Section 321 shipments were those that used to qualify for duty-free import status under the U.S. de minimis exemptions. The imported merchandise could be for personal use or for domestic distribution (within certain rules). However, this exemption is longer in effect after a series of US government actions.

Key Takeaways:

Keep reading, and I’ll show you more about how these shipments used to work, what to expect with the provision's suspension, and which regulations to be wary of.

As of 12:01 AM on 8/29/2025, the Section 321 de minimis provision has been removed for all countries. This means that if you import anything from another country into the US, regardless of its value or how many units you ordered, you will most likely owe import taxes.

The order lays out the following methods for calculating duties and tariffs on these low-value shipments.

The second option will only be available until February, 2026. Afterward, the first method mentioned will be the only acceptable caclulation.

Let’s see how different types of importers might feel the effects of this suspension.

If you’re a US-based importer, the impact of this change to US customs procedures will differ based on how frequently you import goods and the delivery method(s) you use.

To simplify things, we can break importers into four basic categories:

If you’re a commercial importer looking for a way to minimize the drain on your profits this suspension could cause, consider a one-on-one consultation session with one of our licensed US customs brokers.

Stay ahead of your competition by adjusting your importing plans today.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

The pause on the collection of duties from low-value shipments out of China and Hong Kong was lifted on May 2, 2025. From that date forward, shipments from the PRC or Hong Kong that would have otherwise qualified for duty-free entry will need to pay any applicable duties.

Shipments entering as freight (non-postal items) must go through the Automated Commercial Environment (ACE) system. At this point, they will be subject to the same duties and tariffs as any other entries, including the following:

Items entering through an international postal system, usually personal ecommerce purchases, will be charged by the postal carrier company. There is some discretion in terms of when each company will collect this fee, but the calculations will be the same.

There are two options:

The option values were set to their current value based on an amendment issued on May 12, 2025 which lowered a higher established rate and removed a price hike that would have taken effect on June 1st.

At the moment, these fees should only apply to low-value shipements out of China and Hong Kong. We encourage anyone shipping through an international postal service to confirm with that carrier how payments will be handled.

To clear up any confusion, unless the seller specifically states that they will cover the shipping fees, assume that your final invoice will include a tariff charge or additional shipping charge. These fees are considered to be the responsibility of the U.S.-based buyer NOT the Chinese company offering the sale.

Related: How Trump's Policies May Impact International Trade

Note: The information in the following sections reflect the way Section 321 shipments worked prior to the previously mentioned suspension.

Before you can understand the Section 321 provisions, you should know what led to it: de minimis exemptions established by the Tariff Act.

The term de minimis refers to something of minimal value, meaning it is too small to warrant regulatory attention. In the context of U.S. imports, it represents the established $800 value threshold allowing goods to enter the country tax-free.

That 800 must be in USD and based on the fair retail value in the country of export. CBP valuation finalizes the determined retail value upon entry. More detail on this later.

