Customs bonds are used for most commercial imports into the United States. That said, many importers are unsure of how to renew them as needed. If you plan on obtaining a customs bond for the first time, there is important information that you should know.

Key takeaways:

In this guide, we’re going to educate you about customs bond renewal and show you how easy the process can be.

A continuous customs bond renews on its own. It will cover any number of imports that you make for one year, and then self-renew on the anniversary of its effective-date automatically.

Single transaction bonds don’t renew on their own. As the name implies, this customs bond is only good for one transaction. Once a transaction is completed, it no longer has any use.

Although a continuous customs bond is described as being good for the entirety of a year, it doesn’t have an official expiration date. The continuous bond will remain in effect until one of the involved parties terminates it or payments cease to be made.

Many surety companies offer multi-year payment plans. They usually come in increments of two, three and five years.

Payment must be collected for your continuous customs bond each year it renews.

Paying the premium after your bond renews is fairly similar to the way that you pay for the continuous bond. You will send payment to your customs broker, who works with the surety company that issued the bond.

At USA Customs Clearance, you can obtain a customs bond at an affordable price. Navigate to our customs bond page and obtain your continuous customs bond by completing a few simple steps.

As an importer, you might forget when your bond will be renewed. Thankfully, surety companies are adamant about getting paid on time. You’ll typically receive a notification one month prior to the renewal of your bond.

This will give you enough time to get your finances in order and pay the amount. Nonetheless, you should still make sure to record the date your bond will renew for your records.

If you have a continuous bond that you no longer need, then you should terminate it immediately.

You can do this by sending a termination notice to Customs and Border Protection (CBP). Termination notices can be sent by mail, fax, or email. A licensed customs broker can also submit the notice on your behalf.

It will typically take CBP 10 business days to review and approve a bond termination request. If you choose to give a specific date as to when you want your bond terminated, be sure to take these 10 days into consideration.

You should also note that once you submit a termination request, it cannot be retracted. Be sure of your decision to terminate your bond when you make the request.

Surety companies can also terminate your bond, with or without your consent. However, they will have to give you notice ahead of time that your bond will be closed.

You will need to get a customs bond under two different circumstances.

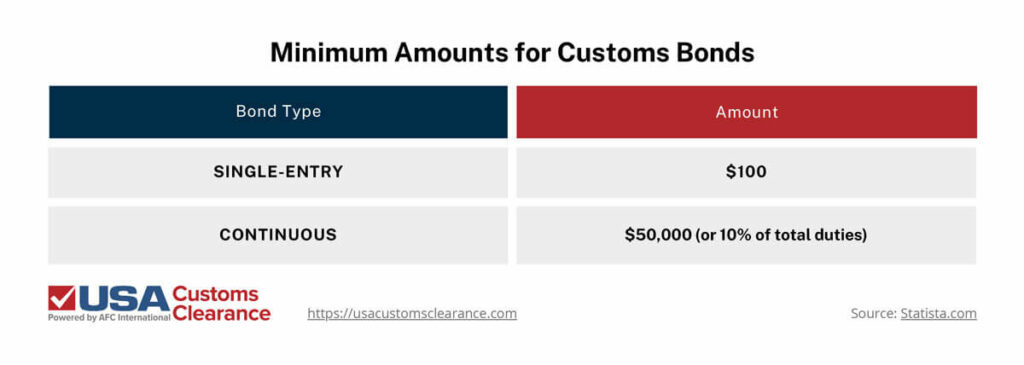

Here’s are the minimum amounts for single-entry and continuous customs bonds.

Keep in mind, the amount for your bond may be higher depending on what the product is and where it’s coming from. If you only need to import once, then you should obtain a single transaction bond. A continuous bond is a better option if you plan on importing multiple times for a year or more.

Related: Types of Customs Bonds

At USA Customs Clearance, you can obtain a customs bond for your import with just a few clicks. All of our bonds are continuous, which means they’ll be able to renew year after year. We also offer a variety of other services that might be useful to your importing journey.

Start your importing journey with USA Customs Clearance today by using one of our services. You can also contact our team at (855) 912-0406 if you have more questions.

Get your continuous bond today and start importing as often as you want!

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post