The U.S. construction industry maintains steady but consistent growth and drives the import of related supplies, including plywood. China remains the largest exporter of plywood globally, but not necessarily to the United States due to a number of specific tariffs that have been put in place.

Key Takeaways:

We’ll further review the specifics to import both OSB and plywood from China successfully, along with potential alternatives that may help you save on costs.

When you import OSB and plywood from China, importers should be aware of the standard duty rates assigned by the Harmonized Tariff Schedule of the U.S. (HTSUS) and two other major tariff add-ons.

These fees include the following:

Section 301 and applicable AD/CVDs hinge on the product’s HTS classification. The tariffs imposed via executive order and reciprocal trade actions are mostly flat tariffs applying to all products.

The executive order tariff stands at 30% as of August 2025 and is applicable to all imports out of China and Hong Kong. It was put in place by the Trump Administration to serve as a deterrent to the influx of illegal drugs.

Reciprocal tariffs were imposed worldwide as a means of combating trade imbalances. Nearly all trading partners as of April 2025 have at least a 10% flat rate applied to their exports upon entry for consumption.

However, this rate may fluctuate. We encourage you to check out our Tariff Tracker for more details.

Now, I’ll get into some detail on the duties and tariffs specific to OSB and other engineered wood items.

OSB and plywood, as well as other types of engineered wood products, are identified under HTS Chapter 44. Plywood, which is composed of pressed wood sheets, falls within the heading 4412, while OSB is under the heading 4410. This heading covers various types of particle board products made with wood scraps rather than whole logs.

Within those headings, there are numerous descriptions tied to specified HTS codes based on factors such as:

General rates of duty for these products falls somewhere between 0% to 8%. Due to the variety of factors, misclassification is a real risk, one that comes with steep penalties from Customs and Border Protection (CBP).

One of the most surefire ways to be sure your shipment is classified with the correct HTS code is to work with a licensed customs broker.

Confirming the HTS code will determine which extra fees you’ll need to cover, at least as far as Section 301 and AD/CVD is concerned.

Related: Importing Wood to USA

The first of the additional duties that your OSB or plywood import may face are through the Section 301 Tariffs. These tariffs specific to China were implemented beginning in 2017 and gradually rolled out through 2019.

Currently, the Section 301 tariff applied to chapter 44 products is 25% ad valorem. It is applied in addition to general rates of duty.

Related: A Guide to China’s Section 301 Tariffs

As of this article update, OSB imported from China is not subject to AD/CVD penalties. However, hardwood plywood products from China have been under both a countervailing and anti-dumping order since January 2018.

The specifics of these orders are found under 83 FR 504 & 513. Your product(s) may fall under one or both orders, depending on the Chinese supplier/exporter you are working with.

Anti-dumping duties are currently set at 183.36% ad valorem. Countervailing duties are either 22.98% or 194.9% ad valorem.

If plywood importers need to pay both, they are looking at additional fees between 206 - 378% of total product value. Not to mention the additional 25% owed due to Section 301 penalties and normal trade relation rate (NTR) established by the HTS.

