Foreign trade zones (FTZs) are designated areas for foreign merchandise to be imported, exported, stored, and more. They are situated near or within US ports of entry so importers and exporters can access special customs procedures under CBP with low to no duties and tariffs, as well as other commerce benefits. We’ve helped numerous businesses take advantage of FTZ. We’ll draw on this experience to give an inside look into how they work.

Key Takeaways:

Let’s take a look at how FTZs could boost your bottom line and set your supply chain up for smooth sailing.

Applying for a foreign trade zone membership is another step in the customs clearance process that USA Customs Clearance can assist you with. Contact our freight specialists to get started today.

Under local CBP authority, foreign trade zones (FTZs) are where importers and exporters can move foreign goods in and out of the US with deferred or eliminated duties and tariffs.

The purpose of a FTZ is to stimulate US production and manufacturing by allowing businesses to import, produce, and distribute foreign goods.

There are other commerce perks, such as efficient warehousing, manufacturing, supply chain advantages, and more that you can expect when becoming a FTZ member.

FTZs are managed by the Foreign Trade Zones Board, which consists of the Secretary of the Treasury and the Secretary of Commerce, as well as the Commissioner of CBP. CBP advises these officials to provide the regulations and rules regarding customs security and resources within foreign trade zones.

Importers and exporters can apply to operate within a FTZ or apply to be an operator or grantee of one or multiple FTZs. Let’s break down the application fees for new FTZ grantee and/or operators.

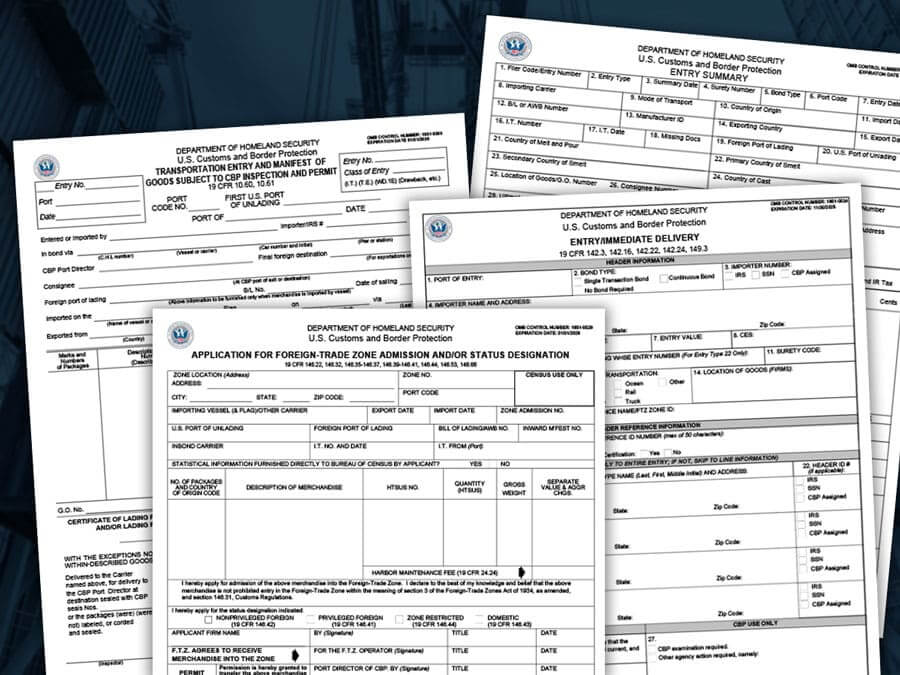

If you wish to simply use an existing FTZ, we advise working with a customs broker who operates on your behalf to pay membership fees, submit admissions forms, like Form 214, and handle other customs clearance procedures.

Every port of entry is allowed to have at least one FTZ, with additional or new zones approved when the grantee applicant can prove the current FTZ is not meeting shippers’ commerce needs in that area.

Keep in mind that foreign trade zones are not free trade zones, even if they share the abbreviation “FTZ.” Foreign trade zones are designated only in the US and US territories, while free trade zones function similarly but are located internationally.

By becoming a user or grantee and/or operator of a FTZ, shippers enjoy benefits that save on a variety of customs expenses.

Inverted Tariff and Duty Exemption or Deferral

FTZs are perfect for importers and exporters seeking fair commerce advantages in the competitive global marketplace. To that effect, foreign trade zones provide special customs processes that reduce or eliminate duties on imported goods that are re-exported later.

For manufacturers, when you finish your assembled products within a FTZ, you can reap the benefits of an inverted tariff, reducing your duties up to 50%.

