Every industry uses machinery of one variety or another. Due to their various designs and purposes, the process for importing these products can vary.

Key Takeaways:

In this detailed guide, we will use our customs knowledge to go in-depth and explore what it takes to import machinery into the United States.

One thing to keep in mind are the government regulations you’ll need to follow. There are multiple federal agencies that oversee the importation of machinery and have their own set of rules for bringing them into the country.

These include:

The EPA and NHTSA are primarily concerned with vehicle imports. The EPA wants every vehicle that’s imported to meet their emission requirements. NHTSA is concerned with the safety of vehicles that enter the country.

Equipment that emits radio frequencies (RF) fall under the jurisdiction of the FCC. Your goods will need to meet one of their 11 conditions to get import approval.

For machinery used in the medical industry, your commodity will be subject to regulations set by the FDA. You’ll need to complete the various registration, device classification, and labeling requirements they’ve outlined.

Working with a licensed customs broker is crucial when importing machinery. They keep up with changing laws to determine which documents, licenses, and certificates you’ll need for a smooth entry process.

Before your goods can make entry, you’ll need to make sure you have the necessary documents. First, we’ll discuss the generic paperwork you’ll need, regardless of the machinery you’ve purchased.

These documents are a used for nearly all imports and exports. Next, we’ll discuss the paperwork that’s required by specific agencies that regulate machinery imports.

An EPA Form 3520-1 is required if your commodity qualifies as a passenger vehicle or highway motorcycle. If you’re importing heavy-duty highway engines in that same category, then you’ll need an EPA Form 3520-21.

NHTSA will want you to submit an HS-7 Declaration form for motor vehicle imports. The document allows the NHTSA to monitor your vehicle as it enters the country. They can also use the paperwork to verify if your goods conform with their safety guidelines.

The FCC requires a Supplier’s Declaration of Conformity or Certification for machinery imports that emit RF. The document used will vary based on the equipment authorization procedure for your shipment.

Related: Importing Electronics to the USA

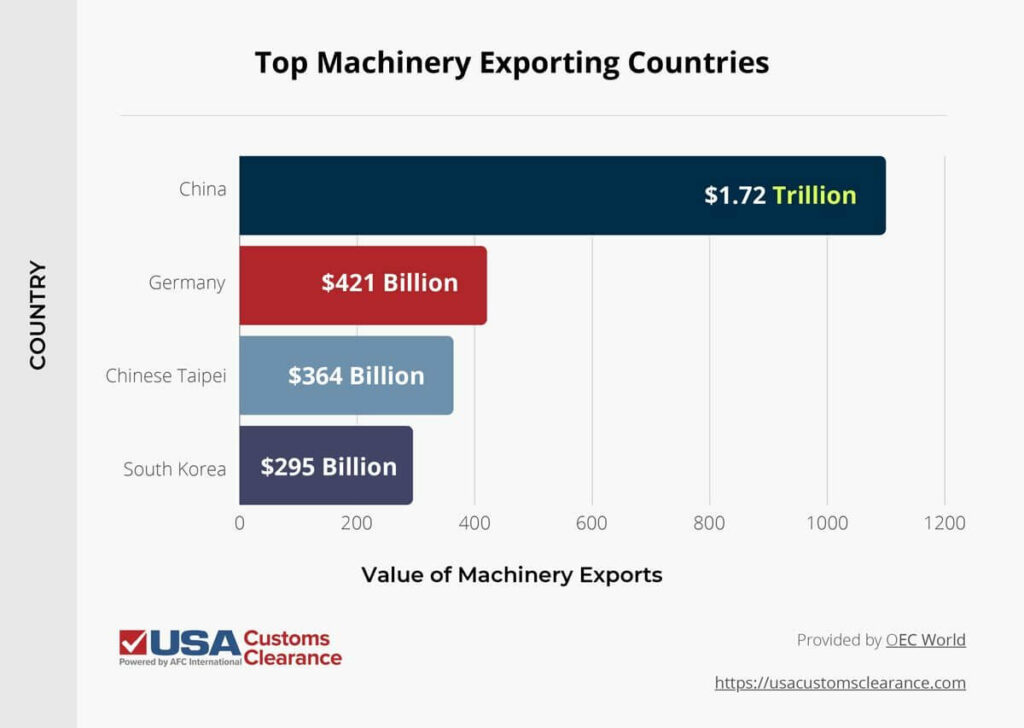

If you don’t already have a supplier, then you’ll need to locate one. While China is a great place to source a variety of products from, additional tariffs are now being applied that cut significantly into potential profits.

