Last Modified:

Total Duties & Taxes | Bond Size |

$0 to $499,999 | $50,000 |

$500,000 to $599,999 | $60,000 |

$600,000 to $699,999 | $70,000 |

$700,000 to $799,999 | $80,000 |

$800,000 to $899,999 | $90,000 |

$900,000 to $999,999 | $100,000 |

$1,000,000 to $1,999,999 | $200,000 |

$2,000,000 to $2,999,999 | $300,000 |

$3,000,000 to $3,999,999 | $400,000 |

$4,000,000 to $4,999,999 | $500,000 |

$5,000,000 to $5,999,999 | $600,000 |

$6,000,000 to $6,999,999 | $700,000 |

$7,000,000 to $7,999,999 | $800,000 |

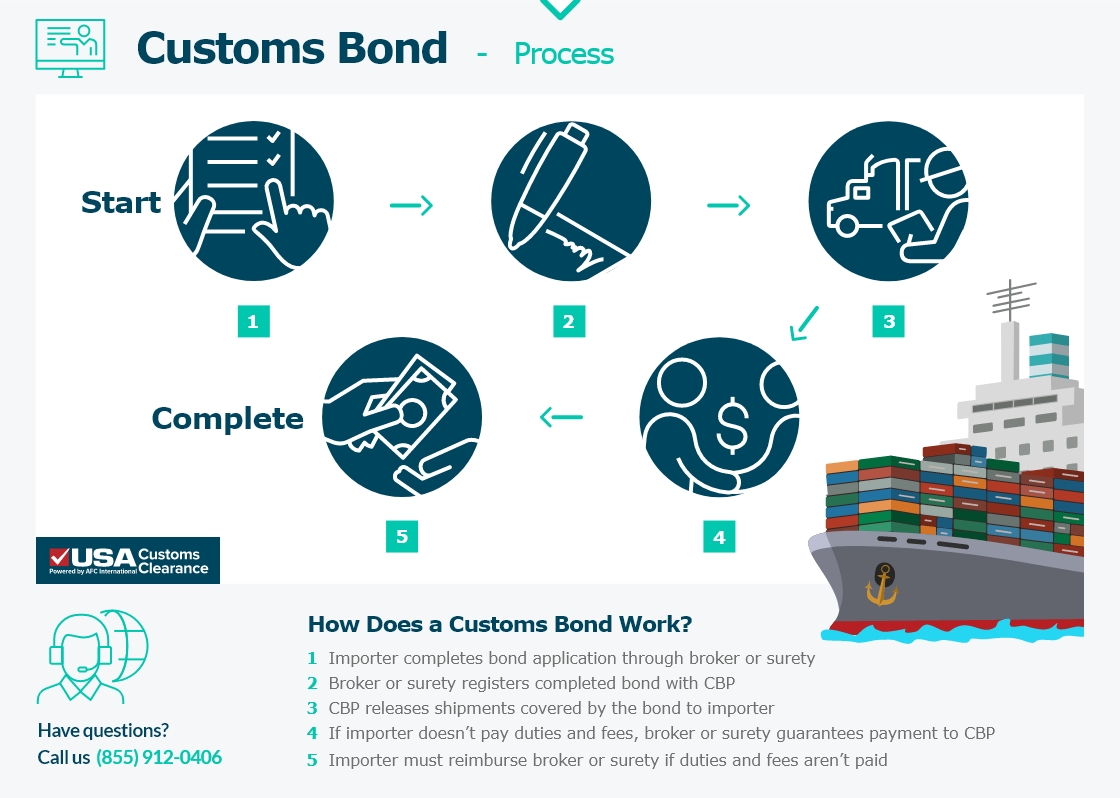

That means you did the right thing and got a customs bond! In short, a bonded shipment means your goods are covered for customs charges, including all duties, taxes and any penalties that may occur during the import process.

When you are shipping goods in-bond, that means your products are moving within the United States, but are still waiting on official customs clearance from Customs before the goods can officially be sold. Customs brokers can help your goods obtain official approval from CBP.

Import bonds are used by customs brokers to clear goods. The bond is critical because it:

If you fail to pay any of the fees owed on your shipment, the surety who issued your bond will pay the amount owed to CBP and then seek payment from you in full using legal means.

Yes, there are many different types of customs bonds, used for a variety of situations. Each type of bond is labeled with a different Activity Code.