Several factors influence the amount of import duty an importer will pay:

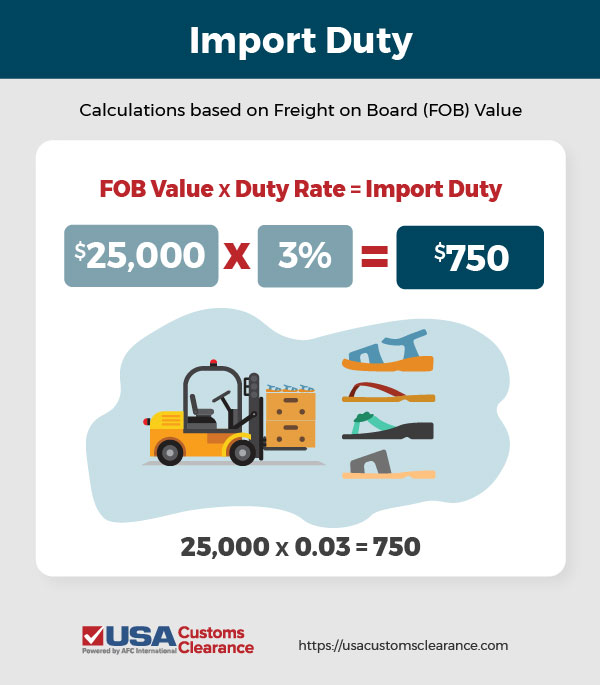

Customs duties are calculated based on the FOB value of the imported goods and the applicable duty rate. The FOB value only takes into account the cost of the goods that will be entered into the U.S.; not the insurance and freight costs. The duty rate is determined by the classification of the goods in the Harmonized Tariff Schedule (HTS).

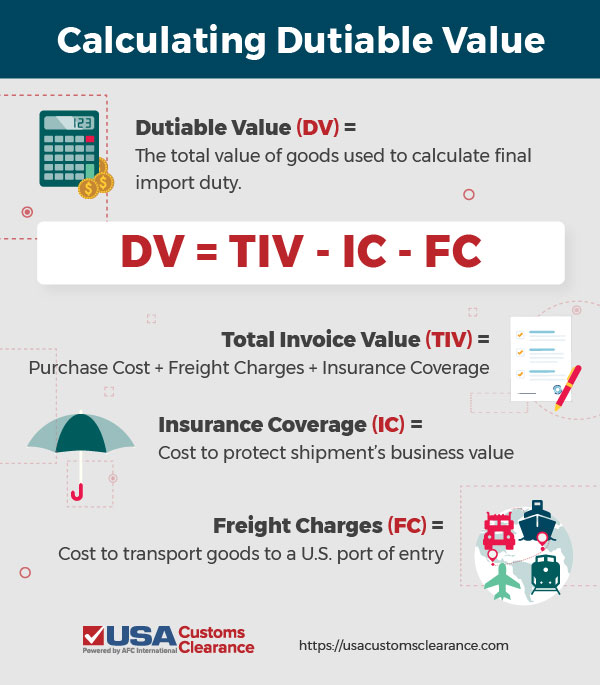

The calculation formula for import duties is straightforward: Simply multiply the total dutiable value of the product by its duty rate (as defined by its HTS code).

(Value of Goods x Duty Rate) = Import Duty

We’ll look at a real-world example of a duty calculation for an importer shipping sandals from Germany to the United States using the HTS code 6402.99.27 and working with USD currency values.

First, let’s figure out the dutiable value of the shipment once it arrives at a U.S. port of entry.

An importer purchases 500 pairs of sandals from a German manufacturer at $50 per pair/unit. This makes the total value of the goods at initial purchase $25,000.

Then comes the shipping process. Additional costs paid by the importer will now include:

That’s an extra $3,000, so now they’re looking at a total invoice value of $27,500 at the time the goods arrive.

Good news, though. Duty rates are assessed on the dutiable value, which only includes the initial purchase cost. The freight and insurance charges are not part of the final duty calculations, so you will still only be calculating duty for $25,000.

Once the dutiable value is determined, you can calculate the duty rate. The rate is published alongside the product’s confirmed HTS code and can be based on a percentage of the value, quantity, or a combination of both.

Sandals fall under the HTS code 6402.99.27, which carries a duty rate of 3% of the dutiable value only. In order to calculate the duty rate, we will multiply $25,000 by that 3% duty rate to get a final duty amount owed of $750.