There are other countries stepping up that provide great sourcing options. I’ve provided some data on the top machinery exporting countries to give you some ideas.

Germany and the U.S. share a treaty that allows for an efficient flow of funds between each nation. This can make purchasing products from Germany easier. German made machinery is also well-known for its quality and reliability.

South Korea and the U.S. share the U.S.-Korea Free Trade Agreement (KORUS), which eliminates duties on nearly 80 percent of industrial and consumer goods. That means your equipment may be duty free if it qualifies as an industrial product.

While Mexico isn’t in the top four exporting machinery exporting countries, the U.S. does import a considerable amount of machinery from this southern neighbor. In 2022, machinery & mechanical appliances was the top commodity imported from Mexico and made up 36.4% of imports from the country.

The United States, Mexico and Canada Free Trade Agreement (USMCA) also provides duty-free access to machinery. As a result, you’ll be able to enjoy reduced import costs if you purchase your equipment from Mexico. I’ve included a list of other top U.S. trading partners that account for current imports. These are countries with well established supply chains to the United States.

Any of these countries will make for excellent trading partners, depending on the type of machinery you want to import.

Related: Importing From China: What You Need To Know

There is a wide range of machines used in various U.S. industries. Most of them fall under HTS chapters 85 and 84. Subheadings within those chapters cover items such as:

While each piece of equipment we listed are commonplace, they are only a fraction of the opportunities available. Regardless of what you’re importing, chances are you can find an array of companies in need of some kind of machinery, from engine parts to book binding machines.

While the steps you’ll need to follow when bringing machinery into the U.S. will differ based on your specific piece of equipment, I’ll provide you with a list of general procedures.

I’ll guide you through these steps and show you what each one entails.

You can choose from one of the countries previously discussed, or you can search another country of your choosing.

Regardless of where your supplier is located, ensure they’re trustworthy and provide quality equipment that meets U.S. standards. Be sure to do research on any suppliers you have in mind to ensure you’re purchasing from someone reliable.

Figure out which agencies have jurisdiction over your equipment to help you determine which regulations you’ll be required to follow. Remember, it could be more than one.

If you’re still not sure which agencies oversee your equipment, then reach out to one of our customs clearance team. They’ll be able to which rules are applicable to your machinery.

After finding out which agency regulates your shipment, you’ll need to get the corresponding documents ready.

Most import documents can be submitted electronically through Customs and Border Protection’s (CBP) Automated Commercial Environment (ACE). However, with machinery imports, you may need to submit certain items directly to the regulating agency.

For example, NHTSA has the Vehicle Importation and Safety Tracking Application (VISTA) where HS-7 documents can be submitted electronically to them, although paper copies are also an option.

You’ll need to arrange to move your equipment out of the port of arrival. This can be done by rail or truck.

Be sure to choose an option that’s compatible with your import. For example, if you’re importing large gas turbines, you need to be working with heavy equipment shippers.

Finally, this is when you need to make sure all your duties and fees have been paid, otherwise your goods won’t be allowed to enter the domestic market.

