your product, including the different varieties available to consumers.

Here's why getting into the business of importing them could be your next big break.

There are various types of AC units to consider importing, each catering to different consumer needs.

Out of these six designs, the U.S. market is dominated by window/wall units, ductless (including cassette ACs), portable, and central air conditioners.

Air conditioners are subject to regulations regarding energy efficiency and refrigerant use. Importers must ensure that the units comply with the Department of Energy's standards and EPA regulations regarding refrigerants.

Speaking of refrigerants, these chemicals are at the center of most import regulations regarding AC units. Over the years, studies have shown that refrigerants belonging to the chemical groups of chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs) have a profound negative impact on the ozone layer.

As of 2020, the following refrigerants can only be sourced from recovery and reclamation. They are no longer legal to manufacture.

These refrigerants were phased out in 2020 in favor of new formulations. These include:

As of January 2023, the industry has pivoted away from even these recent formulations in favor of R454-B, also known as Puron Advance. If you decide to import air conditioners, it’s in your best interest to ensure the units are charged with this up-to-date refrigerant, as the HVAC industry will use it as the new standard in the fourth quarter of 2024

It’s worth mentioning that certain refrigerants can only be purchased by individuals who have section 608 or 609 technician certifications under the Environmental Protection Agency (EPA). However, they’re not necessary if you are simply bringing in air conditioning equipment and components.

Look for units with the Energy Star badge. This indicates that the AC meets or exceeds energy efficiency standards set by the EPA. Also, be aware of the Seasonal Energy Efficiency Ratio (SEER) ratings, which indicate how efficiently the unit uses energy.

The US Department of Energy mandates a minimum rating of 13 for air conditioners. In most cases, units sold in the United States will have a SEER rating between 13 and 26, depending on quality and design.

Customs bonds are essential for any shipment valued at $2,500 or more. They guarantee that any necessary import duties and taxes will be paid once the imports reach port. Selecting the appropriate customs bond for your air conditioner imports is critical in ensuring a trouble-free importing process.

USA Customs Clearance is here to assist you with every aspect of importing products from overseas. We offer expert consulting services and can even put together an import compliance manual that addresses the specific rules and regulations governing the import process for AC units.

We can also provide other customs clearance services, including:

Don't let the complexities of importing leave you hot and bothered. Partner with USA Customs Clearance for a cool and profitable importing experience. Give us a call at 855-912-0406 or contact us via online today!

Copy URL to Clipboard

Copy URL to Clipboard

Hi We are planning to import ac from india and china OEM supply. Please advise what are all the certifications we need get before import and process and cost.

Intertek

SEER

AHR

A to Z complete import process and licenses we need to require?