Understanding the taxes owed on imported goods is essential for anyone involved in international trade. Whether you are an importer running a business or a traveler bringing back personal goods from overseas, knowing what duties and tariffs are required can prevent unpleasant surprises at U.S. Customs.

Key Takeaways:

In this guide, we'll cover everything you need to know about import taxes, including how to find and calculate your duty rate, how to pay your import taxes, and additional fees that you should be aware of.

Import taxes are government-imposed charges on goods entering the U.S. to protect domestic industries and raise revenue. These taxes come in two main forms: tariffs and customs duties.

In addition to duties and tariffs, you'll also need to account for other taxes like the Merchandise Processing Fee (MPF) and the Harbor Maintenance Fee (HMF), which can add up and increase your total import costs. Reciprocal tariffs are another recent edition that can greatly impact your import costs.

The MPF is an additional fee that applies to most U.S. imports. It’s based on the shipment’s value and applies to both formal entries (over $2,500) and informal entries (under $2,500).

Although the MPF might seem small, it can add up for businesses with frequent shipments. However, importers using free trade agreements like USMCA may be exempt from paying the MPF.

If your goods are arriving by sea, you’ll also need to pay the HMF, which is set at 0.125% of your shipment’s value. This fee is mandatory for all imports by ocean freight, regardless of the value, and goes toward maintaining U.S. ports.

A reciprocal tariff is imposed when the U.S. is focused on balancing out trade between itself and a foreign partner. Specifically, it's for cases when a nation places a greater tariff on incoming U.S. products than what the U.S. has in place for the same or similar products in return.

Currently, nearly all trade partners/nations have a flat 10% ad valorem tariff attached to all products in addition to the general rate of duty. The one exception to this is China, which currently has a very high tariff placed on its goods. To find out the most recent rates, give our team a call at (855) 912-0406.

Related: What Are Reciprocal Tariffs: Defintion and Purpose

Beyond basic tariffs and duties, U.S. Customs and Border Protection (CBP) collects several other types of taxes and fees on behalf of other federal agencies. Some common examples include:

Each of these additional duties is applied on a case-by-case basis, depending on the type of goods you’re importing and any applicable U.S. regulations. It’s essential to review your shipment details carefully to ensure you account for all possible fees.

To determine how much customs duty you owe, you should start by identifying the correct Harmonized Tariff Schedule (HTS) code for your products. This 10-digit code is used by U.S. Customs to classify products and assign their corresponding duty rates.

Related: How Do I Find My HTS Code?

Each product has a unique HTS code, and these codes help distinguish between various duty rates. Two similar products made out of different materials could carry vastly different rates of duty. Or, two of the same product could be taxed differently depending on the country it’s being imported from.

The U.S. International Trade Commission (USITC) provides tools to help you look up HTS codes, as do we here at USA Customs Clearance. These tools make it easier to calculate the precise duties you owe based on the classification.

Related: HS & HTS Code Lookup Tool

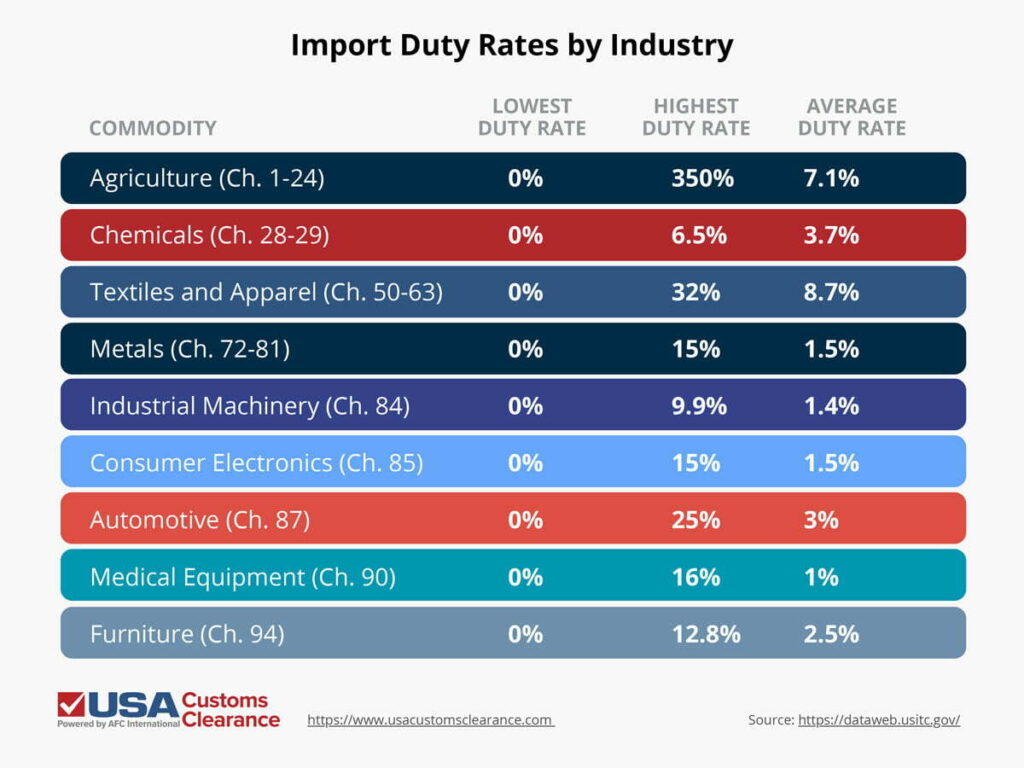

Duty rates can vary from 0% to upwards of 350%, even when importing from a country with Most Favored Nation status. Across the board, the average duty rate for imports into the U.S. is 4.2%.