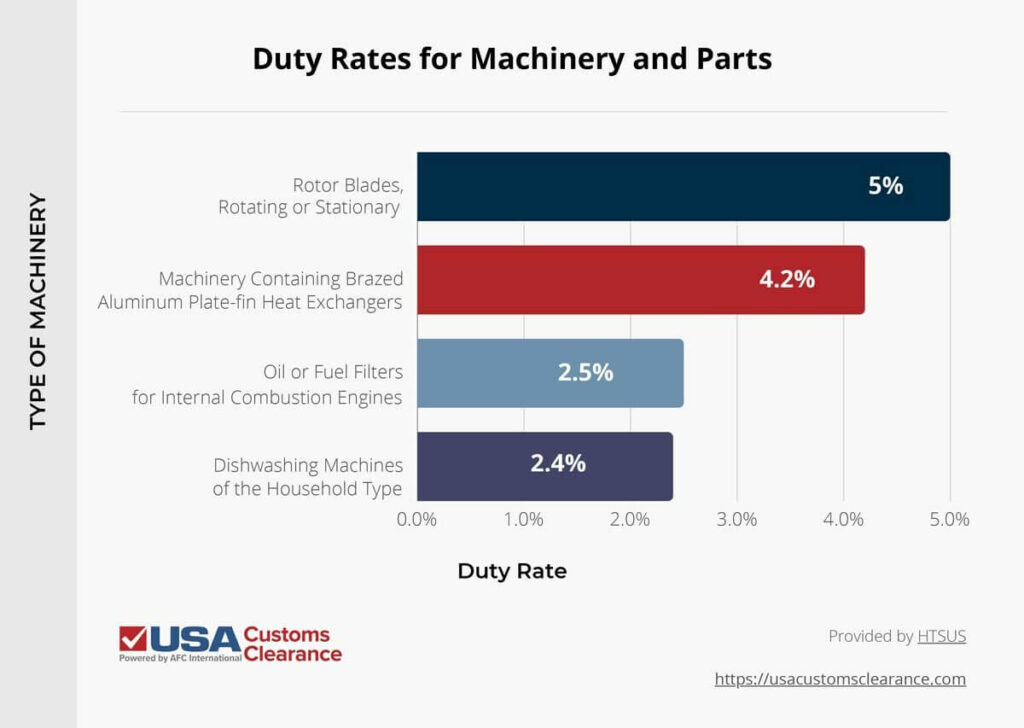

Machinery can come in many varieties, which makes it impossible to give a definitive duty rate. However, I’ve consulted the Harmonized Tariff Schedule of the United States (HTSUS) to provide the duty for different types of equipment often in demand.

Certain classifications of machinery have a reduced or eliminated tariff if they’re brought in from a country that shares a Free Trade Agreement with the United States. An extensive amount of agricultural equipment is duty free as well.

However, the opposite can also happen should you import from a country subject to additional tariffs, such as China. In such cases, you pay the standard duty rate and then an additional tariff on top of that.

Most of the machinery I’ve reviewed here can be found under these HTS headings:

You can calculate a fair estimate of your duties on your own by using the Harmonized Tariff Schedule (HTS). This robust document is based on the HS system used by the World Trade Organization to make commodity classification simpler. The U.S. version is known as the HTSUS and contains its own unique tariff schedules.

For an exact determination of duties, we recommend meeting with one of our licensed customs brokers. They can specifically classify your commodity and determine duty based on specific values.

With our HTS Code Look Up Tool, you can find the duty rate for your product in a matter of minutes!

At USA Customs Clearance, we’ve seen importers struggle to get their machinery into the country. We don’t want you to have a bad experience like so many others. When you hire our team, you’ll have access to a wealth of knowledge straight from our Licensed Customs brokers.

Our array of services will also help with your importing endeavors.

If you’re ready to start importing machinery, then pick one of our premiere services. You can also contact our team through the site, or give them a call at (855) 912-0406 if you have more questions.

Copy URL to Clipboard

Copy URL to Clipboard

I'm looking to import a 40 ton (US) Liebherr all-terrain mobile crane from Sweden to California. Fift off, would something like this even be possible? Second of all, how much would all the services cost in the end? Please email me at cy64060@gmail.com, I greatly appreciate it!

Is it possible to get excavators shipped from Shanghai to Port of new orleans? Fees from customs high? Would like to purchase some machines in Shanghai, need info on how to get them home.

Did you have any luck with importing from Shanghai? I've found some I'd like here. My biggest worry is emissions, and taxes.

What do I need to clear Japanese/Chinese made small heavy equipment so to import to the US?