Copy URL to Clipboard

Copy URL to Clipboard

Harmonized Tariff Schedule (HTS) codes are required to accurately classify products and assess tariffs on goods imported into the U.S. Unfortunately, finding the correct HS or HTS code can be a challenge, especially for new importers. Thankfully, there are readily accessible tools and resources available to use.

Key Takeaway:

A licensed customs broker can look up your HS or HTS code with pinpoint accuracy. This is the best way to ensure you use the correct code, tariff classification, and duty rate when importing your goods. You can also use an HTS code lookup tool to search your item by name or description, or request a binding ruling from CBP.

Our guide below explores the various resources that can be used to find your tariff code. Additionally, I’ll explain which resource is best to use based on your budget, experience level, and more.

When importing an item, there are three primary resources you can use to find your tariff number:

It’s worth noting that while there are slight differences between HS and HTS codes, both can easily be found using any of these resources.

Related: Harmonized System 101: An Importer's Guide to HS Codes

A licensed customs broker costs money up front, but it can be a worthwhile investment, especially for importers. Not only can brokers offer expert assistance and provide you with peace of mind that your information is accurate, but they handle the hard work for you.

Customs brokers and import consultants are familiar with all the ins and outs of the customs clearance process. With their expertise, they can look up your product’s HTS code for you, or request a binding ruling on tariff classification on your behalf.

Once you have that information, you’ll know exactly what duty is owed on your products and the specific government regulations they’re required to abide by.

Take it from Sarah Jeris, one of the customs brokers here at USA Customs Clearance. She had an importer reach out after being overcharged for using an incorrect classification code.

“The misclassification caused their products to be reviewed by the FDA, and they were paying additional duties in error,” said Jeris. “Upon our review, we properly classified their goods, saving them over 15% duty.”

Finding the correct HS or HTS code for shipping can be complicated and confusing, but consulting with a licensed customs broker can help simplify the process and ensure that you’re only using correct information.

Find your HTS codes and get accurate tariff classification and duty rates for every item in your shipment.

Speak to one of our Licensed Customs Consultants today!

If you’re set on finding your HS or HTS code without assistance, the best way to find it is by using a lookup tool.

To find your HTS code, simply use the search function found on the USITC’s website, or search via USA Customs Clearance’s free HTS code lookup tool.

You can input a product name or keyword into the search bar and the tool will pull up a list of potential matches and their corresponding codes.

Lookup tools like ours are free, but in our experience, unless you are intimately familiar with the way that the Harmonized Schedule works, it can be difficult to pinpoint your product’s exact code.

If you’ve tried to find the HTS code for a certain product yourself, but are still having difficulty identifying the correct code, you can reach out to CBP and request a binding ruling. The ruling that CBP gives you is a final determination, so you can be sure you are using the correct HTS code for your import entries.

You can also speak with CBP’s Centers of Excellence and Expertise (CEE). The CEE is divided up by industry and is able to offer you advisory classification on your products.

While this is not a binding ruling on tariff and product classification, it should give you a better idea of how to classify your products.

Once you find your HS or HTS code, it won’t do you much good unless you know how to read it; so let’s continue.

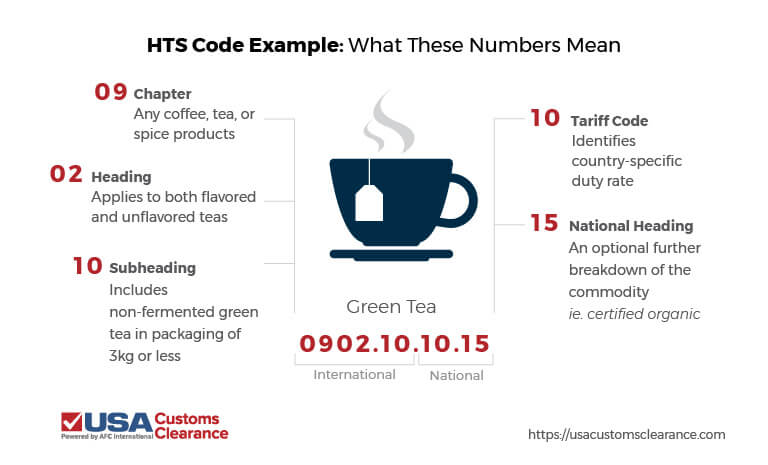

HTS codes are made up of five distinct 2-digit segments: the HS Chapter, HS Heading, HS Subheading, Tariff Code, and National Heading. Each segment provides additional detail about the product, allowing importers to properly and accurately classify goods.

In order to understand this fully, I’ll break down each segment using green tea as an example.

These numbers note the chapter within the HS nomenclature that applies to the goods. There are 21 sections within the HS, broken down into 99 total chapters. These sections and chapters represent the broadest categories that products can be classified under.

For example, all coffee, tea, and spices are classified under chapter 9. Therefore, the HTS code for any coffee, tea, or spice products will begin with the numbers ‘09’.