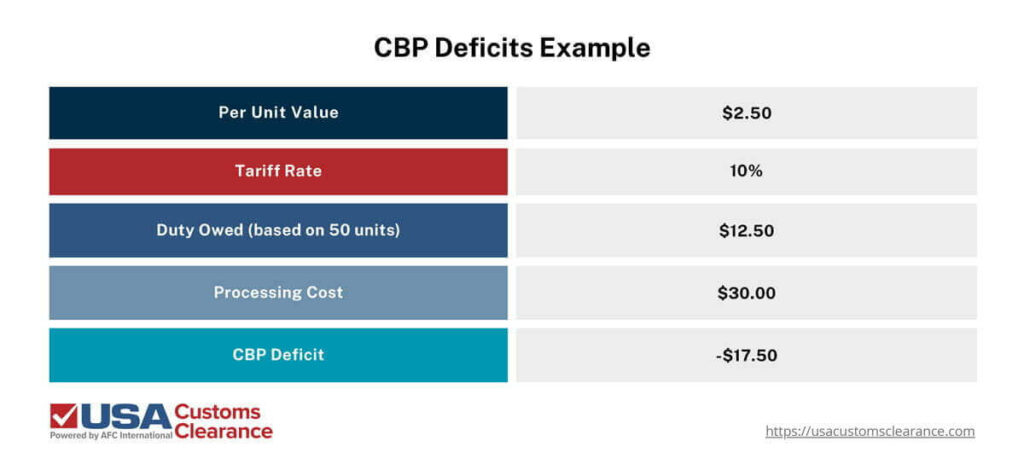

The U.S., like every other nation, makes money from collecting taxes on imported goods. However, processing a duty payment for low-value goods often ends up costing more than the tariff being collected.

Allowing de minimis shipments to enter without paying actually helps U.S. Customs and Border Protection (CBP) operate more efficiently and save money.

To illustrate this, consider a simplified example based on entering items that would be taxed by unit. Phone cases, an electronic accessory, are valued at $2.50 per unit. Assuming a 10% tariff, the owed duty would be $0.25 per unit.

On average across all imports, it costs CBP about $30 per formal entry to handle inspection and documentation processing. Even if the buyer bought 50 phone cases, the tariff owed would only be $12.50 resulting in a $17.50 deficit.

Even though these are quick sample numbers, they indicate the main issue with imposing duties on everything. While such deficits may not be the case for every low-value shipment, enough enter the country to significantly slow down CBP functions and increase their operating expenses.

Through the de minimis threshold, the system becomes more efficient and international trade becomes more accessible to everyone.

Section 321 is the provision under the Tariff Act that outlines what de minimis means in terms of trade. Therefore, a Section 321 shipment is simply an import that enters duty-free under the U.S. de minimis rules.

CBP’s rulings on Section 321 are found at 19 U.S.C. 1321, which also outlines value limits, eligibility, and other details. Many of the provisions and edits made over the years by CBP were heavily influenced by the rise in ecommerce and its effects

The original language of Section 321 suggests that the provision was put in place to help out individuals who occasionally imported low-value items.

Over time, and with the expansion of ecommerce on a global scale, the way Section 321 is applied has expanded. Today, the de minimis provision benefits a broader range of importers, including commercial entities that rely on streamlined import processes to maintain efficiency and cost-effectiveness in logistics.

Aside from individuals, businesses leveraging Section 321 include:

Of course, the businesses I’ve mentioned have only been able to benefit because of various amendments and advances in technology that have been made over the years.

Aside from expanded importer eligibility, these include the following:

These regulatory and operational changes have enabled businesses to scale their import operations while reducing costs and customs-related delays. However, the increased use of Section 321 has also led to heightened scrutiny and, in recent years, calls to further screen such shipments.

Entry Type 86, which I mentioned in the list above, is one tool that does make things smoother for importers but also gives CBP a better tool to track shipments. More on this in the next section.

Getting a designated customs broker who can direct how to best start using Section 321 shipments, might be a great investment to grow your import business if you’re starting from scratch.

Could Your Goods Qualify for Duty-Free Treatment?

Our 45 Minute Licensed Expert Consulting Provides Answers.

The CBP created Entry Type 86 in 2019, allowing customs brokers and self-filers to submit Section 321 claims while providing the agency with a better way to track qualifying shipments.

Importers are not required to file under entry Type 86, but are highly encouraged through the numerous benefits it offers.

CBP continues to encourage shippers filing for Section 321 declarations to do so as an Entry Type 86 for the safety and well-being of consumers as well. If an inspection reveals a harmful product, importers can be warned off certain suppliers.

Meeting the de minimis threshold is only part of the requirement for granting tax-free status. To legally claim Section 321 benefits, your shipment must meet specific conditions outlined by CBP.

These ensure that low-value shipments entering the U.S. under a section 321 exemption remain compliant with current regulations. Actions, such as splitting up consolidated shipments just to claim duty-free status, are highly penalized.

There are three phases of qualification.

For ecommerce businesses, the shipment frequency applies to the one making the purchase, not the seller. This is one of the provisions that makes it possible for businesses to ship multiple orders out in a single day.

