Import costs from Mexico are more relevant now than ever before. Many U.S. businesses conduct trade with this vital partner. That said, importers can incur additional expenses when buying goods from suppliers in Mexico. Companies should know their expenses and learn how to avoid excess import fees.

Key takeaways:

Import costs from Mexico may seem challenging, but with our support, you’ll be able to reduce your expenses.

Tariffs on non-USMCA imported from Mexico to the US remain at 25%, while sectoral tariffs on steel and aluminum are now 50% with no exceptions on such goods sourced from Mexico. Vehicles imported from Mexico also receive a 15% tariff on non-USMCA components, while vehicles imported from most other countries face a flat 25% rate.

On April 2, 2025, the U.S. announced that it would be implementing a variety of reciprocal tariffs on most countries. A few days later, most of the tariffs were reduced to a 10% baseline rate. Mexico and Canada are exempt from this baseline tariff.

However, they are subject to a 25% flat rate tariff that comes from an executive order introduced in February and officially implemented in March. This rate applies to goods sourced from Mexico that don’t fall under the USMCA. The rate covers approximately 50% of Mexican goods.

Steel and aluminum products face a higher 25% tariff, from which Mexico is no longer exempt.

Other provisions written into the order to provide clarity on specific exceptional situations.

All orders were pushed through as part of a national emergency under the International Emergency Economic Powers Act (IEEPA) and the National Emergencies Act.

To learn what commodities will be allowed duty-free entry and under which conditions, please contact our team.

Related: How Trump’s Tariff Policies May Impact International Trade

Mexican President Claudia Sheinbaum stated that her country could respond with retaliatory tariffs, but these have never been specifically outlined or imposed as of this writing.

Stay up to date with the constantly shifting tariffs with our tariff tracker tool.

Providing an exact amount on the cost to import from Mexico is near impossible. The details of every shipment are different, which causes expenses to fluctuate. That said, it’s helpful to know the type of costs businesses can incur when importing from this vital trading partner.

Importing products from Mexico seems straightforward. However, there are numerous costs that inexperienced businesses and brokerage services don’t know about.

The primary expenses businesses will encounter include:

Duties and tariffs are taxes imposed on specific goods. The rates can vary depending on the type of product a company is importing. As mentioned earlier, most USMCA-compliant goods sourced from Mexico can be brought into the US duty-free.

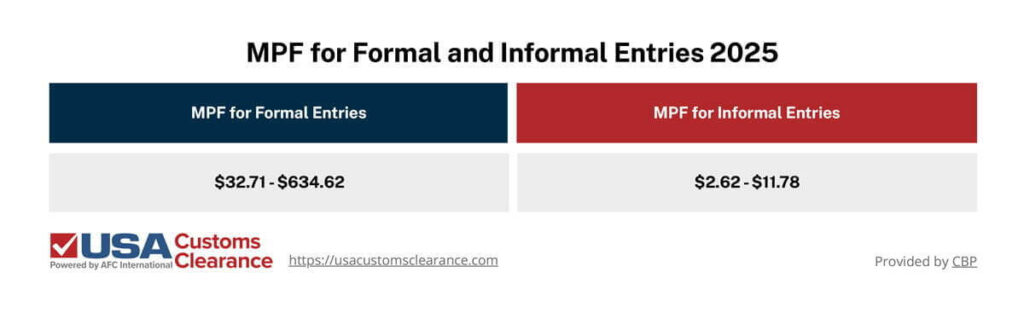

Companies will have to pay a Customs and Border Protection (CBP) Merchandise Processing Fee (MPF) for all formal and informal entries. Formal entries are shipments that are $2,500 in value. Therefore, informal entries apply to shipments with a value lower than $2,500.

The MPF is charged as an ad-valorem fee of 0.3464% of the total shipment value. MPF’s change every year. We’ve provided a table of MPF’s for formal and informal entries in 2025.

The exact fee will differ based on the value of the goods that have been imported from Mexico. That said, formal entries will be no less than $32.71 and no greater than $634.62.

