Wooden furniture is very popular amongst U.S. consumers. This type of high-quality furnishing gives a cozy and appealing aesthetic to any home. That said, you’ll need to get familiar with the regulations you’ll have to follow when importing wood furniture in bulk.

Key takeaways:

I’ll give you a rundown of everything you need to know when you import wood furniture to the U.S.

There are numerous regulations placed on wood furniture imports that you’ll have to follow.

To make these rules easier to grasp, I’ll explain these requirements for each one in the following sections.

APHIS requires you to prove the wood in your furniture as been properly sanitized.

This is done to prevent foreign pests from inside wood and disturbing native wildlife in the United States. There are two ways wood in furniture can be sanitized.

Wood that’s heat treated must be placed in a kiln at a core temperature of 56℃, or 132.8℉, for at least 30 minutes. Chemical treatment can be completed using surface pesticide or preservatives under pressure. Methyl bromide fumigation is also an option.

You’ll need to provide a PPQ form 585 to prove that your wood furniture has received heat or chemical treatment. This form is also known as the Timber and Timber Products Import Permit.

APHIS will also enforce the Lacey Act, and you’ll need to fill out and submit a PPQ form 505.

Compliance with CITES is only necessary if your furniture uses wood that’s endangered. CITES lists all its endangered species in Appendices I, II, and III. They also provide resources dedicated specifically to the protection of timber species.

If the wood used in your furniture is listed in any of CITES’ appendices, you’ll need to follow one or all of the following requirements:

Figuring out which CITES requirements apply to you can be pretty challenging due to the uniqueness of every import. To make things easier, meet with one of our Licensed Customs Brokers. They’ll explain your responsibilities and guide you through the process.

Related: Importing Rosewood: How to Comply with CITES and the USDA

Meet with one of our Licensed Customs Brokers to better understand wood furniture import regulations during a 45-minute consulting session.

Furniture that contains composite wood will need to adhere to the TSCA requirements. There are three types of composite wood.

Your composite wood furniture should also include a label that shows compliance with TSCA Title VI and the California Air Resources Board (CARB) Phase II. CARB Phase II is a regulation that limits formaldehyde emissions.

The label should be applied as a stamp, tag, or sticker and contain information pertaining to the import in legible English.

To confirm all of this, you’ll need to obtain a certification from a third-party certifier (TPC) that’s recognized by the Environmental Protection Agency (EPA). A positive certification statement must also be given.

It should say the following:

“I certify that all chemical substances in this shipment comply with all applicable rules or orders under TSCA and that I am not offering a chemical substance for entry in violation of TSCA or any applicable rule or order thereunder.”

The statement should appear on your commercial invoice or other entry documentation and filed with the port of entry director. If you don’t want to use physical customs paperwork, you or our customs broker can submit it electronically through the Automated Commercial Environment (ACE). Your TSCA label will need to have the certification statement as well.

Finally, you’ll need to keep records of all documents related to your composite wood furniture import for three years. If the EPA makes a request for you to provide information pertaining to your import, then you’ll need to make your records available within 30 days.

Besides the required agency specific documents, you will have to submit a few other types of general paperwork to import your wooden furniture, such as:

In some cases, you might need a Certificate of Origin if you’re applying for preferential tariff treatment under a Free Trade Agreement (FTA). Other documents will be needed depending on the specifics of your import. Make sure to submit all necessary customs paperwork to Customs and Border Protection (CBP).

Related: Documents for Import and Export

According to the CBP, wooden furniture will be duty-free as long as it is imported from a country that has normal trade relations with the United States. The HTS codes for wood furniture can be found under Heading 9403.

Even though your goods will be duty free, you’ll need to make sure you include the correct code. If you’re not sure which one applies to your wood furniture, use our HTS Lookup Tool. You can use it to find the correct HTS that applies to your wood furniture in a matter of minutes.

Our easy-to-use HTS Lookup Tool will help you find the HTS code that applies to your wood furniture products.