However, because duty rates can vary so wildly from industry to industry, it makes much more sense to view duty rates from the perspective of specific commodities. Using the USITC’s database, let’s take a look at the range of duties you can expect to pay when importing some of the country’s most popular products. The chart below groups commodities by their HTS chapter, providing the highest, lowest, and average duty rates you will pay in each industry.

Notably, import duties are charged on the FOB value of the merchandise, meaning these taxes are only calculated based on the value of the products, not counting freight and insurance costs.

Let’s say you're importing a shipment of LED lamps (8539.52.00) valued at $10,000. The HTS code of this commodity carries a duty rate of 2%, meaning you would owe 2% of $10,000, or $200 in import taxes.

Related: U.S. Import Duty Calculator

To ensure accurate duty calculations, it's advisable to work with a licensed customs broker, who can help classify goods correctly and avoid costly penalties due to misclassification.

In addition to regular duties, importers need to be aware of anti-dumping and countervailing duties. These special duties are only applied in specific situations and can make importing certain products prohibitively expensive.

Anti-dumping duties are imposed when foreign companies sell products in the U.S. at prices that are lower than their market value, hurting U.S. manufacturers. For example, if a foreign company exports large quantities of steel to the U.S. at a price far below what U.S. companies can match, anti-dumping duties may be applied to level the playing field.

Similarly, countervailing duties are applied when foreign governments provide subsidies to their exporters, allowing them to sell goods at lower prices.

These duties are designed to offset the unfair advantage foreign producers might have due to these subsidies. Countervailing duties are typically imposed after an investigation by the U.S. Department of Commerce and the International Trade Commission (ITC) to ensure that domestic industries are protected from unfair competition.

These duties are usually much higher than standard tariffs and can dramatically increase the cost of importing certain goods. Importers must stay informed about which products are subject to these duties to avoid unexpected costs.

Related: Antidumping and Countervailing Duties: Balancing World Trade

Importers have several opportunities to reduce or eliminate duties through exemptions and preferential trade agreements. Understanding these options can significantly reduce your import costs.

The de minimis rule allows goods valued at under $800 to enter the U.S. without duties. This exemption is highly beneficial for small e-commerce businesses and individuals importing small shipments. Each shipment must remain under this value threshold to qualify for duty-free entry.

However, certain goods are excluded from this rule, such as alcohol and tobacco, which are still subject to duties and regulations regardless of value. Travelers returning to the U.S. can also bring goods duty-free up to $800, with limitations on items like alcohol (only one liter can be brought in duty-free).

Related: Section 321 Shipments

Temporary imports can enter the U.S. duty-free under specific conditions. For businesses participating in trade shows or needing to temporarily import professional equipment, an ATA Carnet can be used. This document allows duty-free entry for up to one year, provided the goods are exported again without being sold.

Related: What is an ATA Carnet? When You Need One and How to Acquire

For one-time imports or shorter stays, a Temporary Import Bond (TIB) can be used. This is particularly useful for demonstration or exhibition items that will be exported within a specified period.

Related: Temporary Import Bond (TIB): Duty-Free Entry of Goods for Re-Export

In addition to exemptions, importers can benefit from preferential duty rates when importing from countries with which the U.S. has Free Trade Agreements (FTAs). These agreements allow for reduced or even zero-duty rates on specific goods, depending on the terms of the agreement. For example, under the U.S.-Mexico-Canada Agreement (USMCA), many goods imported from Mexico or Canada may qualify for reduced duties or duty-free status.

To qualify for these preferential rates, goods must meet specific rules of origin, which confirm that the product was either produced or significantly transformed in a partner country.

Understanding how to leverage these FTAs can significantly lower the cost of importing goods, and it’s worth working with a customs broker or trade specialist to make sure you meet the criteria and claim the correct rates.

Related: U.S. Free Trade Agreements

Once your shipment arrives, the duties and taxes are assessed based on the declared value and classification of the goods. Here's how to make sure you handle payments smoothly:

Once payment is confirmed, and duties are cleared, your goods are released and can proceed to their final destination. It’s important to track all transactions and keep records, as CBP may audit your imports to ensure compliance.

Failure to pay import taxes can lead to serious consequences. U.S. Customs can seize your goods, issue fines, and in some cases, pursue criminal charges.

Misclassifying items or underreporting the value of your goods can result in hefty penalties, so it’s crucial to ensure that your paperwork is accurate. Always double-check your HTS codes and make sure all duties and fees are paid before your goods reach U.S. shores

If all of this tax talk seems complicated, don’t worry—working with a licensed customs broker can take much of the burden off your shoulders.

At USA Customs Clearance, our licensed customs brokers can answer any and all questions or concerns you may have about the taxes owed on your shipment. From tariff classification and calculating import duties, to handling paperwork on your behalf, you can trust our experts to handle your imports with confidence.

Schedule a personalized consultation, or give our team a call at (855) 912-0406 to get started today.

Q: What is the Customs Territory of the United States?

A: The Customs Territory of the United States includes all 50 U.S. states, the District of Columbia, and Puerto Rico. It excludes U.S. territories such as Guam, American Samoa, and the U.S. Virgin Islands, where different customs rules may apply. Goods entering from outside the Customs Territory are subject to U.S. import duties and tariffs.

Q: What documentation is required to pay import duties and taxes?

A: To pay your import taxes, you’ll need the following paperwork:

Q: Is it possible to get a refund on import duties that have already been paid?

A: Yes. This process is known as duty drawback and allows importers to recover a portion or all of the duties, taxes, and fees paid on imported goods that have been re-exported, used in manufacturing for re-export, or destroyed.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post