In addition to MPF’s, businesses will face unique transportation and logistics costs when importing from this trading ally. Since Mexico shares a land border with the U.S., it’s possible to transport goods by rail or truck. Vessel and air transport are still viable options as well.

Some businesses choose to store their goods before distribution. Cargo will be kept in a bonded warehouse if importers decide on this option. There will be associated fees that business have to pay when using these facilities.

Terminal charges are another cost associated with importing from Mexico. When shipments come into an airport or seaport, workers will have to unload the goods and move them throughout the facility. These services will add to your overall costs.

Some fees associated with terminal charges and warehouse storage include:

You should also be prepared for the possibility of your goods being inspected by CBP prior to clearing customs. This is part of an ongoing effort to reduce the amount of illicit substances from across the border.

Smugglers will go to extremes in their efforts to hide products from inspection services, so border checks must be equally thorough. These inspections can take up to four days to complete, and the cost of the inspection is passed to the importer.

If businesses don’t transfer their Mexican imports from the terminal within the agreed time, they will face demurrage fees. The expenses will only get higher the longer goods are kept at the facility. This is a common risk of importing that every business can face.

When the container leaves a terminal, importers have a limited window of time to unload the contents and send it back to the port. If the container chassis isn’t returned within the allotted time frame, businesses will incur detention charges from their carrier.

Learn more about importing products from Mexico to the U.S. with our comprehensive guide.

There are many fees that importers will incur when they buy goods from Mexico. These expenses are determined in different ways. First, we’ll start with how tariffs are decided.

Essentially, there are two variations of this cost.

Specific taxes levy a fixed fee based on the item. For example, this could include a $300 tax on an agricultural import. Ad valorem tariffs are based on the value of the items. This could be a tax that’s 4% of the shipment’s value.

Transportation and logistics costs vary e based on distance and the mode of shipping. Importers can expect to spend more if they use international air transport. Vessel shipping is cheaper, but takes a bit longer than plane. In most cases, terrestrial transport (truck and rail) is used to ship goods into the U.S. from Mexico.

Calculating import costs from Mexico can be broken down into a few parts.

This includes:

The customs value t will change with every load of imported goods. Businesses can find their tariff rate by checking the HTS code for their products. Thanks to the USMCA, most imported goods from Mexico may have a reduced or eliminated tariff.

To ensure that all fees are being handled properly, it’s highly recommended for you to work with a licensed customs broker. If you are a domestic carrier service looking to expand and provide cross-border deliveries for U.S. companies nearshoring their operations in Mexico, partnering with a reliable customs brokerage firm is a must to avoid mistakes.

Calculating import costs can be difficult. Our Licensed Customs Brokers can help you find the exact amount you'll need to pay during a consulting session.

Yes, the USMCA free trade agreement (FTA) can decrease Mexican import costs. There are many facets of this FTA that help lower expenses for importers and promote trade.

The cost saving benefits of USMCA include:

We’ll explain each of these points and how it will help importers save money on their purchases.

De minimis is the threshold value of goods that can be imported without incurring customs duties or taxes. The de minimis level for U.S. importers is usually $800. For many Small and Midsize Enterprises (SME), importing goods from other countries is extremely costly.

De minimus helps cases such as:

Importers should be aware that de minimis shipments from Mexico are likely to begin incurring tariffs in the near future. The White House planned to invoke this change in March 2025, but has delayed it for the time being.

Under USMCA, a vast majority of goods traded between the member countries can receive preferential tariff treatment. This means products imported from Mexico will have a reduced duty. For certain products like agricultural goods and textiles, tariffs will be removed completely.

Other products that enjoy preferential tariff treatment under USMCA include:

Keep in mind that while many USMCA products can be imported to the US free of duty, the 25% steel and aluminum tariff still applies as of this writing.

Before an import can receive preferential tariff treatment, the shipment must qualify under USMCA rules of origin. To do so, goods must meet a minimum of 9 elements to meet the requirements set by the FTA.

Certificates of origin aren’t required for shipments that have a value of $2,500 or less. The exception to this rule is if multiple importations valued $2,500 or less are made repeatedly and in a short time span to evade U.S. laws and regulations.

