As you know, customs duties on imports from China have been a pretty hot subject since early 2018, and they’ll continue to be for the foreseeable future. Staying abreast through 2024 on how each change may affect your business is crucial to your growth and success.

I promise these updates are quick, clear, and won’t cause a migraine or heart palpitations. However, if you need support, give us a call at (855) 912-0406.

Since 2018, the U.S.-China trade relationship has been on rocky ground due to the increased tariffs imposed under Section 301 policies. New changes were made based on the conclusion of the four-year review begun by the U.S. Trade Commission (USTR) in May 2024.

The Biden administration continued increasing current Section 301 tariff rates imposed on Chinese imports. These will impact approximately $18 billion worth of current Chinese exports to the US beginning this year and extending through 2026.

It’s also important to note that some exclusions previously extended are set to expire May 31, 2025. For more details on exclusions, see our handy dandy Track the Section 301 Tariff Exclusions List.

Should you need assistance with confirming any impact on your business between tariff and/or exclusion changes, you’re in luck. We have all the answers to your import and customs needs. Reach out online for help.

President-elect Trump has announced plans to expand and intensify tariffs on Chinese goods, which could significantly alter the scope and impact of the existing Section 301 import duties. These changes aim to address long-standing trade imbalances and other economic concerns with China.

The Section 301 tariffs that were implemented during Trump’s previous administration imposed levies ranging from 7.5% to 25% on an array of Chinese imports, including electronics, machinery, furniture, toys, plastics, and much more. Under the new proposal, Trump plans to add an additional 10% tariff to all Chinese goods already subject to Section 301 duties, further increasing costs for importers.

Beyond these increases, Trump has suggested removing China’s Most Favored Nation status, which could pave the way for even more extreme tariff measures, potentially exceeding 60%. Such moves would dramatically escalate the U.S.-China trade relationship and could lead to higher costs across supply chains, particularly for industries heavily reliant on Chinese manufacturing.

While specific details and implementation timelines remain uncertain, Trump has indicated that the expanded tariffs could be enacted as early as January 20, 2025. Importers should closely monitor developments and assess the potential financial and operational impacts of these proposed changes to Section 301 tariffs.

Proactive planning, such as diversifying supply chains or exploring alternative sourcing options, may help your business mitigate the effects of these potential increases. As U.S.-China trade relations continue to evolve, staying informed and agile will be key to navigating this uncertain landscape.

Learn more about How Trump’s Tariff Policies May Impact International Trade.

