Having an import flagged at entry, especially by agencies like the Food and Drug Administration (FDA), can induce serious anxiety. Following the protocols prescribed by the FDA when they flag your good’s HTS code will ensure that your imports enter the country without incident. To accomplish this, you’ll need to understand the agency’s entry process and how they focus on certain products.

Key takeaways:

Regulations for HTS codes with FDA flags are numerous and difficult to follow. Our guide below highlights all the essential information you need to know.

HTS Codes help to ensure the proper tariff rate for your product is applied to it upon entry. They also give a statistical category to the item that you’re importing.

HTS Codes are derived from the International Harmonized System (HS). The HS serves the same purpose, except it works on a global scale to describe almost all the world’s commodities. Once an import has its HTS Code, it will be assigned an FDA flag if it falls under the FDA’s jurisdiction.

An HTS Code is product-specific, so the duty rate is as well. Ensuring you have the correct HTS code for your imported product(s) is often one of the most challenging tasks when it comes to importing. This is especially true for new importers that aren’t familiar with the process.

If you don’t know what HTS code applies to your products, then use our HTS Lookup Tool!

With a bit of typing and a few clicks, our Lookup Tool will help you find the right HTS code for your goods.

After correctly identifying the HTS Code for your import, you might notice it’s being flagged by the FDA. This flagging system is used by the FDA to help them conduct reviews and determine if regulated goods are in compliance with their regulations.

FD flags can indicate what product is being imported and if the FDA requires more information about it.

The FD flags are as follows:

In the following sections, I’ll explain when each flag is used and their differences.

FD1 flags are products that may or may not be regulated by the FDA. If the product is something that is regulated by the FDA, then you should submit all the relevant information they’ll require. Be aware that some products that are regulated by the FDA might share similar names with products that are not regulated.

Products that would fall under FDA regulation and receive an FD1 flag are:

Products not regulated that share similar names to these are:

Even for products that receive an FD1 flag and are not regulated by the FDA, additional work must be done. The importer or their customs broker must provide sufficient evidence at the time of import that proves the products aren’t intended for medical use.

If your products receive an FD1 code, but don’t fall under the jurisdiction of the FDA, simply provide the Disclaim A code. This will signal to the FDA that your products aren’t subject to their regulations.

Given its name, the FDA doesn’t regulate only food. The FD2 flag is used to indicate products that are regulated by the FDA but do not fall under the food category.

Such products include:

Importers are required to submit appropriate entry information for these goods.

FD3 flags are used to determine if a product is food or not. Similar to the FD1 flag, some regulated food products share names of non-food-regulated items.

Products that are food include:

A product that is not food would be:

Again, just like FD1 flagged products, importers will need to submit documentation for either type. The documentation will either prove compliance with FDA standards or support that fact the intended use is not for food consumption.

The Disclaim A code should also be provided if your products aren’t considered food. This will indicate to the FDA that your import won’t be subject to their requirements.

The last type of flag that will be found with an HTS Code is the FD4 flag. HTS codes that have an FD4 flag attached to them are food products that are regulated by the FDA.

Food products regulated by the FDA can include:

Products that have HTS codes with an FD4 flag must submit required entry information. Additionally, Prior Notice (PN) must be filed with the FDA before the products arrive.

Related: The Penalty for Using Wrong HTS Codes

At this point, you might be asking yourself, “do all HTS Codes connected to the FDA have FD flags?” The answer to that question is no. The FDA does not use FD flags on all the imported products they regulate.

That said, just because an imported product doesn't receive an FD flag doesn't mean that the FDA doesn’t regulate it. If it’s food or drug related, information will still need to be submitted to the FDA, regardless of flag status.