Thanks to the preferential treatment offered by the USMCA, Mexico is a lucrative sourcing destination. This can help U.S. businesses mitigate risks associated with over-reliance on a single import source. Preferential tariff treatment also reduces the financial burden imposed on businesses when they import from Mexico.

The USMCA allows the U.S., Canada, and Mexico to impose antidumping and countervailing duties as necessary. These provisions are in place to address unfair trade practices.

The U.S. has the following antidumping and countervailing duties in place:

Businesses that want to import these products will need to familiarize themselves with the relevant AD/CVD orders . It’s important to note the list of goods subject to these duties can change in the future.

Related: Antidumping and Countervailing Duties

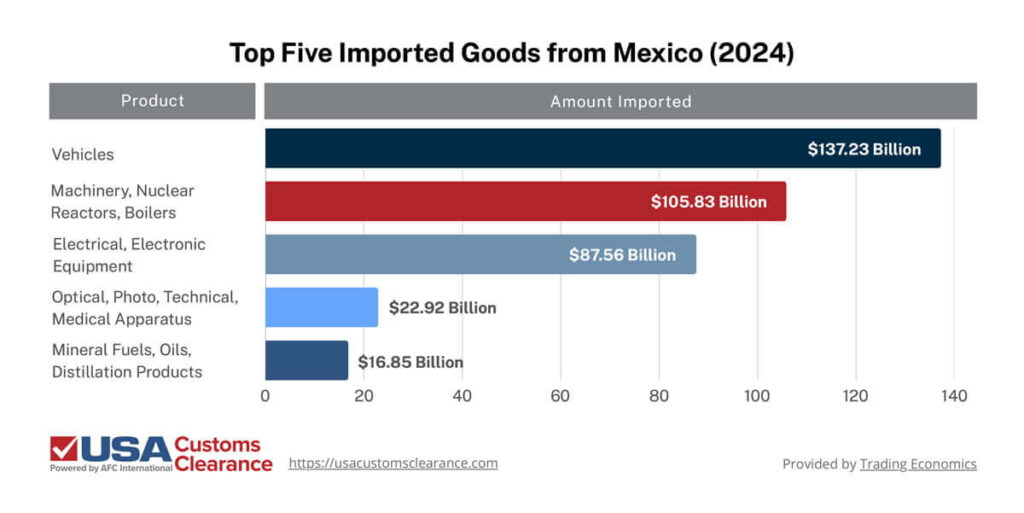

Mexico is one of the U.S.'s most significant foreign trading partners. It plays a pivotal role in the American market by supplying a wide range of goods.

Products the U.S. imports from Mexico include:

Mexico excels at producing commodities for various reasons. For one, the country has a diverse climate and topography that makes it a great place for producing agricultural products.

Mexico also has a skilled and adaptable workforce in the manufacturing sectors. Coupled with cost-effective labor rates, Mexican companies offer U.S. businesses high productivity levels without the overhead found in some other countries.

Out of all the goods the U.S. imports from Mexico, there are a few that are more popular than the rest. We’ve included some data on the top five commodity categories the U.S. sources from its neighbor below the border.

Fortunately for importers, many of these goods will qualify for preferential tariff treatment. This means businesses that sell these products will be able to affordably source their commodities from Mexico.

Vehicle and auto parts importers should stay abreast of tariff changes, however, as the White House has said it's seeking a way to impose tariffs on any non-USMCA component of an otherwise compliant vehicle or part.

When it comes to understanding and managing import costs from Mexico, the journey can be intricate. At USA Customs Clearance, we pride ourselves on being your guiding hand. With decades of experience and a keen understanding of the import landscape, we ensure that your importing endeavors are both smooth and compliant.

Our services include:

Don't let the intricacies of import costs deter your ambitions. Choose a partner who understands the changing landscape of international trade and is equipped to steer you clear of potential pitfalls. Call us now at (855) 912-0406 or contact us through the site to embark on a hassle-free import journey with USA Customs Clearance.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post