Also note that filing for Entry Type 86 or ‘release from manifest’ does not automatically make your shipment tax-free. The item must still be cleared by CBP, and only after all paperwork checks out, do items obtain final approval as Section 321 shipments.

Shipments that fail to pass will be charged a tariff and perhaps even a penalty fee if there was a deliberate attempt made at avoiding a rightfully owed duty. Just the delay as it gets sorted out could potentially cost you thousands in fees.

Not all products will qualify for Section 321 entry, even if they are valued below the $800 limit. There are restrictions in place to prevent abuse of duty-free provisions and to ensure compliance with other U.S. trade and security regulations.

Products that are ineligible for duty-free treatment under Section 321 include:

Products that may qualify for a tariff exemption, but still be subject to fees from a Partner Government Agency (PGA) include:

Understanding these limitations is especially crucial for businesses relying on Section 321 for cost-effective imports. Ensuring compliance with customs regulations and avoiding restricted goods can help maintain smooth and penalty-free shipping operations.

Much of the changes to de minimis exemptions and Section 321 by extension, were because of ecommerce market growth. The peak of Covid-19 pandemic pushed the market to even greater heights because of increased demand for home delivery options.

For digitally native businesses, especially those just getting started, it provides multiple benefits:

Ecommerce retailers can use their status to access markets in places such as India, Singapore, and Taiwan. At this time, Chinese sourcing is still possible but does result in significant import fees.

Since 2018, an increasing number of tariffs have been placed on incoming goods from China on everything from vehicles to baby bottles. These tariffs were put in place under Section 301 of the Trade Act and have resulted in overall less trade with the manufacturing superpower - at least for certain industries.

Low-value shipments seem to have gone the opposite direction, increasing dramatically since limits increased.

Per an April 9th amendment to tariffs impacting China, low-value shipments, regardless of category, are no longer eligible for duty-free entry and are not exempt from applicable tariffs under Section 301 or other active tariffs.

Further information on Section 301 can be found in our comprehensive guide.

There are now three major actions in play within the government that could change the way Section 321 exemptions are applied when it comes to products from China and the rest of the world.

While these actions may not phase them out entirely, they will drastically alter how they are applied and who may be eligible.

Neither congressional act has received final approval, although there is support for both. With regard to the Executive Order, the additional tariffs are now place, though currently they only impact goods from the PRC and Hong Kong.

While I can’t tell you with any certainty that Section 321 shipments will be phased out on a global scale, there is a strong possibility that the number of qualifying products and nations of origin will change at some point in the future.

Bringing merchandise into the U.S. as Section 321 shipments has money-saving potential for your business. Whether you are just getting your ecommerce store up and running or are looking for ways to improve current fulfillment costs, 321 provisions are worth looking into.

Work with the experienced customs consultants at USA Customs Clearance and gain a resource capable of helping you every step of the way.

Ensure your business stays on track and stay updated on what changes may soon be impacting your supply chain.

Call us at (855) 912-0406 or send us a direct inquiry through our online contact form. A better importing strategy awaits.

Copy URL to Clipboard

Copy URL to Clipboard

Hello, I have noticed within the last couple of months (3Q to 4Q 2022) that DHL has charged duties on imports from Japan for goods that had not been charged in the past. The result of my inquiry w/ DHL indicated that the duty was the result of a violation section 321. My shipments were handbags, each purchase was less than $800 on different days. What seems to have changed from prior months is that though the shipments were under $800 was that they applied the law on the date that the shipments "cleared customs" rather than either the purchase date or the shipment date. For me to avoid any section 321 violations I thought that I had to manage/ensure no more than one purchase or shipment per day. That was true for the first 9 months in 2022. I can't control the date that clearance starts though. My question is "What is the section 321 requirement ... purchase date or shipment date or clearance date?" Hoping this in not one of those gray areas left to interpretation which can vary.

Please clarify if the requirement of section 321 is

1. Goods purchased on different days

2. Goods shipped on different dates

3 Goods cleared on different dates

Do we need to send prior notice for goods that qualify for tax exemption under section 321