There’s nothing quite like going camping for a weekend to enjoy some fresh air, go fishing, and kick back and relax outdoors. However, importing camping gear isn’t necessarily a walk in the park.

Key Takeaways

In this guide, we’ll go over the fundamentals of importing camping gear into the USA. You’ll also learn how brokers from USA Customs Clearance can help you stay in accordance with CBP guidelines.

According to data from IndexBox.com, the U.S. was the largest importer of camping equipment in the world in 2022. During that year, importers brought approximately $1.2 billion worth of outdoor gear into the country. This serves as a clear indicator of the popularity these commodities enjoy among American consumers.

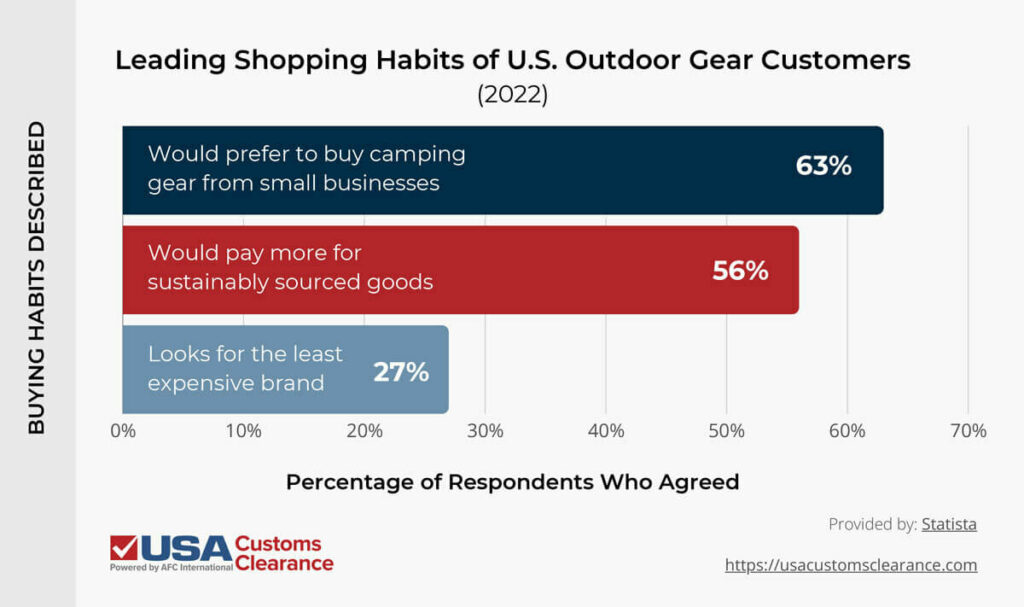

In that same year, a study conducted by Statista.com revealed some interesting facts about outdoor gear customers, which I’ve presented in the table below.

Source: https: www.statista.com

Given the percentage of buyers who prefer to avoid big box retailers for their camping equipment needs, these commodities present a great sales opportunity for small import businesses.

There are many kinds of camping, hiking, and outdoor gear that get imported into the U.S. on a regular basis, such as:

Regardless of what you’re importing, if you want to clear customs with your shipment, you’re going to need to submit the proper documents to Customs and Border Protection (CBP). Clearing customs is a complicated process, and you must fill in these documents correctly. Otherwise, you risk delaying your shipment, or losing it entirely if CBP determines it should be destroyed.

To import camping gear, you’ll need to fill in and submit these documents to CBP:

These documents apply to any import transaction. However, importing goods that are regulated by another Partner Government Agency (PGA) may require you to fill out additional paperwork.

For example, camping snacks like jerky or trail mix require you to comply with regulations from the Food and Drug Administration (FDA), such as filling out a Prior Notice of Imported Foods. If you’re importing walkie-talkies or radios, they’ll need to comply with the regulations of the Federal Communications Commission (FCC).

You will also need a customs bond if your order exceeds $2,500 or if your imported goods are regulated by certain PGAs.

Products imported into the U.S. are classified by a 10-digit number known as an HTSUS code. These codes are used to identify commodities, and each includes a specific description. They make it easier for customs to document each import, and quickly identify shipments that are considered higher risk than others.

The HTSUS code is going to be different depending on what you need to import. You can look up specific products with our HTS lookup tool, but I’ve included some codes for common camping gear imports for you here:.

Many importers make mistakes when classifying their goods. These errors can have significant consequences, including fines or seizure of goods by CBP.

The experts at USA Customs Clearance have years of experience in tariff classification. If you need help finding the right HTS codes for your goods, our licensed customs brokers are available to assist you.

Americans love spending time in the great outdoors, and that means camping accessories enjoy steady, sustained popularity in the U.S. If you want to import these accessories to meet consumer demands, we can help.

At USA Customs Clearance, you’ll find expert assistance with every aspect of the import process. We can get your import moving through the U.S. border quickly and efficiently, saving you time and letting you focus on building your business without concerns about clearing U.S. customs.

Our services for U.S. importers include:

Give us a call at (855) 912-0406 or contact us online for expert assistance with importing tents, sleeping bags, and other outdoor gear.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post