Importing steel has become a massive industry for U.S. importers due to the demand for this metal domestically. However, there are a number of things you need to know when deciding how to import steel to the U.S. Important details include calculating import tariffs, licensing requirements, and where to import your steel from.

Key takeaways:

Our comprehensive guide provides a complete breakdown of the requirements you’ll need to comply with to successfully import steel into the United States.

On June 4th, 2025 at 12:01 AM EST, the U.S. raised the tariff for Section 232 imports impacting steel. The tariff rate for steel has increased from 25% to 50%. Even if your goods entered into a Free Trade Zone (FTZ) prior to implementation, your steel may not be grandfathered in under the older rate.

Steel imports from the United Kingdom will remain at 25%, but this could go up or down in the future. This will largely depend on the outcome of the US-UK Economic Prosperity Deal (EPD) that will be negotiated May 8th, 2025.

Fortunately, Section 232 imports are protected from tariff stacking. The application of tariffs on imports consisting of mixed materials has also changed. You’ll need to provide a breakdown of aluminum/steel and non-metal content. Any non-steel/aluminum in your shipments will be subject to other tariffs per their HTS classification.

According to data on the world’s leading steel importers, the U.S. is the world’s largest buyer of these products. In fact, over the past several years, America has averaged nearly 28 million metric tons imported per year.

The reason the U.S. must import steel is simple: since reaching a peak of 141 million tons produced in 1969, the country has steadily reduced the amount it produces domestically. To reflect that trend, small specialty and mini-mills have gradually replaced most of the large mills that powered the United States during its most productive stretches.

So while the need for steel hasn’t gone anywhere, America’s output has been reduced. Hence, the need to import this commodity from outside sources.

Related: Importing Scrap Metal

While China sits just outside the top 10 U.S. U.S. sources for steel, it still accounted for more than 430 thousand metric tons imported into the U.S. in 2021.

Due to Section 232 and Section 301, there is a 25% tariff on imports of this product from China. Section 301 specifically targets fabricated structural steel, which is not covered by Section 232.

Additionally, various imports of this commodity coming from China are subject to anti-dumping/countervailing duties (AD/CVD). These duties place an additional set of taxes on imports entering the country. If you’re sourcing from China, make sure you have the financial means to cover these additional expenses.

Related: Importing from China To the U.S.

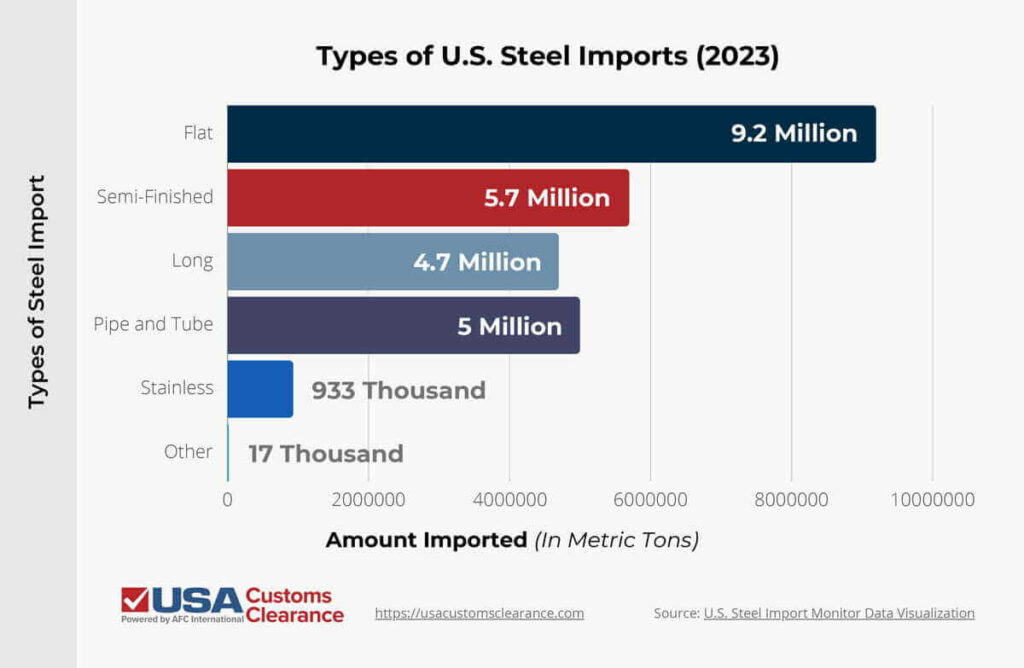

While there are many types of steel products imported into the U.S. each year, the ITA tracks six primary categories. Those categories are:

Below, I’ve provided some data that shows how frequently each category is imported into the country.

