As international trade became more of a day-to-day reality in the 20th century, a number of acts were passed in the United States granting the government authority to impose tariffs to protect domestic industries. The Trade Expansion Action of 1962 is one such act, and tariffs imposed under Section 232 continue to have a significant impact on trade between nations to this day.

Key Takeaways

Find out how Section 232 tariffs can impact your cost of doing business in this article.

By definition, a Section 232 tariff varies from other import levies since it is recommended, investigated, and implemented via a process laid out in Section 232 of the 1962 Trade Expansion act.

The act was initially used to grant authority to the U.S. president during trade negotiations, giving them latitude to negotiate rates of up to 80%. More recently, the Trump and Biden administrations have leaned on its provisions to increase tariffs on select commodities and materials that are vital to international trade.

Related: Section 301 Tariffs: A Comprehensive Guide

Get Expert Assistance With Duty Calculations, HTS classification, and More.

Our 45 Minute Licensed Import Consulting Session Will Personally Guide You.

For a specific example of how Section 232 tariffs are determined and applied, we can look to the imposition of steel and aluminum tariffs during President Trump’s first administration. In early 2018, he assessed several notable tariffs, including a 25% increase on steel and 10% increase on aluminum from most countries.

Section 232 also includes a provision that allows domestic manufacturers to request that competitive foreign goods receive high tariffs to help protect their US-based businesses.

Let’s take a closer look at some of the commodities that incur Section 232 tariffs.

There are three commodities primarily impacted by Section 232 tariffs, which are:

The rates of these tariffs can change almost overnight. In the following section, I’ve put together the current rates for the most common Section 232 tariffs, which will be updated as changes occur.

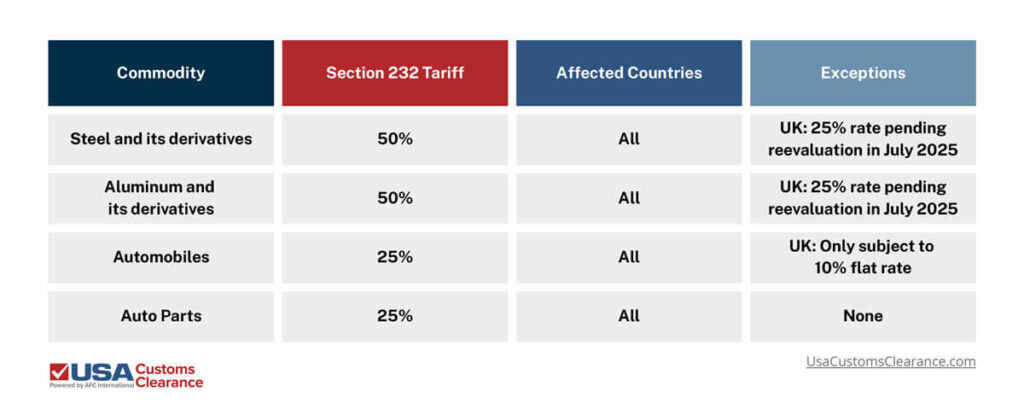

As of the time of this writing, the most significant of these import taxes are as follows:

Common derivative articles of steel and aluminum include hardware such as nails, staples, nuts, and bolts.

Importers should keep in mind that there is currently no exclusionary process for goods subject to Section 232 tariffs, only some country-by-country exceptions implemented by the presidential administration as part of certain trade deals.

The ever-shifting landscape of tariffs can cause even the most experienced importers to stumble and risk hurting their bottom line. If you’re unsure how much you should be prepared to pay in duties and tariffs, or you’re looking for ways to minimize these costs, we’re here to help.

The licensed customs brokers at USA Customs Clearance have decades of combined experience helping businesses of all sizes with each aspect of the importing process. Whether you need help calculating tariffs and duties or full brokerage services, we’re standing by to take the guesswork out of this complex process.

Our services include:

Call us at (855) 912-0406 or submit a contact form online today!

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post