As a new importer, you might be wondering if you can clear goods through customs on your own. After all, hiring a customs broker is just another process that costs time and money. However, the answer to this question might not be the one you expect, or the one you want. We’ll give you the answer and provide you with further import guidance you should know.

Key takeaways:

Let’s take a closer look at solo importing and the factors you’ll have to consider.

According to Customs and Border Protection (CBP), there is no legal requirement to hire a customs broker to clear your goods through customs. However, many importers choose to hire a customs broker because of the assistance they can provide.

Brokers are licensed by CBP and have plenty of experience clearing goods through customs. They also have connections with other logistics providers in the supply chain. This means they can secure domestic transport and warehousing once your goods make it into the country.

That said, you’re still free to import by yourself if you’re feeling up to the task. In the next section, we’ll discuss all the responsibilities you must complete in the customs clearance process.

Importing alone is extremely risky. At USA Customs Clearance, our licensed customs brokers will help you circumvent these challenges and ensure your imports are successful.

Clearing imports through customs is no easy task, especially if you’re doing it alone.

Here are your primary responsibilities:

All imports that come into the U.S. must comply with CBP and PGA regulations. A PGA is any government agency that helps CBP oversee the importation of products into the country.

This can include:

Navigating import documentation can be a challenge as well. There are certain types of paperwork that are used universally for all goods entering the country. This includes bills of lading, pro forma, and commercial invoices.

However, other documents unique to certain imports might be required. For example, the DOT HS-7 form is used specifically for declaring the entry of motor vehicles into the country.

HTS classification, valuation, and paying applicable duties must be handled with the utmost care. There are numerous codes within the Harmonized Tariff Schedule of the United States (HTSUS) to choose from, and selecting the wrong one can affect your ability to complete this step.

After your goods have successfully cleared customs, you’ll need to abide by different record keeping requirements. Records for imports should be kept for five years after the date of their entry.

Using the right HTS code is essential when you import. Use our handy tool to find the one that applies to your goods.

When you import without professional assistance, you open yourself up to a variety of risks.

This includes:

Mitigating these risks can be extremely challenging by yourself. It’s the job of a customs broker to help you avoid them altogether.

Violating the customs clearance process, intentionally or unintentionally, can result in serious penalties for importers. CBP uses three levels of culpability when assessing infractions.

CBP penalties for these import violations can vary between civil and criminal. Civil penalties typically result in a fine. How the fine amount is calculated is based on whether there was a loss of duty when the violation was committed.

The following graphic shows the civil penalties for violations that resulted in lost duties.

The next graphic shows the civil penalties for violations that didn’t result in lost duties.

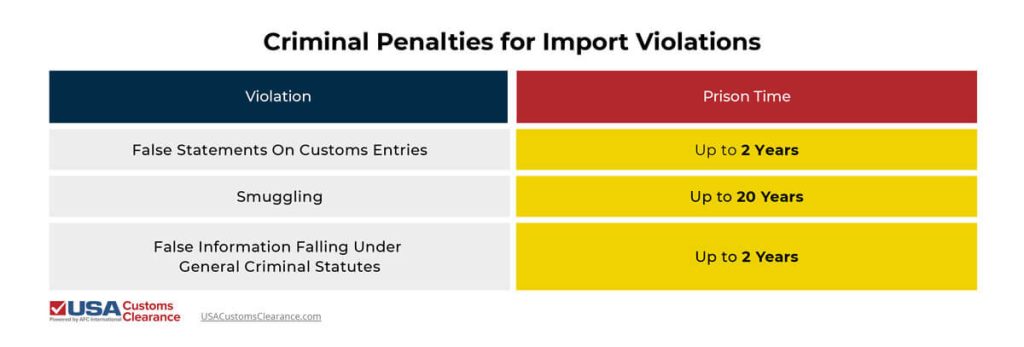

Criminal penalties for import violations can lead to imprisonment. The third graphic shows the amount of time you could serve.

For better clarity, false information falling under general criminal statutes refers to crimes like money laundering, obstruction of justice, and similar wrongdoings. As these graphics show, you can run into a variety of legal troubles if you commit an import violation. You’ll need to proceed carefully and be aware of all applicable regulations.

As a first time importer, you'll need to register your business with CBP. Complete your registration quickly and effectively with our IOR.

To give you an idea of what it would be like to import by yourself, let’s go through hypothetical. Suppose Maria, owner of a coffee shop in California, wants to import coffee beans from growers in Colombia.

Here are the steps she’ll have to follow:

Due to the delays, Maria spent over thousands of dollars on storage fees and fines. Her business also lost over a week of sales because of her shipment arriving late. Had she hired a customs broker, she would’ve only paid a fraction of those costs.

Although Maria was able to get her coffee beans into the country, she ran into a variety of problems that cost her unnecessary time and money. You may find yourself in a similar situation if you choose to import by yourself.

Importing alone is vastly different from importing with a customs broker. Let’s start by looking at the pros of going solo.

Now, let’s consider the pros of hiring a customs broker:

Despite the additional expenses that come with hiring a customs broker, there is an exceptional amount of support they can provide. Importing alone might give you more control over the customs clearance, but it’s more work on your end.

Here at USA Customs Clearance, we have experienced customs brokers and other importing professionals that can provide you with vital assistance. They’ve helped importers from various industries clear their goods through customs. With us by your side, you can be sure all your shipments make it into the U.S. without problems arising from lack of knowledge or inexperience.

Don’t take on the risks of importing alone. Start importing with customs specialists you can trust. If you have any questions about the services we provide, call our team at (855) 912-0406 or reach out to us on our contact page.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post