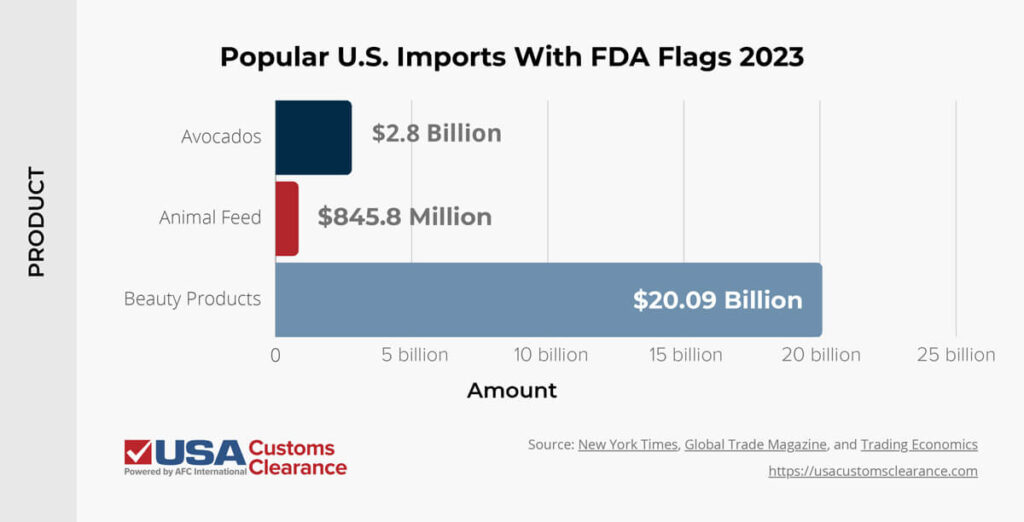

While not all FDA imports are flagged, here are some common U.S. imports that may have FD flags attached to them and their average annual import value.

There are many categories of goods that are heavily regulated by the FDA besides these. If you’re unsure if your imported products are subject to FDA regulations, a Licensed Customs Broker can help you.

They can identify the intended use of your import by looking at key factors. Based on that knowledge, your customs broker will know if they have to submit more information to the FDA.

Countless products are imported into the U.S. and knowing which ones fall under FDA regulations can be difficult to discern.

To make it easier, I’ve provided a broad list of items the FDA regulates:

How you register your product with the FDA all depends on the product itself.

Related: FDA Customs Clearance

During a consulting session, you'll learn everything you need to know about HTS Codes and FDA Flags

If you want to import FDA-Regulated products into the U.S. there are other steps that you should know besides the entry process:

Keep in mind, these are just the general requirements that will be expected of you. The specifics of the FDA import process will vary based on your products.

The primary way to expedite the review of your FDA-regulated products is to use the Import Entry Review System. This is an FDA application that’s used to examine imports and documentation.

The information you provide will be electronically screened against FDA criteria. It’s essential to provide accurate and complete details about your goods. You should also respond in a timely manner if the FDA requests more information about your import, as it will help expedite the entry review process.

If you haven't already noticed, a customs broker/entry filer is a vital asset to have if you are importing FDA-regulated products. We have already discussed how customs brokers can determine what products are FDA regulated and how customs brokers are licensed by the CBP.

Customs brokers can also make the process of importing FDA regulated goods easier. They can file entry paperwork and arrange the necessary payments for duties.

They can also submit important information about your products to the FDA:

All of this information can be submitted by your customs broker electronically or manually on documentation provided by the FDA. The documentation must be submitted to a local FDA Import Office. There are many other ways that a customs broker can help you with importing.

Related: 12 Benefits of Using A Customs Broker

At USA Customs Clearance, we can keep track of all FDA regulations for you. Whether you import for commercial use or personal use, your time is valuable. With our over 100 years of combined experience in importing, you can count on us to take care of all import needs. When you choose USA Customs Clearance, you’ll have access to a variety of other services.

The team at USA Customs Clearance is dedicated to your success. If you’re ready to get started, then call us at (855) 912-0406. You can also contact our team through the site.

Our Licensed Customs Brokers can help you better understand HTS Codes and FDA Flags during a consulting session.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post