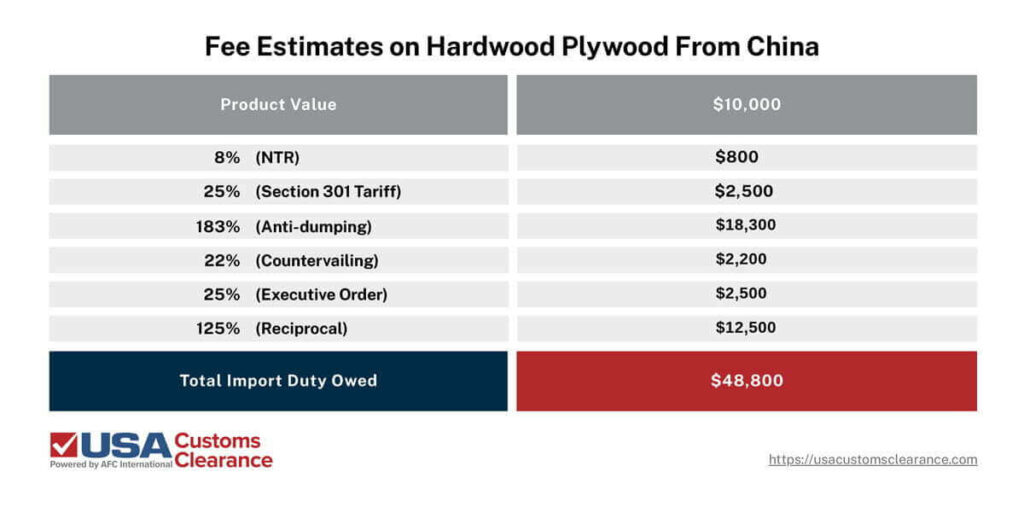

Just in case that wasn’t enough, the tariffs imposed due to the executive order and via reciprocal tariffs will also stack. For the worst case-scenario, I’ve outlined the following duty calculation.

Rising import costs prior to 2025 meant that engineered wood imports from China were already declining.

With even greater landed costs now, it’s understandable if you want to look at other potential suppliers. I would suggest taking a closer look at Canada, both for its proximity and its established status as a timber supplier to the U.S.

Costs savings in this case would come from the following:

There is an anti-dumping duty currently imposed on certain Canadian lumber products, but it only imposes about 14% in ad valorem duties. Compared to the rate imposed on China, it is significantly less.

Related: Importing from Canada to the U.S.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

If you still plan on importing from Chinese suppliers, despite the high fees and lagging popularity of their plywood and OSB, you’ll need to get all your documents in order.

Basic documents that need to be included with your import include:

All of these documents are required in order to legally import your goods into the U.S. and must be provided in English.

Related: What Documents Do I Need to Import and Export?

Chances are your plywood or OSB is going to arrive by vessel, so you’ll also need to complete your Importer Security Filing (ISF) documents at the right time.

Related: ISF Filing Deadline

Finally, you’ll need to secure a Customs Bond to ensure that the various and considerable import duties required when bringing plywood from China are covered upon entry.

Regardless of the value, it’s regulated by the USDA and subject to AD/CVD penalties. A customs bond in such cases is a must.

If you’re overwhelmed or worried about obtaining and submitting all of these documents, that’s why we’re here. Our licensed customs brokers clear shipments for importers every single day, so they know exactly how to get the job done.

All wood products being imported into the U.S. require a Lacey Act Declaration to be filed at the time of import.

This declaration requires some specific information about the wood product being imported:

This declaration can be filed via the paper form, PPQ Form 505, or electronically through CBP’s online filing system ACE (Automated Commercial Environment).

When declaring imported OSB, a Special Use Designation (SUD) can be used in place of providing the genus and species since material often comes from several sources.

Failure to file the Lacey Act Declaration in accordance with the requirements can lead to monetary penalties of up to $200,000 and forfeiture of goods.

Lastly, you may need to obtain a Timber Import Permit.

In most scenarios, this particular permit won’t be required because by definition OSB and plywood are manufactured wood products. However, if the wood is being imported with any unfinished veneers or there is a risk of harmful insect and pest infestation, a timber import permit will be required.

For more information on specifics related to importing plywood from around the world, check out our article on importing plywood to the USA.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Considering the current state of OSB and plywood imports from China, you can’t afford to make any mistakes. Our licensed customs brokers are here to ensure your products can enter safely and with all duties and fees properly calculated.

As part of our full range of brokerage services, we offer:

When you’re ready to get help, give us a call at (855) 912-0406 or reach out with a specific question via our online contact form.

Copy URL to Clipboard

Copy URL to Clipboard

I will be importing plywood from China. How can you help me get it safely

This is Tony who from playwood factory pls contact with me

Hi Mr/Mrs

Do US regulation have any volume limit / quota for plywood from China that will import to US? Thanks

I heard for importing timber continuously, you have to pay a $500,000 cash bond. How true is this?

Hi Mr/Ms

I will import plywood from China. How can you help me to get them safely such as which certifications need to be completed, how much duty rates,how much fees totally do I need to pay,etc, thank you.

Hi Tommy,

We can definitely help you with this! You'll have many steps to go through as plywood is heavily regulated, especially when it comes from China. The best thing for you to do is consult with our Licensed Customs Brokers. They'll go over the complete process and all of the requirements you'll need to comply with. You'll also receive a comprehensive summary with everything that was discussed after the consultation is complete.

You can sign up for the consultation at the link below. We look forward to helping you!

Customs Broker Consulting