You can also expect to pay duties later on products entering the US market, as well as no duties on waste, rejected and defective parts, or scrap during FTZ operations.

Quota Avoidance and Merchandise Processing Fee (MPF) Reduction

For shippers looking to save on quotas, FTZs allow goods subject to quotas to be held there if the quota has been reached for the product that year. You won’t have to pay a new quota until the following year—plus, you may be able to alter your goods into a new category that isn’t subject to the same quotas as before.

Say goodbye to individual forms of entry for each product. FTZ users can submit a single entry for their entire shipment of goods, bringing down the overall entry filing fees.

Simplified Logistics

Because FTZs help lower operation costs, such as importing fees, warehousing, and more, importers can enjoy streamlined logistics by spending less time on the customs clearance process and more time moving freight to its destination.

While you could utilize foreign trade zone benefits on your own, partnering with a licensed customs broker is the optimal approach to getting the most out of your FTZ operations.

File Required Documents

Customs brokerage services include submitting an array of paperwork on your behalf to speed up the customs clearance process.

For FTZs, customs brokers submit FTZ documents for you to ensure you have everything you need before your first shipment, like the following:

Customs brokers assist with other necessary paperwork and payment preparations, such as your weekly export/import estimate and customs bonds.

Set FTZ Operator Bond

Customs brokers help FTZ operators obtain a continuous bond, known as a FTZ operator bond. This bond ensures that FTZ operators will comply with CBP regulations regarding the zone’s activity and handling of goods.

Related: All Types of Customs Bonds: Activity Codes And Uses

Write FTZ Operator’s Standard Operating Procedures (SOP)

Filing, setting bonds, checking off customs clearance tasks, and other customs processes are the core of professional customs brokerage services. Customs brokers create FTZ operators’ standard operating procedures (SOP) to help importers and exporters stay in compliance with CBP and improve logistics from start to finish.

FTZs are located either inside a port of entry, within 60 miles or 90 minutes of it, or further if CBP can accurately monitor the zone’s activity.

The International Trade Administration provides a full list of FTZ locations nearest to your preferred port of entry. Once you know what port you’ll be shipping to, you can search for a FTZ with the type of framework you’d want to operate in.

There are two types of FTZ frameworks that importers and exporters can choose to manage FTZs: Traditional Site Framework (TSF) or Alternative Site Framework (ASF).

Traditional Site Frameworks are considered the default zone type. They include the same zones you’d find under Alternative Site Frameworks, except they are older subzones/usage-driven zones that haven’t been updated into ASFs, or subzones/usage-driven zones that are outside of a FTZ’s approved ASF service area.

Expansions

This is when a zone makes minor adjustments to the FTZ’s service area, adds new sites, or reorganizes the zone into an ASF.

Minor Boundary Modifications (MBMs)

Minor Boundary Modifications (MBMs) happen when a grantee requests small changes to a zone’s current service area, as long as those changes don’t affect the zone’s production activation limit.

Where TSFs were established under the Foreign Trade Zones Act of 1934, Alternative Site Frameworks seek to update this method to help shippers apply for FTZs quicker, make the MBM process smoother, and more.

Magnet Sites

Both TSFs and ASFs include magnet sites for importers and exporters to manufacture, distribute, and store their goods. However, ASFs allow grantees to select magnet sites in hopes of drawing more FTZ operators and users to a particular zone, as the name “magnet” implies.

ASFs also include a deadline, or “sunset,” for magnet sites to remove designation after five years.

Subzones/Usage-Driven Zones

Like magnet zones, you can find subzones or usage-driven zones in TSFs, too. Yet when subzones/usage-driven zones are under an ASF, the minor boundary modification is swift and simple when compared to TSFs. This process is sped up thanks to ASFs not requiring acreage swapping like TSFs.

Similar to the previous zone type, sunset periods apply to subzones/usage-driven zones. The FTZ Board will test the production activity every three years to decide if the zone is still useful to shippers and their commerce goals.

Production activity within a foreign trade zone is one of the biggest benefits FTZs have to offer shippers. All in one place, you can import, export, manufacture, and store your goods to enhance your logistics.

Before you can get started, you’ll need to request production authority from the FTZ Board staff who will then approve your scope of authority. While there are start-up costs to operate in a FTZ, the production authority request has no fee.

While you can enjoy a substantial supply chain boost operating within a foreign trade zone, this does not include retail trade.

Foreign trade zones can strengthen your logistics strategy by saving time and money operating from a central location. Partnering with USA Customs Clearance is the next step in that strategy to import with confidence.

Get in touch with us at (855) 912-0406 or request your customs brokerage quote today.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post