These digits represent the specific heading within the broader chapter of the HS.

For example, the heading for the HTS code above is 02, which applies to both flavored and unflavored tea. Chapter headings follow a numeric order beginning with 01, continuing with 02, and so on, until there are no more headings. There is no limit to the number of headings included within each chapter.

These numbers represent the subheading within the specific heading. In short, an additional subcategory of a larger category.

In the example above, the subheading is 10, which includes non-fermented green tea in packaging of 3kg or less. Some HS and HTS codes will have 00 as their subheading, which indicates there are no further category breakdowns within the HS for that particular commodity.

Digits 7 and beyond are used to identify country-specific information. In the U.S., digits 7 and 8 signal the specific import duty rate for the product.

For example, the HTS code 0902.10.10 is subject to an import duty rate of 6.4%. However, a product classified as 0902.10.90 can be imported duty free. The difference in classification between these two products, and the duty rate owed on each, is determined by digits 7 and 8.

The final two digits of an HTS code are present to identify an optional further breakdown of the commodity. As noted earlier, the U.S. uses 10 digit HTSUS codes. However, many commodities contain 00 for digits 9 and 10. This occurs when there is no further breakdown of the commodity beyond the duty rate digits for 7 and 8.

When there is a unique value for digits 9 and 10, it is typically used for statistical reporting. In some cases, though, the final two digits are used to signal important information to CBP agents or representatives from PGA’s (partner government agencies).

In the example above, the last two digits indicate that the green tea is organic. When the HTS code changes to 0902.10.10.50, this shows that the tea is not organic. However, the rate of duty for both remains the same.

Related: What is the HTSUS? (Understanding the Harmonized Tariff Schedule of the United States)

Failing to provide an HS or HTS code on your import entries and ISF filings, or providing the wrong code, can affect things like your product’s duty rates, government requirements, tariff reductions and anti-dumping orders.

Not knowing your tariff code can result in you paying too much or too little in customs duty, neither of which is a good thing.

If you pay too little, you’ll be required to file a Post-Entry Amendment (PEA) to pay any additional duties owed. If not, you’ll receive additional fines from CBP on top of the remaining amount that you owe.

Related: What is the Penalty for Using the Wrong HTS Code?

If you pay too much, it’s also possible to request a PEA to request a refund. This can be done until the entry is liquidated (typically 315 days after entry), after which you will have to file an administrative protest, which can be done up to 180 days after the entry’s liquidation.

As a shipper, you are liable for any issues that are caused by providing incorrect HTS information, so it’s imperative that the codes you provide are accurate. Keep in mind that by working through a customs broker and using them for the clearance process, you can easily avoid these costly delays and potential fines.

Related: Customs Penalties and Fines

Navigating the commercial import process and finding the correct HS and HTS codes can be complicated and confusing, no matter how experienced you are. It can also lead to significant penalties if done wrong.

USA Customs Clearance, powered by AFC International, can provide you with access to customs clearance services capable of walking you through the entire import process. Our experts take the guesswork out of the situation, guaranteeing that you’ll have accurate information on tariff classification, duty requirements, government restrictions and more.

You can schedule a personalized, 1-on-1 consulting session and gain peace of mind that your import process will be smooth and successful.

Speak with one of our consultants or give us a call at (855) 912-0406 and get help finding your HS or HTS codes today.

Find your HTS codes and get accurate tariff classification and duty rates for every item in your shipment.

Speak to one of our Licensed Customs Consultants today!

Copy URL to Clipboard

Copy URL to Clipboard

I need a tariff code for two picture of orchids

Hi

I need to jnow my entry taxes from Vietnam to usa

hi I need a tariff code for A beauty, bio glow pro with USB charger

I need a tarrif code for a book

going to stockholm county sweden

Looking for a HTS Code the item is measuring checking precision electronic/

Mechanical offshore equipment. The one we use in the UK is 9024108000

harmonized tariff for life belts from china and if requires additional hts

Looking for a HTD Code for a men’s 100% cotton polo shirt

Looking for a code for a battery charger for a cordless drill

I need HTS code for our products. HS code is 40159030 and 62101000 but I can't find HTS code for this products. Kindly help me to find HTS code.

I need tariff code for 2 ton cartridge for refrigerator

I need the HS Taric Code from UK to USA

I need HS TARIFF CODE ON MY TOY SWORDS CONTROLLER?

need hts#b# code for music cd

Trouble looking for a HS code for a McDonald's novelty plastic reusable drinking cup/squeeze bottle.

I would like to sell battery packs for electric scooters to Indonesia. I want to know HS-CODE.

Hi, I am staying in Dar es salaam Tanzania.I was told by a friend that HS Code 4802.55.00 was 25% but recently it was amended and reduced to 10% kindly let me know if it is true, and if you can share the amended regulation

hi, im enquiring on hs code for windsocks