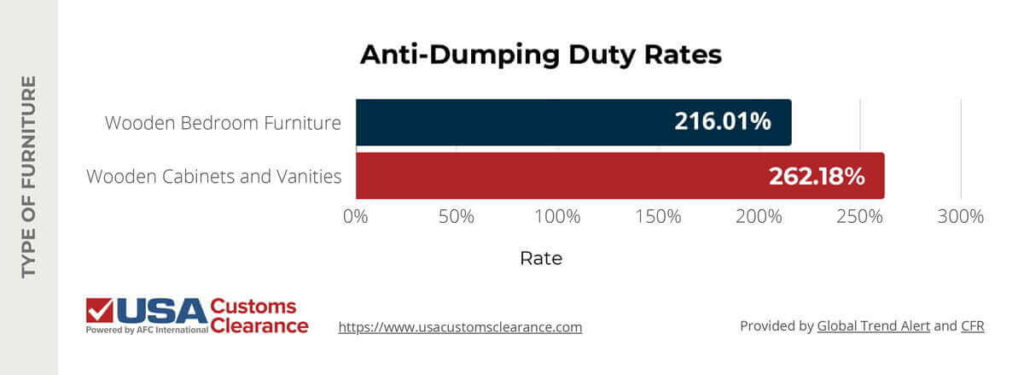

There are numerous anti-dumping duties placed on different types of wood furniture from China. I’ve provided a graphic that shows the anti-dumping duty rates the U.S. has in place on each one.

While China is the U.S.’s top supplier of furniture, the high anti-dumping duties are too expensive for many small businesses. You should also keep in mind that rates can rise or fall in the future. If you’re unable to afford these high anti-dumping duties, then consider importing your wood furniture from another country.

