The primary difference between HS and HTS codes comes down to the level of specificity in classification they provide. While the difference may not seem major, using the wrong one could have a big impact on your import declarations.

An HS Code is a standardized number associated with a given commodity that identifies that product worldwide. It is a 6-digit number universal to all countries under the International Harmonized System. An HTS code ranges from 7 to 10 digits and provides country-specific product and tariff classification.

In this blog, I’ll drill down into the differences between these two types of codes and how they can help you properly navigate the world of international trade.

A Harmonized System (HS) code is a 6-digit code used to determine tariffs and classify goods traded internationally.

These codes are created by the World Customs Organization (WCO) and provide a standardized system for more than 200 countries and territories, streamlining trade by acting as a universal language for import classification.

Besides being used for classification purposes, the HS code is also present to help countries compile data for statistical reasons.

Related: Harmonized System 101: An Importer's Guide to HS Codes

A Harmonized Tariff Schedule (HTS) code is a 7- to- 10-digit code providing unique tariff rates and statistical information on products imported into a specific country. In the U.S., these are called HTSUS codes and are maintained by the International Trade Commission.

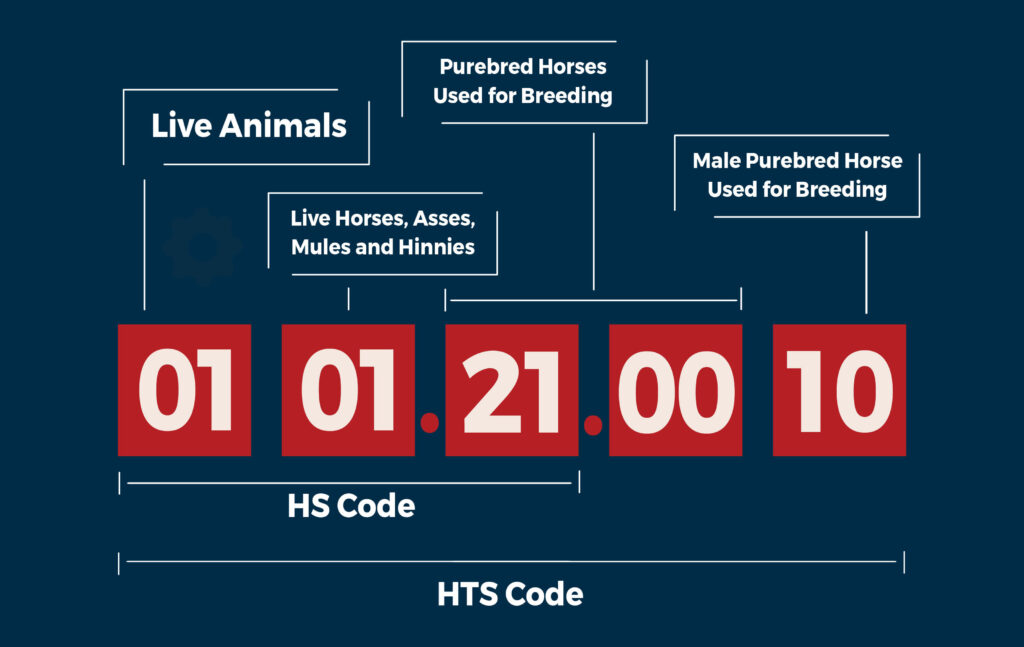

HTS codes find their basis in the HS - literally. The first six digits of a product's HTS code are the same six digits that are used to classify that product globally. The additional 4 digits classify the product further, providing specific duty rates and statistical information for U.S. (or other another country’s) entries.

Related: What is the HTSUS? (Understanding the Harmonized Tariff Schedule of the United States)

As previously outlined, an HS code is a universally used and unique 6-digit number that defines a commodity on a global scale. It makes up a portion of the HTS, but it is not an exact match because it does not contain the additional classification that make the code specific to a certain country.

Here’s an example of how these numbers work using live animals as an example:

Related: What is the Penalty for Using the Wrong HTS Code?

Now that you know the differences between HTS codes and HS codes, consider using USA Customs Clearance to properly classify your goods.

Our licensed customs clearance services can help you fill out the appropriate paperwork or find your HTS and HS codes and ensure your shipment clears without issue. You can also use our HTS code lookup tool where you can search for your commodity code yourself.

If gaining clarity on tariff classification or knowledge about anything customs-related is your aim, USA Customs Clearance offers import and customs consulting sessions with our licensed customs brokers.

Reach out to USA Customs Clearance today at (855) 912-0406 to get started.

Not sure which HS or HTS code to use? Leave it to the professionals.

Book a consulting session with a customs expert.

The short answer is no. Like HS and HTS code, a Schedule B number is also a tariff and product classification number used in international trade, but unlike those two, a Schedule B code is used specifically to monitor U.S. exports - not imports.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post