Due to a number of executive actions from the White House, one word has been on everyone’s mind lately: tariff. More specifically, businesses and personal importers in the United States have both been confronted by the development of stacking tariffs.

Key Takeaways

In this article, I’ll explain how tariff stacking works, some scenarios in which stacking may apply, and legal methods of mitigating the issue.

Tariff stacking refers to multiple tariffs simultaneously being applied to a single commodity. When several of these levies are stacked together, they are often referred to as a cumulative tariff.

In early 2025, the executive branch of the United States federal government began levying multiple types of tariffs specific to factors like country of origin, commodity classification, and calculations based on trade deficits with other countries.

To gain a more complete understanding of how tariffs can stack, let’s look at some of the different types of import taxes countries use.

Now that we’ve defined these different types of tariffs, let’s look at some examples of how they might stack on top of each other.

To illustrate how multiple tariffs can stack on a single commodity, let’s look at automobile imports from Japan. Personal and commercial importers have brought Japanese vehicles into the US for decades. There is no free trade agreement between the two countries when it comes to vehicles, so importers are charged an ad valorem duty rate of 2.5%.

As of this writing, cars imported from Japan into the US are subject to two additional tariffs, which are:

For simplicity’s sake, let’s say you want to import a small car from Japan to the United States. The car is valued at $10,000. The following table will show you how the duty and tariff calculations would work on such a transaction.

Between tariffs and duties, the original cost of the vehicle jumps almost 36%.

I can’t discuss tariff stacking without also mentioning another Asian trade partner: China. Between reciprocal and commodity-specific tariffs, commercial importers in the US have seen tariff rates of 145% or more on Chinese imports.

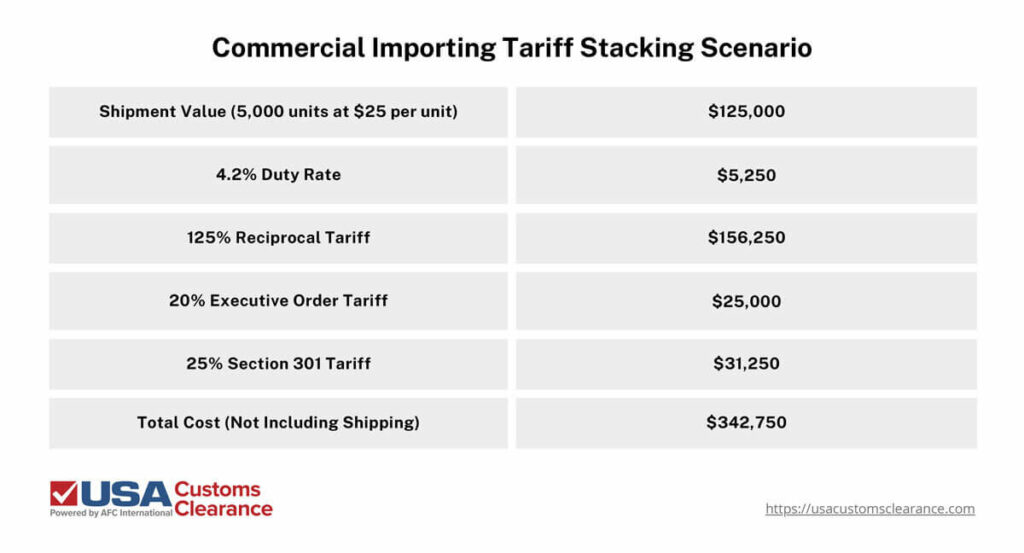

My previous example was based on a personal transaction. Now let’s take a look at a commercial shipment of blenders to see what import businesses in the US can expect to pay on goods from China.

In China’s case, the 10% flat fee mentioned in the first graphic is superseded by the reciprocal rate.

This amounts to an increase of almost 175% over initial costs. Keep in mind that these rates can change quickly during times of high tension in international trade.

Given the sharp rise in the overall cost of popular consumer goods, it’s no wonder importers are looking for ways to eliminate or mitigate these tariffs. There are some options available to do so.

Related: How to Import Vehicle to the USA

With the 10% flat tariff in effect on all goods imported to the USA, regardless of country of origin, tariff stacking can be difficult to avoid. However, it can be mitigated by sourcing your products from countries with whom the USA shares a free trade agreement (FTA).

Free trade partners with the U.S. receive preferential rates of duty, which usually amount to no duty at all. Just realize that this is only likely to apply to the general rate of duty assigned to the product by its HTS code, not the flat tariff.

In theory, a product with a 5% ad valorem duty assigned by an HTS code could be reduced to 0% when imported from a nation with an FTA. In which case, only the reciprocal tariff of 10% would apply upon entry. The same product imported from a non-FTA nation would result in a 15% tariff.

So, if you have a choice of sourcing goods from an FTA partner and a country subject to the general rate of duty, assuming product costs are the same, you’ll pay less overall in import taxes from the FTA country.

The best way to make sure you don’t pay more in import fees than necessary is to have a licensed customs broker handle the clearance process on your behalf.

Related: How Reciprocal Tariffs Impact Global Trade

The brokers and customs experts at USA Customs Clearance have over a century of combined experience helping import businesses cut through the red tape of the clearance process. Additionally, they can put their knowledge to work helping you mitigate tariff costs on imported goods.

Our full list of services includes:

Don’t let tariff turmoil tear down your business. Call us at (855) 912-0406 or submit a contact form online today!

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post