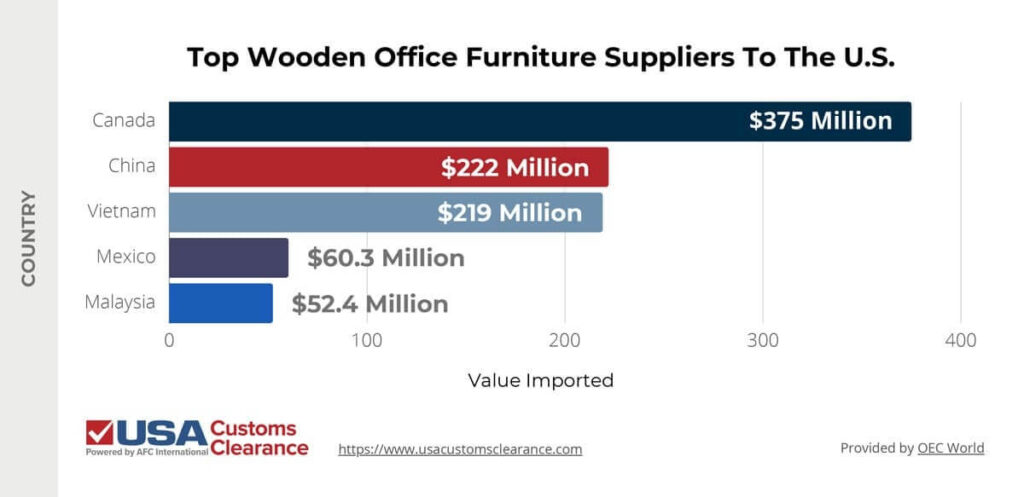

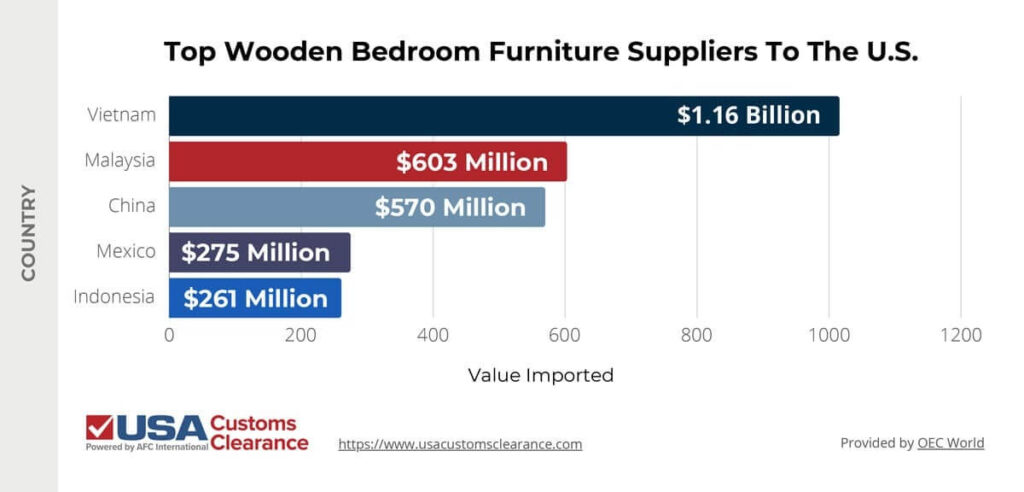

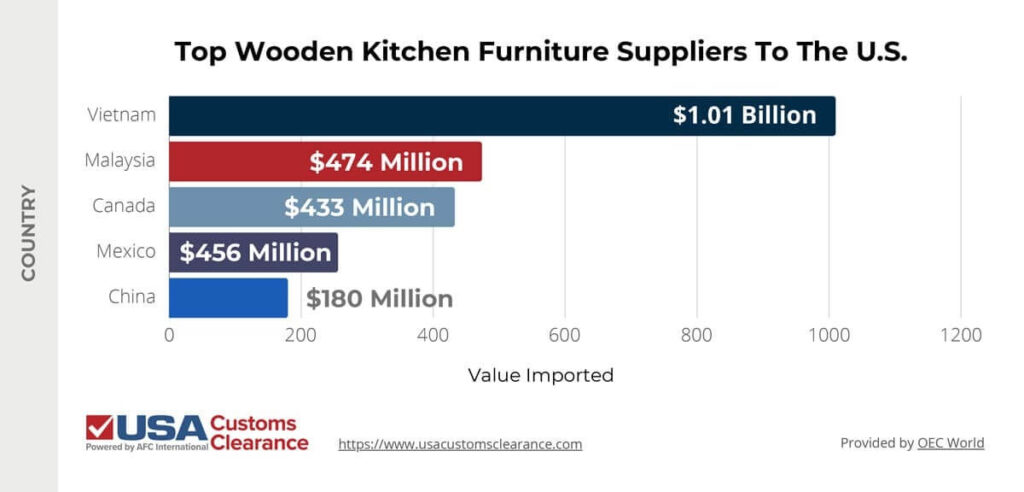

There are numerous countries to choose from when it comes to importing wood furniture. To help you narrow down your search, it’s a good idea to look at the U.S.’s top suppliers for these commodities.

It’s also good to examine these based on what type of wood furniture you’re looking to source, since that can affect what countries are worth considering.

As an example, I’ve provided data that shows the top five suppliers of wooden office furniture.

The U.S. also imports a large amount of wooden bedroom furniture as well. You’ll notice the exporting countries are slightly different.

Finally, let’s look at top kitchen furniture exporters, another important part of every home and a popular U.S. import.

As the data shows, the U.S. imports most of its wood furniture from the same five countries, with some variation. Regardless of which one you choose, you can count on receiving quality-made furnishings. That said, importing from Mexico and Canada is especially beneficial.

Both countries share a border with the United States. Thanks to their geographic proximity, your imports won’t take as long to arrive. The closeness of each country will also help reduce transportation costs.

Related: NAFTA vs USMCA

Importing wood furniture doesn’t need to be a hassle. At USA Customs Clearance, we’ll provide you with the assistance you need to import your home furnishings with success. Our Licensed Customs Brokers and import experts know all the regulations that you’ll have to complete. Get their support and access to other resources using our services.

This includes:

Don’t wait to import your furniture any longer. Get started with one of our services or call our team at (855) 912-0406. You can also contact us through the site for any questions you might have.

Worried about the Strict Regulations for wood furniture imports? Discuss these rules with our Licensed Customs Brokers.

They will personally guide you during a 45-minute consulting session.

Copy URL to Clipboard

Copy URL to Clipboard

We are a manufacturer of wooden furniture,wall decor tableware and kitchen ware in India and want to export our products to usa kindly let me know how I find usa buyer to export our products.

I am going to California U S A in early Dec ‘ . I want to take a wooden Macrocarpa small stool as a wedding gift with me .

Is this possible please ??

Thank you

We need to import the furniture into USA

Hola, mi nonmbre es Mabel soy de Ecuador y estoy buscando un broker para ingresar muebles de madera a tiendas en Estados Unidos. Usted tiene este servicio?

Is import duty applicable for WOODEN FURNITURE from India ?

what's percentage of customs duty applicable for import wooden furniture from India to US.

what is the 10-digit HSN of Wooden Furniture (for household used)

I’d like to know about the regulations that affect the imports in US like STURDY, ISTA or Greenguard Certification. Can you explain me about this?

Hi there, I have a guest who is a US citizen coming to visit here in New Zealand.

I have made them a small finished timber souvenir as a gift and want to know if they will have any problems taking it back with them.

It is made from American white Oak and has been machined and carved then coated with polyurethane to seal.

Thanks.

Can I import wooden furniture from another country other than China, India & Mexico?

can wooden furniture that is custom built from cebu philippines that is finished and treated be imported to the US ? And are there any requirements. what would the total cost be.

I NEED FURNITURE IMPORT LESS THAN 800 USD.

I WOULD NEED THE WOOD FURNITUR HAVE A PHYTOSANITARY CERTIFICATED ?

BEST REGADS