To obtain a customs bond, importers can either purchase one directly from a surety company licensed by the U.S. Treasury or, more commonly, through a licensed customs broker who can handle the necessary paperwork and expedite approval - typically within 48 hours.

You have a great product to import from outside the U.S., a supplier lined up, and customers clamoring for your goods. Before you can bring your shipment into the country, you’ll need to secure a customs bond. If you’re not sure how to get a bond for your imported shipment, we can help.

Key Takeaways:

Read on to learn more about how to get a United States customs bond and how a customs broker can help simplify the process.

Importing Starts With a Contract.

You Must Pay Import Duties & Taxes for your Goods.

There are two options you can choose when purchasing a bond for customs clearance.

The first is to purchase the bond directly from a surety company that is licensed by the U.S. Treasury Department. This option is usually only used by large, experienced businesses.

The second (and easier option) for most importers is to purchase the bond through f a licensed customs broker. The advantage of this option is that a broker can fill out the paperwork on your behalf and will often work to get you approved within days of the application being filed.

Additionally, a customs broker can ensure that your bond auto-renews correctly each year while you get to stay focused on your business. Otherwise, the responsibility for annually renewing your bond falls all on you.

Speaking of renewing a customs bond…

Related: The Complete Beginners Guide to Importing and Exporting

There are two types of customs bonds to choose from, and the main differences between them involve the number of shipments and coverage period.

Another distinction between these two bonds has to do with the shipment’s port of entry. With a single entry bond, you must designate a single U.S. port of entry ahead of time, and you can’t make a change once the paperwork has been filed.

On the other hand, a continuous bond allows you to import your goods through any U.S. port of entry during the 12-months during which it is valid.

The basic rule of thumb is that if you’re regularly ordering shipments valued at $2,500 or more for commercial purposes, you’ll need a continuous bond. A single entry is made for low-value and infrequent imports.

Related: Types of Customs Bonds - Activity Codes and Uses

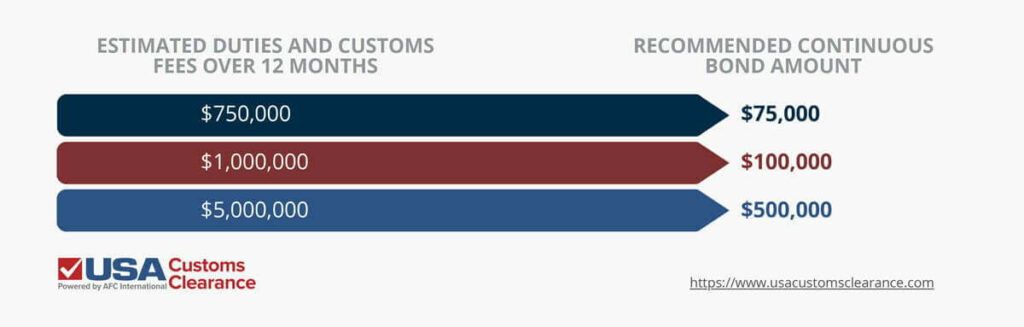

For business owners, it’s in your best interest to have a continuous (annual) bond worth at least 10% of your estimated duties for a 12-month period. In the table below, you can see some common bond amounts based on these estimates.

The best way to estimate these duties is with year-over-year data from your business. New businesses will often start with a $50,000 bond and make adjustments as necessary.

If your shipment is covered by a single-use bond, it should be worth 3x the estimated duties, taxes, and fees the shipment will incur.

No matter which one works best for your business needs, USA Customs Clearance can provide you with a secure single-use or continuous customs bond to cover your shipment. However, our services don’t stop there.

Our team of customs experts can also provide you with:

Make sure your shipment is bonded before it reaches the United States. Give us a call at (855) 912-0406 or submit a contact form online today!

Copy URL to Clipboard

Copy URL to Clipboard

what paper work need to prepare for renew a bound, where can I find this information

customs broker, i am interested in importing dry peppers and spices from Mexico, along withotherbthings such as beans. Can you help me through this process?

Dear broker,

I am enquiring about getting a customs bond if needed for my imported products from outside of the US. I import general goods.