Businesses are constantly trying to get a competitive edge over each other. One way they do this is by importing products from other countries.

Key Takeaways:

USA Customs Clearance employs Licensed Customs Brokers and other team members highly educated on the topic of importing. We’re going to use our expertise to show you the numerous benefits of importing that your business will be able to enjoy.

Unless you’re running a business that prides itself on sourcing or producing goods in the U.S., importing will benefit any operation. However, importing can be especially beneficial for new and smaller companies that don’t have the resources to manufacture their own goods domestically or abroad.

While there’s plenty of great products made in the U.S., importing goods from other nations will open the door to new opportunities for businesses. You’ll be able to save on costs, increase your profits, and obtain a competitive edge over your industry rivals.

The cost to manufacture goods in the U.S. can be fairly expensive. For new businesses or companies on a budget, it might not be feasible to set up domestic manufacturing operations.

Costs you’ll face include:

Importing goods that are produced in other countries is oftentimes a cheaper alternative than making products domestically. Countries in Asia are known for making high quality goods at an affordable cost.

Some businesses import from nearby countries, such as Canada or Mexico. Buying from nations close to the U.S. comes with the added perks of cheaper transportation costs and faster arrival of goods.

Importing is a great way of accessing a diverse range of products. Many countries specialize in exporting certain items that aren’t as common, are better quality, or are cheaper than what can be found domestically.

For example, Colombia is known around the world for the quality of their coffee beans, a product that simply can’t be grown in large quantities in the United States. This makes the country a popular location to purchase both coffee beans and finished roasts from. For the 2023/24 fiscal year, Colombia exported 12.1 million GBE bags of coffee beans.

Another example I can mention is China. They’re a massive producer of electrical equipment and machinery. During 2021, these products made up 26.6% of their total exports.

Colombia and China are only two examples of countries that excel in producing a specific type of product. Other nations around the world produce other quality goods you can import.

Related: Importing Green Coffee Beans

It’s the ultimate goal for any business to be a leader in their industry. One way to do this to sell unique, new, and high-quality goods that outdo what the competition has to offer.

While you can source products like these from the U.S., you can also find great products abroad. If you can identify and import an item that will be a big hit in the U.S., your chances of success will skyrocket.

Supply chain disruptions are always tough on businesses. This can negatively affect your ability to supply your customers with the products they want.

Causes of these disruptions include:

Importing can help overcome these challenges. If domestic suppliers can’t provide you with the goods you need due to supply chain disruptions, you can always search for alternatives in another country.

Likewise, a supplier in a foreign country might become unavailable if there’s political upheaval or if a natural disaster occurs. When this happens, you can pivot your import operations to another location until these problems are resolved.

We recommend planning for such circumstances ahead of time to avoid lengthy disruptions to your businesses. If you import raw materials for products made domestically, this is especially important to avoid slowing down production and potentially affecting your local workforce.

Importing goods from foreign countries will put you in contact with various parties in the logistics industry. Over time, you’ll be able to form strong bonds with these individuals.

This can lead to preferential business arrangements that can lower your import costs. Similarly, suppliers might be willing to work out deals with you after you’ve purchased products from them repeatedly.

New businesses don’t typically have the same resources as ones that are larger and more established. As demand increases, orders from overseas manufacturers can be scaled up gradually, especially if you already have an established reltionship with them.

In this way, you can meet rising demands for certain products during specific seasons. During the off-season, you can then scale your order back to minium order quantities if needed. This way you ensure you never have too much or too little inventory.

Importing can be beneficial for your business, but there are some common challenges that you should be familiar with before bringing in goods from a foreign supplier.

Exchange rates are an important factor when buying goods from another country. This is essentially the rate one currency will be exchanged for another. Changing exchange rates can impact the prices for imported products.

If the U.S. dollar depreciates, then the cost you pay for your imports will be higher. On the other hand, import costs tend to be lower with a stronger dollar.

You should always check the exchange rates before you purchase goods from abroad. Taking this precaution will help you determine if you should buy or wait for the dollar to appreciate.

Importing isn’t as easy as purchasing a good and arranging for transport to bring it to the country. Imports are subject to regulations administered by Customs and Border Protection (CBP). However, your goods might also be regulated by one or more Partner Government Agencies (PGA) also involved in the import process.

