Chinese computer parts are used in technology all across the United States. While this is a popular nation to source from, there are many hoops you’ll have to jump through when importing these products from China. Keeping track of it all can very be overwhelming. That’s why we’ve broken down the tariffs and regulations you should know about.

Key takeaways:

Now that we have the basics out of the way, we’re going to walk you through the requirements that come with importing computer parts from China.

If you want to import computer parts from China, you’ll need to make sure they’re compliant with the various federal agencies that regulate their entry. We’ll cover the applicable requirements at length in the following sections.

Customs and Border Protection (CBP) is the primary federal agency that oversees imported products entering the country. They’ll require you to complete some basic steps when you import computer parts from China or any other country.

You’ll need to maintain import records of your computer parts for at least five years after the date of entry. Imports are filed through CBP’s Automated Commercial Environment (ACE). This allows you to efficiently submit all information pertaining to your products.

The Federal Communications Commission (FCC) regulates the importation of equipment that emit radio frequency (RF) emissions. Most computer parts emit RF when they’re in use. Therefore, FCC requirements must be completed to import your products successfully.

This includes:

The first FCC requirement is equipment authorization. This essentially proves that your computer parts are compliant with FCC standards. There are two ways to achieve equipment authorization for your import:

Next, computer parts must meet one of the FCC’s 11 conditions that allow for the importation of RF devices. The conditions are quite lengthy, so you’ll need to analyze them carefully to determine the one that best apply your computer parts.

After you’ve completed these two steps, you’ll provide the appropriate labeling and documentation for your computer parts. First, the FCC ID should appear on your products. Next, you’ll need to include a compliance statement. This should appear either on the part itself, or in the user manual.

If you’re importing finished electronics, you’ll definitely run into FCC regulations. Consult our article on importing electronics to learn more.

HTS codes for computer parts can be found under heading 8473. However, your specific product will fall under one of the subsequent subheadings. Using the correct HTS code is essential for successful customs clearance.

That said, going through each code can be very stressful and overwhelming. Fortunately, we have an HTS Lookup Tool that you can use to easily find the appropriate code for your computer parts.

Use our tool to find the correct code for your computer parts.

Due to an ongoing trade war and various presidential actions, you may have to pay several tariffs when you import computer parts from China.

These include:

Section 301 tariffs are used the by the U.S. to take action against countries that engage in unfair trade practices that have an adverse effect on American commerce. There are numerous products from China that are affected by these tariffs, including computer parts.

The HTS codes impacted by Section 301 tariffs can be found on four different lists. Most of the HTS codes for the impacted computer parts are on list three.

Since earlier in 2025, there has been a 30% flat rate tariff imposed on all products from China through a series of executive orders.

Since these tariffs have fluctuated so frequently, it’s hard to say how high they will be when you finally import.

Related: What is Tariff Stacking, and How Does it Affect Importers?

During a consulting session, one of our Licensed Customs Brokers will walk you through the steps that you'll need to follow when importing computer parts.

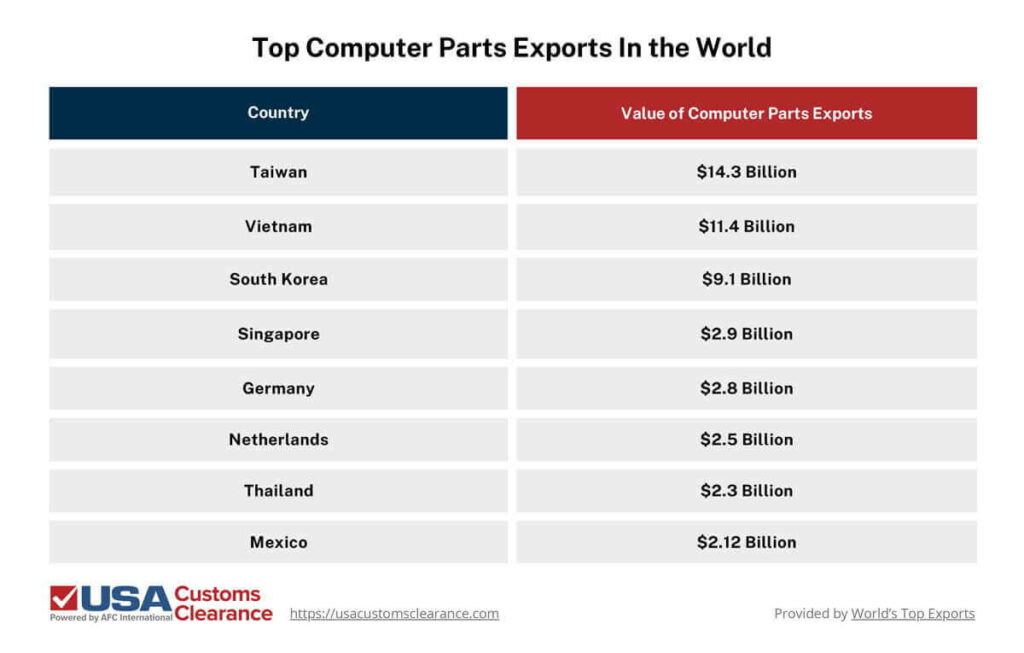

With all the tariffs impacting the costs of computer parts from China, it might be a good idea to source them from other countries. Fortunately, there are a variety of nations that manufacture quality computer parts. We’ve provided a table of the top countries who export these products.

Thanks to the United States-Mexico-Canada Agreement (USMCA), you’ll be able to import most computer parts duty free as long as they meet the USMCA’s rules of origin to receive preferential treatment.

Here at USA Customs Clearance, we’ve got the professional help you need to make your computer part imports a success. Our team consists of licensed customs brokers and import specialists that have years of experience in the industry. With their support, we’re able to provide importers with a variety of services and essential documentation.

This includes:

Start importing your computer parts with confidence with one of our services. You can also call us at (855) 912-0406 or reach out on our contact page if you have questions about our services.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post