Since these categories of steel are used in a variety of industries, importing them efficiently is essential.

Related: Importing Copper

An import license must be issued by the Steel Import Monitoring and Analysis (SIMA) office for all steel product imports that enter the United States. Importers, or their customs brokers, can apply for the import license online through the SIMA Licensing System.

This system allows importers to register, apply and receive their licenses quickly using one online platform. Users may view, archive, or edit any licenses they’ve received. They may also duplicate licenses as a template for future use.

If an importer is entering a shipment valued at $5,000 or less, they may obtain what is considered a “low value” license.

Section 232 and Section 301 are executive orders signed in 2018 that place additional tariffs on the import of steel products into the nation. Those tariffs were originally put in place in order to protect the interest of U.S. producers and manufacturers.

Section 232 tariffs specifically target the imports of steel and aluminum into the country. In addition to the standard import duty owed on each product, importers must also pay a 25% tariff on these products and an additional 10% tariff on aluminum imports when sourced from a country impacted by Section 232.

Section 232 tariffs impact most U.S. trade partners, however, there are a few exceptions. In 2019, an agreement was made to fully lift the tariff for both Canada and Mexico. Other countries have been given exemption from these tariffs as well.

This includes

However, as of 2024, the Biden Administration reinstituted a 25% tariff on steel not melted or poured in Mexico. It’s important to note that these tariffs do not apply to the import of fabricated structural variants of this product.

Section 301 tariffs do not target steel specifically, but they do determine the costs you’ll incur when importing these commodities. This set of tariffs specifically targets the import of products from China, impacting more than $550 million worth of goods.

These tariffs are divided up into four lists, placing tariffs on products ranging between 7.5% and 25% in additional taxes. In the case of steel, this legislation places an additional 25% tariff on fabricated structural steel imported from China.

If you’ve previously imported steel and paid section 301 duties, you may be eligible for a refund based on these recently reinstated exclusions. In May 2024, the Biden Administration announced a new set of tariffs on steel imports from China, again at a rate of 25%.

Related: Section 301 Tariff Refunds

On Feb. 10, the Trump Administration announced a flat 25% tariff on all steel and aluminum imports into the U.S.

This announcement removes all exceptions and exemptions previously allowed on these imports, and raises the tariff price on aluminum from 10% to 25%.

The tariff appears to be largely aimed at Canada and Mexico who account for the vast majority of steel imports into the U.S., and for whom the Section 232 excerptions previously applied.

On March 12th, 2025, the steel tariff entered into effect. It applies to a variety of steel products, which includes raw steel materials and derivative steel articles. The Liberation Day tariffs that were announced on April 2nd, 2025, did not alter the 25% tariff on steel products. Therefore, this rate will still apply for the foreseeable future.

Our personalized approach and commitment to customer service will help you understand your unique customs needs.

According to the U.S. Department of Commerce, there are 152 anti-dumping and countervailing duty orders in place on steel imports from 32 countries.

These duties are put in place in order to protect U.S. industry and combat the unfair dumping and/or subsidizing of steel imports from other countries.

To determine whether the specific steel products you’re importing are subject to anti-dumping or countervailing duties, you can speak to our licensed customs brokers. They’ll examine your previous entries, product information, and more to determine whether you’ll be responsible for paying for these additional duties.

