Before you import goods into the US to be sold, US Customs and Border Protection (CBP) requires that each article of foreign origin be marked with the country it was made in. This regulation protects consumers by sharing crucial information about the goods they know and use daily, such as where the materials or parts were manufactured or produced. USA Customs Clearance makes CBP compliance and the entry process easy, no matter the product or country of origin.

Key Takeaways:

Here at USA Customs Clearance, our licensed customs brokers specialize in importing and shipping freight for importers at every level of experience.

USA Customs Clearance takes the guesswork out of importing and shipping your cargo. Our skilled customs brokers tailor a plan for your freight needs.

The country of origin (COO) denotes where foreign goods and/or their materials were produced, grown, or manufactured.

For example, when importers receive boxes from India of denim jeans to sell in their retail store, each pair of jeans must be marked with a tag that states “made in India.”

If your goods were produced with materials from more than one country, the last country where transformational changes were made to your product is the country of origin.

Using the same example above, let’s say importers first sourced materials like dye and cotton from India, and then imported those materials to the US to handcraft the denim jeans in their own facility. The country of origin would be labeled as “made in US” on each pair of jeans.

Similarly, the United State Department of Agriculture (USDA) requires Country of Origin Labeling (COOL) for certain foods upon US entry, with exemptions to restaurants and particular food establishments.

Other CBP exemptions for country of origin marking can include:

Country of origin markings are also required on repacked goods meant to be sold, unless the repacker is the final purchaser.

While CBP doesn’t require a specific location or size for the COO marking, CBP enforces the following country of origin guidelines for goods upon entry to the US:

CBP enforces sanctions on all goods not marked with their country of origin, which can include additional duties or even criminal prosecution.

If you want to avoid discrepancies or duties during the importing process, obtaining a certificate of origin (CO) may reduce or eliminate your fees.

However, claiming preferential treatment is ideal to save money and speed up the customs clearance process. You can use CBP’s certificate of origin template to get started.

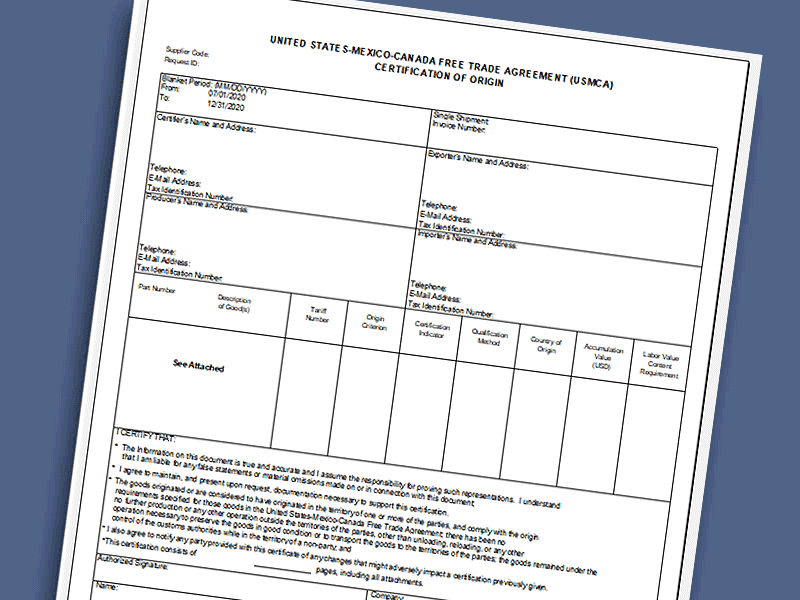

Related: How To Complete a USMCA Certificate of Origin

Importing goods into the US can be a complex process, especially for new importers or certain products. This is where Free Trade Agreements (FTA) can lessen trade barriers and get your goods to their destination more easily.

Free Trade Agreements are agreements between two or more countries to reduce import and export obstacles and benefit international trade relationships.

Like how the United States-Mexico-Canada Agreement (USMCA) may offer importers and exporters some duty and tariff relief when moving freight between the US, Mexico, and Canada, the US has 14 FTAs with 20 other countries to help reduce customs expenses.

Like the country of origin, it’s imperative to follow the rules of origin (ROO) to establish whether your products are eligible for an FTA certificate of origin to bypass import barriers.

If a product was produced in various countries, the final country where substantial transformations were made is the country of origin. FTA ROOs mostly follow this standard with slight adjustments based on how your product was made.

The rules of origin are determined by categories including, but not limited to:

Keep in mind there are additional categories under US Customs regulations. If you aren’t sure how to gather this information, there are three ways to find your rules of origin:

Once you’re certain your product follows the rules of origin for marking the correct FTA country, you can obtain one of the two types of FTA certificates of origin:

Preferential COs

Products that are eligible for tariff and duty reductions or eliminations with preferential treatment from FTA partner countries.

Non-Preferential COs

Products that aren’t eligible for tariff and duty reductions with FTA partner countries.

Certain FTA partners require a specific format to declare your goods, like a particular letterhead. However, all FTA COs should include the following:

Keep in mind that blanket certifications can include multiple qualified products being shipped, but the blanket period can’t exceed 365 days.

We understand that navigating tariffs and duties can get expensive, especially if you’re importing from non-FTA countries. This has led some importers to seek alternative methods to cut down fees when moving their freight.

In turn, CBP has imposed stricter penalties to ensure importers pay accurate tariffs and duties. Let’s take a look at how import fees break down from country to country and how to remain in compliance.

Tariffs and duty fees are calculated by your product’s HTS code. Like the country of origin, the HTS code is essential to classifying your goods and determining the correct import fees.

US HS codes are six digits, and other countries can add more digits to further distinguish your product’s classification.

Duties and tariffs fluctuate based on the country you’re importing from. For example, if you’re importing from China, multiple duties (sometimes referred to as tariff stacking) might apply to your shipment.

Transshipments are when goods are moved from location to location by truck, airplane, or train before they reach their destination.

Importers trying to avoid higher fees may turn to making false customs claims and using third-party routers to undervalue, misbrand, or conceal the true country of origin of their goods. CBP’s penalties for illegal transshipments can result in steep fines or even imprisonment.

When in doubt, a customs broker can steer you in the right direction and stay out of CBP’s scrutiny.

Related: What is Import Compliance? Reducing Risks for Importing

Correctly marking your product’s country of origin, following FTA’s rules of origin when they apply, and avoiding illegal transshipments all factor into CBP compliance.

We recommend obtaining a certificate of origin to smoothen the customs process and check every item off your customs clearance list confidently.

When you complete your certificate of origin, it’s important to:

While a certificate of origin is optional, CBP requires that you keep records of any COs for at least five years from the entry date.

Country of origin requirements and other CBP regulations can be complicated, but navigating them with USA Customs Clearance as your trusted customs brokerage team simplifies the process for easier, quicker imports.

We’re ready to assist you at every turn of the customs clearance process. Give us a call at (855) 912-0406 or get in touch with us through our contact page.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post