Transporting goods to and from foreign nations comes with many risks that can leave you in financial ruin. Fortunately, there’s import export insurance available as a form of financial protection for your shipments. Before obtaining this coverage, there are some important things you should know.

Key takeaways:

We’ll give you in-depth information about each of these points so you’ll have everything you need to obtain insurance coverage for your imports and exports.

Import/export insurance protects you financially from damages or loss that your items could incur. Having insurance coverage on goods is beneficial in the long run, especially if the goods you’ve bought or sold are high-value.

There are various insurance policies that will protect you against different risks. All you need to do is choose the policy that works best for you.

If you’re still not sure if you should get import/export insurance, then consider the potential risks that you and your freight could face.

While vessel and international air transport are considered reliable methods of moving freight, there’s the possibility your cargo could sustain damage during transit. Theft could also occur at some point in the supply chain. This is typically orchestrated by organized criminal groups.

In some cases, your freight could be lost entirely. One way this could happen is if the container holding your cargo falls off the vessel transporting it (happens more often than you think).

Non-payment can be a problem when you’re exporting freight. Certain insurance policies will ensure you get paid, even if your buyer can’t provide payment.

In some instances, the nation you’re importing from might not be the most politically stable. If this is the case, there are various factors that could either delay or completely prevent your goods from leaving the country.

This could include:

Severe weather events like hurricanes and tropical storms can impact international shipments. Vessels and aircraft can be delayed or will have to circumvent these storms altogether. This could potentially delay your shipments.

Related: How To Submit ISF

There are many import export insurance policies that you can use to protect yourself and your shipment, including:

In the following sections, we’ll explain how these policies work and what they protect against.

Export credit insurance (ECI) is used by exporters to protect themselves from non-payment by a foreign buyer. It essentially guarantees you will be paid for the products and services that you sell.

There are various non-payment scenarios that ECI can protect against:

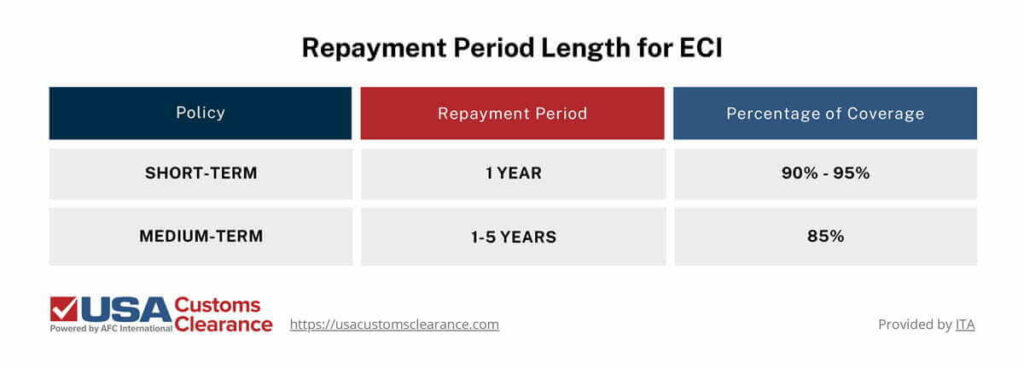

ECI coverage can be used on a single-buyer basis, which means it will cover one transaction. You can also use ECI on a portfolio multi-buyer basis to cover multiple sales. I’ve provided a graphic showing the length of repayment periods and percentage of coverage for each ECI policy.

Keep in mind, ECI is specifically for covering non-payments. That means you’ll need to find another type of protection for your physical cargo.

Related: 11 Types of Incoterms

Marine cargo insurance protects freight from a variety of scenarios that could cause damage or loss. Despite the name, this type of insurance doesn’t exclusively cover items that travel overseas. It can also be used to protect goods that are transported by land or air.

Risks that marine cargo insurance protects against include:

Marine insurance is flexible because it offers multiple policies that you can choose from based on your needs. For example, all risk marine insurance will protect your cargo from all scenarios, while named perils will protect you from only specific dangers outlined in the policy.

Certain marine cargo insurance policies are designed for specific lengths of time. I’ve provided a list of two most common periods they can last.

Before obtaining marine cargo insurance, carefully evaluate your needs as an importer or exporter to determine which policy will be best.

Book a 45 minute consulting session with one of our Licensed Customs Brokers.

They'll help you with all the regulations you'll need to follow to import successfully.

Political risk insurance is a policy that protects against adverse actions or inaction of foreign governments during times of turmoil. Oftentimes, governmental authorities in politically unstable nations will confiscate cargo.

There is also the risk of riots, wars, and other catastrophic events that could damage your goods. Political risk insurance will cover you from all these dangers.

The best time to use this policy is when you’re importing from countries with emerging economies. Nations of this variety can be unstable, but they offer a fresh new market for trade. Thanks to the protection offered by a political risk policy, you can explore and purchase from these markets with peace of mind.

Political risk policies can last as long as 15 years, depending on your insurer. A long-lasting policy is your best option if you plan on importing from an unstable country on a regular basis, while a short-term plan is better for on-off purchases.

Related: Customs Penalties and Fines

Liability insurance protects importers and exporters from legal liabilities if their products cause injury or damage. It does this by helping you pay fees to compensate anyone that was harmed.

An international liability policy protects goods within a designated coverage territory. International liability is a flexible form of insurance, which means you can negotiate with your provider on a policy that addresses the specific risks concerning your goods. You can also use the policy for various spans of time.

Import/export insurance premium costs depend on many factors.

This includes:

While every insurance policy differs based on what they protect against, they can all be calculated in roughly the same way. First, you need to determine the insured value.

This is done by adding the commercial invoice value, cost of freight, and a 10% margin that will cover any additional expenses. Now that you have the insured value, simply multiply it by the policy rate. This will give you the cost of your insurance premium.

You can obtain import and export insurance by finding an insurance provider and scheduling a consultation with them. Insurance is a complicated subject, which is why talking to an insurance broker can be beneficial.

They will provide answers to your questions and determine how much coverage you will need.

Once you have the answers you require and feel satisfied with the insurance company you have chosen, you can apply for a policy.

USA Customs Clearance can offer you support with your importing endeavors. Our team consists of licensed customs brokers and experienced import specialists with a wealth of knowledge. You can access their help by using our many services.

Get the import support you deserve by getting started with our services today. You can also contact our team at (855) 912-0406 if you require more information.

During a 45-minute consulting session, one of our licensed customs brokers

will help you find an insurance policy that's right for you.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post