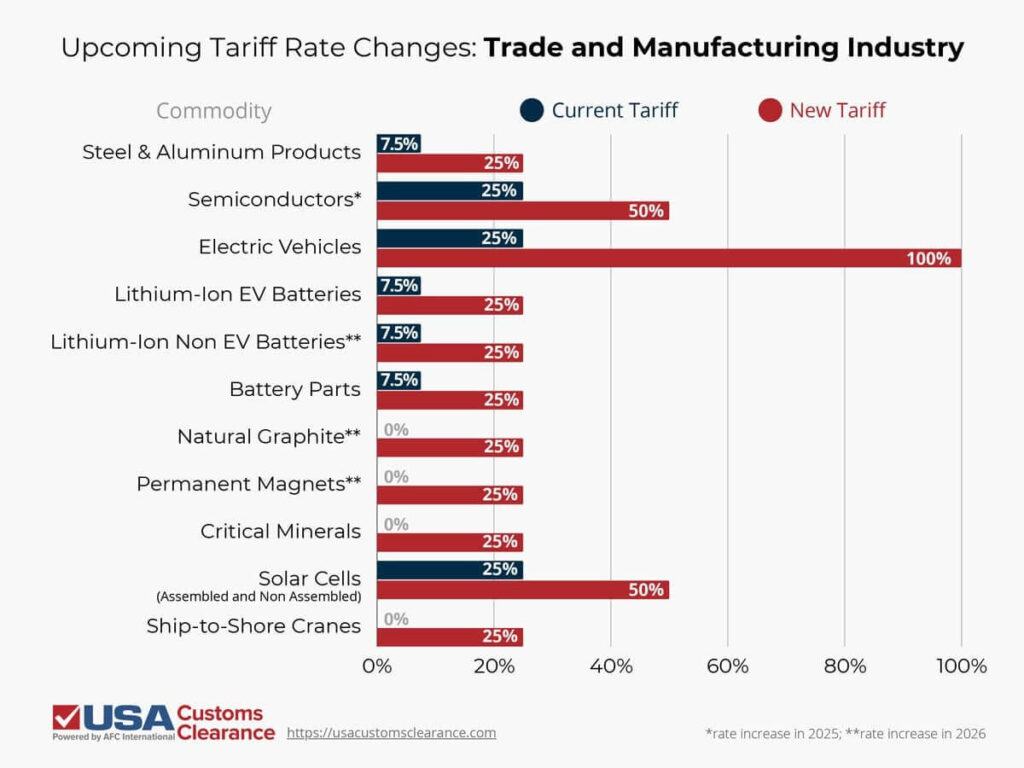

Based on the review findings of the USTR, President Biden is moving forward with increasing tariff rates on limited but crucial categories of commodities.

For those importing commodities used in manufacturing, more specifically the electric vehicle manufacturing industry, these increased rates will hit harder. These upcoming tariffs were confirmed September 2024.

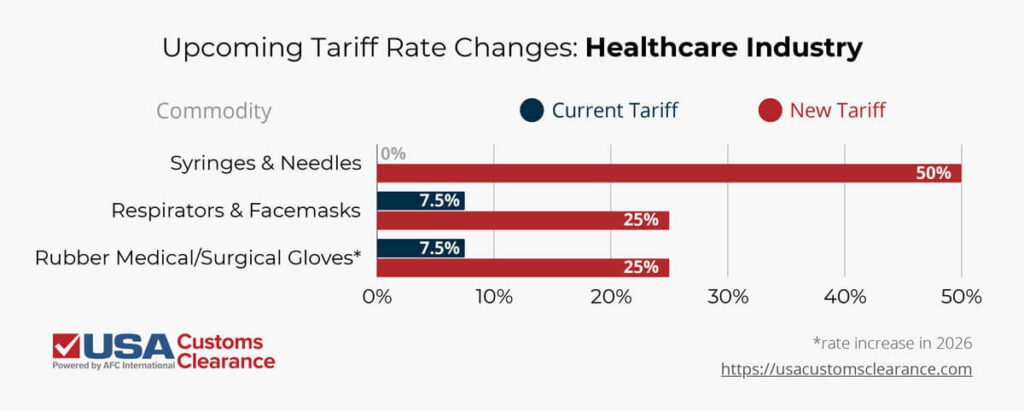

The medical and healthcare industry, still coming to a new normal in a post-pandemic world, will also be affected by tariff increases. Thankfully, the list of such commodities experiencing a tariff hike in this sector is much shorter.

Most of the rate increases are taking effect immediately. Others, like those for rubber gloves or semiconductors, are being given a grace period of one to two years before tariff hikes are officially applied. A similar delay in rate hike was granted to commodities impacting certain EVs and related production materials.

When the USTR first began their review in 2022, they granted a number of tariff exclusions for critical need products. Many of these were related to commodities in high demand due to COVID-19, which was still a major factor.

Items covered in the 99 original exclusions based on critical demand items included respirators, plastic aprons, medical diagnostic machinery, and more.

Exclusions for these products, which have been extended on multiple occasions, expired May 2024. Apart from the COVID-specific exclusions, 352 others that had been extended are also set to expire at the same time.

After review, 164 of these were extended to May 31, 2025. New exclusions specifically covering solar manufacturing equipment are now being considered, as well as exclusions for various machinery imports found under HS chapters 84 and 85.

You’re now clued in to all the important Section 301 must-knows for this year. Of course, we’ll continue to update you right here in this article as more changes arise.

If you could use more help navigating tariff updates, contact USA Customs Clearance Professionals.

Our full list of services includes:

Prefer to call for assistance? We can be reached at (855) 912-0406. Getting help with your unique import and customs needs is just a click away.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post