In the world of international trade, customs violations are no joke. Product classification errors like using the wrong HTS (Harmonized Tariff Schedule) code can lead to severe penalties for the importer.

Key Takeaways:

Whether you’re a new importer or an experienced trader, it’s critical to ensure that the tariff and product classification of your import entries are correct. Our guide below discusses customs enforcement for misclassification, how penalties are determined, and how you can resolve penalties for using the wrong HTS code.

When an importer ships goods into the United States, they are required to submit the proper HTS codes for their products. HTS codes are used for tariff classification and statistical analysis and dictate the amount of duty owed on a product. This includes whether a product falls under any trade agreements or sanctions.

According to Section 484 of the Tariff Act of 1930, the importer of record is responsible for using reasonable care to enter, classify and determine the value of their imported goods. Doing this allows CBP (Customs and Border Protection) agents to properly assess duties, collect accurate statistics and determine if applicable legal requirements have been met.

By incorrectly classifying goods for entry, an importer is committing a customs violation, which can lead to shipment delays, fines, liquidation and other penalties. Additionally, you could end up paying more in customs duty than you otherwise would with the correct HTS code.

Related: Harmonized System 101: An Importer's Guide to HS Codes

CBP enforces the penalties for incorrectly classifying products and other customs violations. The basis of CBP’s enforcement comes from the Tariff Act of 1930. Specifically, Section 1592 of the Act outlines how CBP ensures that customs laws such as HTSUS classification and valuation are followed.

The statute gives CBP the authority to impose penalties for customs violations based on an importer’s level of culpability and a number of other mitigating factors.

Individuals are also prohibited from aiding and abetting another importer in committing a customs violation. It’s important to note that customs violations are considered an illegal act whether or not any duty or revenue is lost.

Not sure which HS or HTS code to use? Leave it to the professionals.

Book a consulting session with a customs expert.

The penalty for committing a customs violation, such as using the wrong HTS code, is determined based on the level of culpability an importer is charged with. The three levels of culpability that CBP uses are negligence, gross negligence, and fraud.

The definition for each level of culpability according to the above statute is as follows:

There are a number of factors that go into determining what level of culpability an importer is charged with. The most common mitigating factors that are considered include:

CBP defines commercial fraud and negligence violations as intentionally or carelessly attempting to bring goods into the U.S. using false or misleading information, whether through documents, electronic data, verbal statements, or actions.

This includes leaving out important information that could change how the goods are classified, valued, or that hides unfair trade practices or violations. Intentionally or not, using the wrong HTS code would fall under this category.

As noted above, non-compliance penalties for committing this type of customs violation depend on the level of culpability an importer is charged with and whether duty was lost due to the violation.

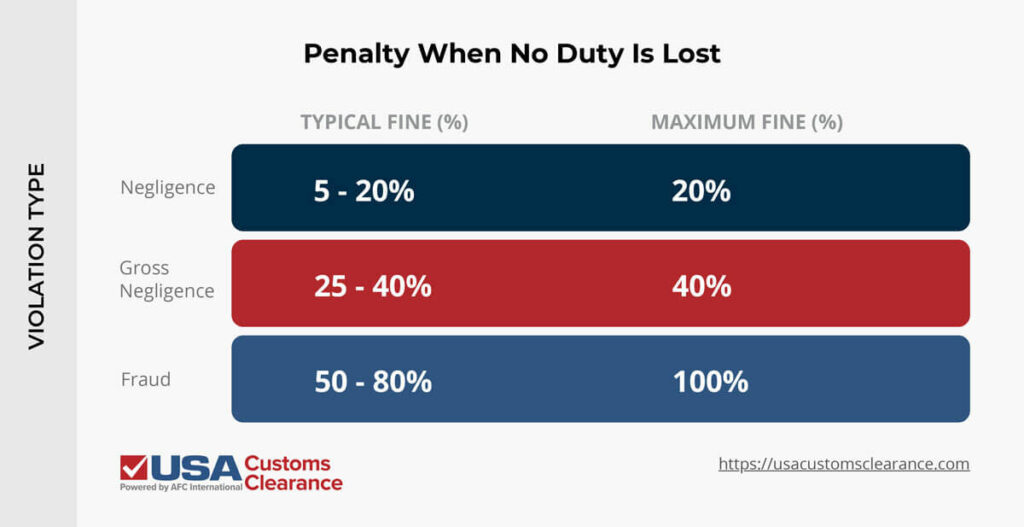

Penalties for tariff misclassification when no duty is lost can range as follows:

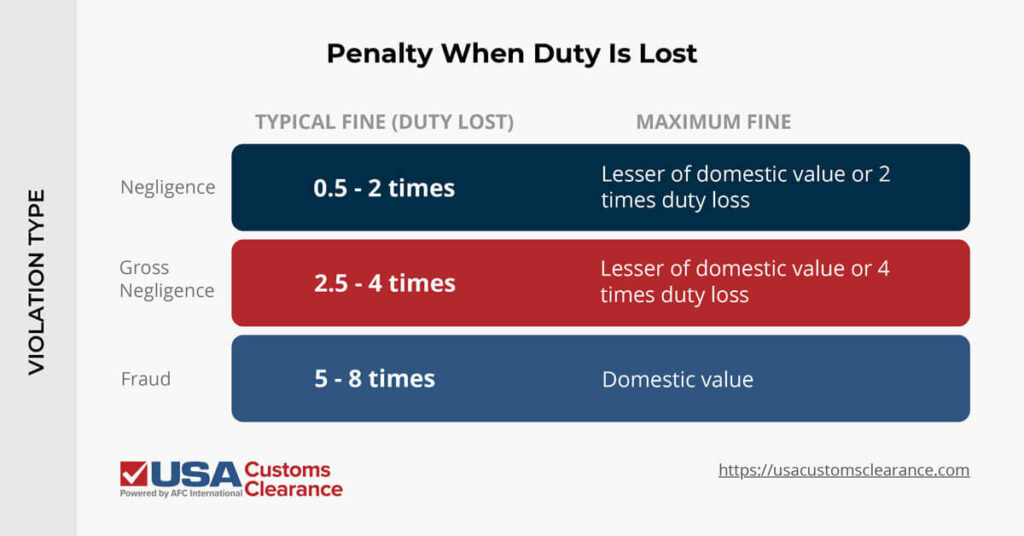

Penalties for committing a tariff misclassification violation when duty is lost is as follows:

Other penalties for using the wrong HTS code include border delays, seizure of products, and even denial of import and export privileges. It’s also important to note that mistakes like clerical errors or mistakes of fact are not subject to these statutory penalties unless there is a proven record or pattern of negligent conduct.

Related: Explaining The Difference Between HTS Code vs. HS Code

Now that we know what the penalties are for using the wrong HTS code, let’s see what it would look like in practice.

In 2023, the average import cost of watermelons was $250 per ton. The amount of duty owed on watermelon imports actually varies depending on the time of year they are entered into the country, and each of these duty rates are specified by their unique HTS codes.

The HTS code ending in 30 carries a 9% import duty, while the code ending in 40 requires a 17% duty rate.

Let’s say you imported 10 tons of watermelons in August when the tariff rate would be 17%, but mistakenly used the HTS code for 9%. This would likely be ruled as negligence with duty lost, which could result in a fine of one-half to two times the duty loss.

Assuming you get penalized on the lower end, you would owe one-half of the difference between a 9% and 17% duty on $2,500, as that’s the amount of duty that was lost. That figure comes out to $200, half of which is $100.

| Import Cost | Correct Duty Owed (17%) | Penalty | Total Cost |

| $2,500 | $425 | $100 | $3,025 |

While a fine of $100 doesn’t seem like a crazy amount, this number was calculated using the lower end of the lightest culpability scale, and on a relatively low-value shipment. Importers trading in much higher amounts can expect far stiffer punishments for potential customs violations.

Let’s say you make a mistake and classify your items incorrectly. If you discover your mistake soon enough, you may have the chance to file a prior disclosure with CBP. This will mitigate any potential penalties that would be required by voluntarily offering an explanation for the customs violation and paying the correct duties.

However, this step must be done prior to CBP starting its own investigation, otherwise, the prior disclosure is no longer considered voluntary.

It’s worth noting that prior disclosure and an attempt to fix a customs violation can be a complicated issue that requires professional assistance. Importers looking to file a prior disclosure should consider getting legal advice or the assistance of a licensed customs broker before preparing and filing any prior disclosure documents.

As noted frequently throughout this guide, using the wrong tariff code on your import entries can lead to a number of penalties, both financial and otherwise. Fortunately, there are a number of resources you can use to make sure you’re using the correct HTS codes.

An HTS code lookup tool is probably the simplest option, but if you want absolute peace of mind, you should consider consulting with a customs broker or request a binding ruling from CBP.

Related: HS & HTS Code Lookup Tool

Now that you’re familiar with the penalties that can result as a consequence of using the wrong product classification, you know what to look out for and the importance of working with an experienced customs consultant.

The experts at USA Customs Clearance, powered by AFC International, can walk you through the import process step by step. Our experienced and knowledgeable team ensures that you are using the correct information for your customs entries, every time. We can help you avoid all of the penalties that come with using the wrong HTS code, like fines, border delays, and seizure of products.

Give us a call at (855) 912-0406 or schedule your personalized session with one of our licensed consultants today and get the trusted import help you need.

Not sure which HS or HTS code to use? Leave it to the professionals.

Book a consulting session with a customs expert.

Copy URL to Clipboard

Copy URL to Clipboard

Customs clearance was carried out with the wrong HS code and the customs duty counter was not checked properly, so the customs clearance cost was paid more than 10 times the original customs clearance fee. Is there any way I can get it back?!