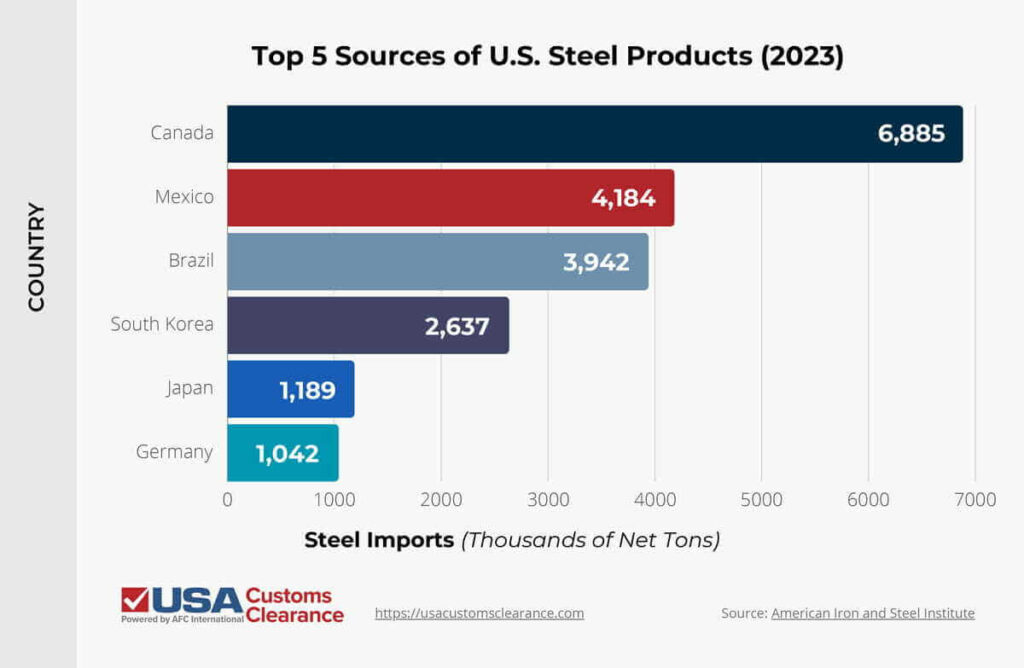

According to the American Iron and Steel Institute, Canada is the largest exporter of steel products to the United States. In fact, America’s two closest neighbors, Canada and Mexico, make up more than one-third of all U.S. imports of these products.

Brazil closely trails Mexico as the third-largest source. However, it is the country’s largest supplier of semi-finished variants of the metal. Canada primarily supplies flat and long steel products, while South Korea is the largest U.S. supplier of pipe and tube steel.

It’s important to note that all four of these countries have also been exempted from Section 232 tariffs, which place an additional 25% tax on imports of this product.

In total, the U.S. imports the product from nearly 80 countries worldwide. Other notable sources include Germany and Japan.

If you’re planning on importing your steel from Canada or Mexico, you can take advantage of the United States-Mexico-Canada Agreement (USMCA). This free trade agreement (FTA) provides preferential treatment on a variety of products and commodities from these countries.

Although the U.S. removed Section 232 tariffs on steel from Canada and Mexico in 2019, it does reserve the right to re-impose this trade barrier if surges in specific steel products occur. Be sure to check if these tariffs have been reinstated before importing from either of these nations.

Brazil and South Korea don’t have an FTA with the U.S., but the trade relations with these countries are overall positive. Imports of steel from Brazil that are processed in Mexico and sent to the U.S. will be exempt from Section 232 tariffs.

If steel mill articles are imported directly from Brazil or South Korea, they’ll be subject to an absolute quota. The threshold will vary based on the product you're bringing in. Once the absolute quota limit is reached, you won’t be able to purchase the product from these countries by paying tariffs.

Instead, you’ll need to obtain a Section 232 quota exclusion from the Department of Commerce.

Imports of Japanese steel will be subject to a tariff-rate quota (TRQ). Similar to the absolute quota applied to Brazil and South Korea, the threshold on the Japanese TRQ will vary based on the specific product.

Items that enter before the Japanese TRQ is reached will be free of Section 232 duties, but goods that enter after the TRQ is met will be subject to a 25% tariff rate.

Related: U.S. Free Trade Agreements

All imports of steel, regardless of import value, must be accompanied by a customs bond.

A customs bond is required to accompany a shipment for two reasons:

In the case of steel imports, your shipment will likely fit both criteria. The commodity is regulated by the Environmental Protection Agency (EPA), which means a customs bond must be obtained in order to import this product. Additionally, it’s unlikely that a shipment of these goods will be valued at less than $2,500.

At USA Customs Clearance, we have a team of licensed customs brokers and import professionals. They’ll be able to provide you with the assistance you need to get your steel imports into the country. We also have a variety of services and documents available that you can use.

If you’re ready to start importing with USA Customs Clearance, then click one of the links or contact us through the site. Our team is also available at (855) 912-0406 if you have any questions.

Our expert consultants get your shipments where they need to go. Let us show you how it’s done!

Copy URL to Clipboard

Copy URL to Clipboard

Hello,

I operate a small shipyard on San Francisco Bay that fabricates barges from ASTM 1008 steel plate.

I want to explore the possibility of buying steel from outside the US but I have no prior experience with importation.

A convenient order size for us would be 20 short tons every 6-8 months or 10 tons every three months. China's vendors advertise 1/4" 1008 plate for $500 - 650 per ton.

What would be an approximate total cost DDP San Francisco including a broker to handle sea freight, importation,duty, and 15 mile trucking from the port to our shop?

W