The United States has always used tariffs to influence trade in one way or another. While most importers are familiar with standard practices such as ad valorem calculations, reciprocal tariffs are not often discussed. While these are not a new concept, how they are applied has varied greatly in U.S. history.

Key Takeaways:

We’re reviewing the basic definition of reciprocal tariffs, why they are used, and how the U.S. has implemented such procedures in the past.

A reciprocal tariff is when one country imposes an import duty that is intended to match or counteract what another country is applying to its exports.

The reasoning in such a case is to promote balanced trade and ensure that one country doesn’t benefit more than the other by maintaining high import fees while expecting low fees from others.

Typically, a reciprocal tariff is not meant to be used in retaliation against perceived unjust trade practices. In fact, in an ideal situation, both countries under a reciprocal tariff should be able to benefit.

The U.S. has used reciprocal tariffs in the past, starting in the 1930s. As the global economy evolved, so too have such trade policies.

We’ll examine three instances of such tariffs as part of U.S. trade policy to show you why they started, how they were applied, and what effect (if any) they had.

This act was applied by the presidential administration during the Great Depression. The goal at the time was to stimulate trade, and it did so by allowing the president to lower import tariffs by as much as 50% in exchange for similar reductions by others.

This act stayed in place until 1962 and led to multiple bilateral trade agreements, setting the framework for future multilateral agreements, such as the World Trade Organization. It was replaced by the Trade Expansion Act.

A few decades later, another trade act was proposed that utilized reciprocal tariffs. The basic proposal of the U.S. Reciprocal Trade Act of 2019 (HR 764) was to allow the president to raise duties on countries that had raised their own tariff rates on American exports.

Other key provisions of this act would have included the following:

The key difference between this proposed act and the one that was passed in 1934 was the specific intent to use tariffs as a strong-arm technique. Such a proposal was a means of pushing other countries to lower tariffs by making their products less profitable for U.S. importers.

Ultimately, this act did not pass on to become a law, as it never progressed in discussion beyond the subcommittee level.

On August 7th, 2025, the U.S. placed reciprocal tariffs on a variety of countries. This came after months of announcements and delays. Even the U.S.’s top trading partners haven’t been able to escape the new tariff rates.

Imports of Chinese products face a 30% rate. Mexican and Canadian products received a 25% and 35% rate respectively. However, if your imports qualify under the United States-Mexico-Canada Agreement (USMCA) rules of origin, you’ll be able to avoid the tariffs on products from each country covered in the agreement.

Other nations are receiving tariff rates that are much higher. For example, Brazil’s exports have a combined 10% reciprocal tariff and a 40% International Emergency Economic Powers Act (IEEPA) tariff.

The current presidential administration has also subjected specific commodities to tariffs by invoking Section 232 of the Trade Expansion Act of 1962.

There are some exceptions to the tariffs listed in the table. For one, steel and aluminum from the UK is only subject to a 25% rate. There is a deal between the U.S. and Japan that could lead to a 15% tariff on Japanese automobiles and auto parts, but as of now, it hasn’t been set in stone.

Avoid tariff errors as new policies become active. Ask Our Experts.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Based on what has historically been done, reciprocal tariffs imposed by the U.S. are used in the following situations:

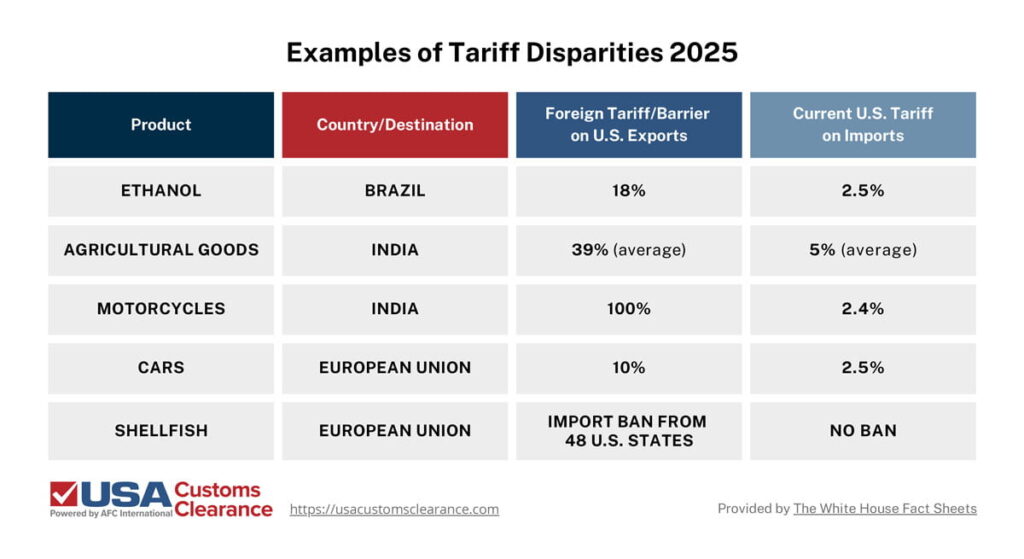

Going back to the Fair and Reciprocal Plan currently proposed, there are a number of current trade situations that meet one of the situations I’ve just mentioned.

On paper and just comparing tariff rates, the imbalance is obvious. However, in these international situations, there are likely to be a number of other factors involved. If there weren’t, then the reciprocal tariff calculation would be simple.

Let’s use ethanol as an example. Currently, Brazil applies an 18% tariff rate on incoming U.S. products, while the U.S. only charges 2.5%. By applying a reciprocal tariff of 15.5% on Brazilian ethanol imports in addition to the standard rate, companies would now be paying 18% ad valorem total.

In practice, this means that U.S. importers would now have to pay the same percentage value in duties to import ethanol from Brazil as Brazilians already pay when importing ethanol from the United States.

Ideally, the end goal would be to have Brazil lower their duty rate to match the U.S. standard of 2.5% rate.

As the U.S. looks to implement policies aimed at reducing its current trade deficit, chances are your import business is going to be impacted sooner or later.

Whether that results in your businesses needing to scale up or down, working with an experienced customs brokerage can help you navigate the changes. USA Customs Clearance offers a full suite of import services meant to ensure your shipments meet all requirements from destination to final entry.

Call us today at (855) 912-0406 to speak with a representative directly or send us your questions through our online contact form.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post