Depending on the type of products you import, you’ll need to provide different documents and certifications to clear customs. Most goods have tariffs you’ll have to pay as well. You might be able to obtain a reduced or eliminated tariff if you apply for preferential tariff treatment, but I can tell you now, that isn’t always an option.

Even when you focus on importing from nations that the U.S. has a Free Trade Agreement (FTA) with, it’s a good idea to hire a Licensed Customs Broker to help you navigate the fine print that’s often involved.

Related: U.S. Free Trade Agreements

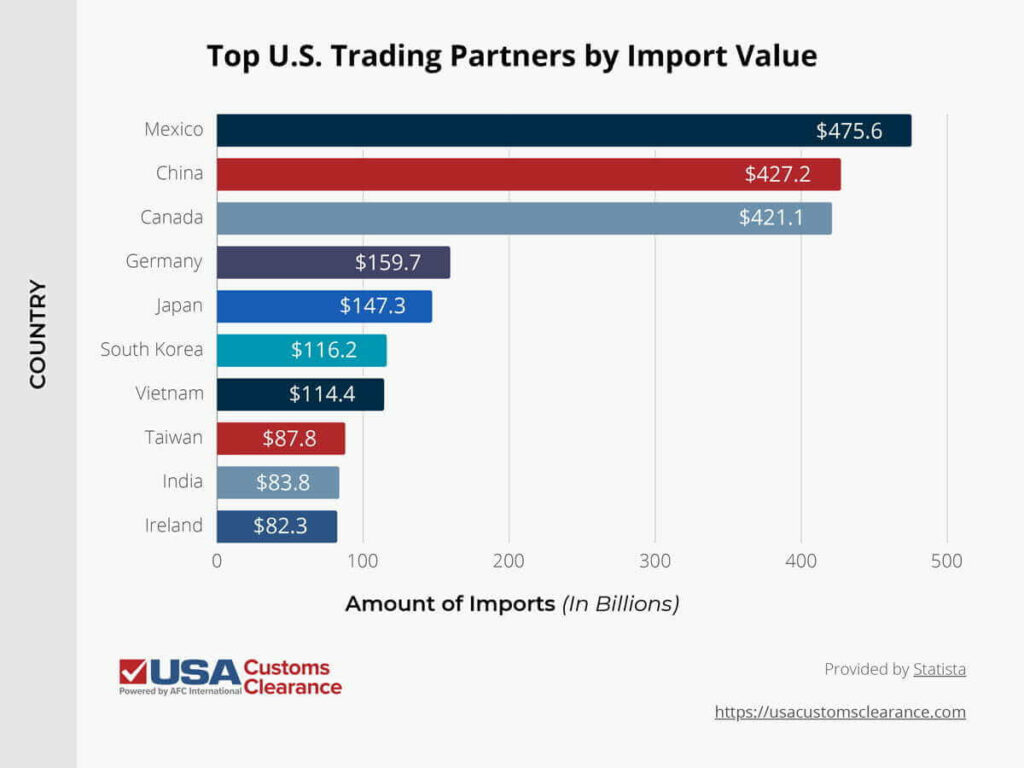

It can be overwhelming to look for a country that has the products you want to sell. That’s why I’ve compiled a list of the U.S.’s top 10 trading partners in 2023 to help you out. Each of these countries are great places to source goods from and offer many opportunities for new importers.

While most of these countries have good relations with the U.S., Mexico and Canada in particular share a beneficial trade agreement with the U.S. through a mutually beneficial FTA. All agricultural products receive zero-tariff treatment under this FTA. This FTA also has other perks you’ll be able to enjoy.

Related: United States-Mexico-Canada Agreement (USMCA)

If you’re ready to enjoy the benefits of importing, then look no further than USA Customs Clearance. Our team of Licensed Customs Brokers are subject-matter experts when it comes to importing. They’re caught up on all the current regulations you need to follow.

You can also access one of our many services, such as:

Here at USA Customs Clearance, our goal is to see you succeed in your importing endeavors. Connect with us on our site or click on one of our services to get started. If you’re in need of more information, you can always get a hold of our team at (855) 912-0406 to learn more about the services we provide.

Our personalized approach and commitment to customer service will help you understand your unique customs needs.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post