The United States Food and Drug Administration (FDA) is responsible for regulating some of the most vital commodities on the U.S. market. Importers who wish to bring FDA-regulated items into the country may find it difficult to ensure their shipments are compliant with the administration’s numerous rules and guidelines.

Key Takeaways:

Join us as we review the rules and importing processes that apply to FDA-regulated goods.

All products regulated by the FDA need to be reviewed and approved by the FDA before they can be imported into the U.S. Entries submitted through Customs and Border Protection (CBP) are reviewed electronically by the FDA. In this process, they check that those products comply with all relevant laws and regulations.

Goods that have already been reviewed and approved by the FDA do not need to go through the process again. This means you can import goods that have met approval as long as you, as an importer, meet any other relevant qualifications.

However, if you want to import a new, unapproved product, you’ll need to submit the appropriate form or forms to the FDA. These forms vary based on the type of product or products you want to bring into the country.

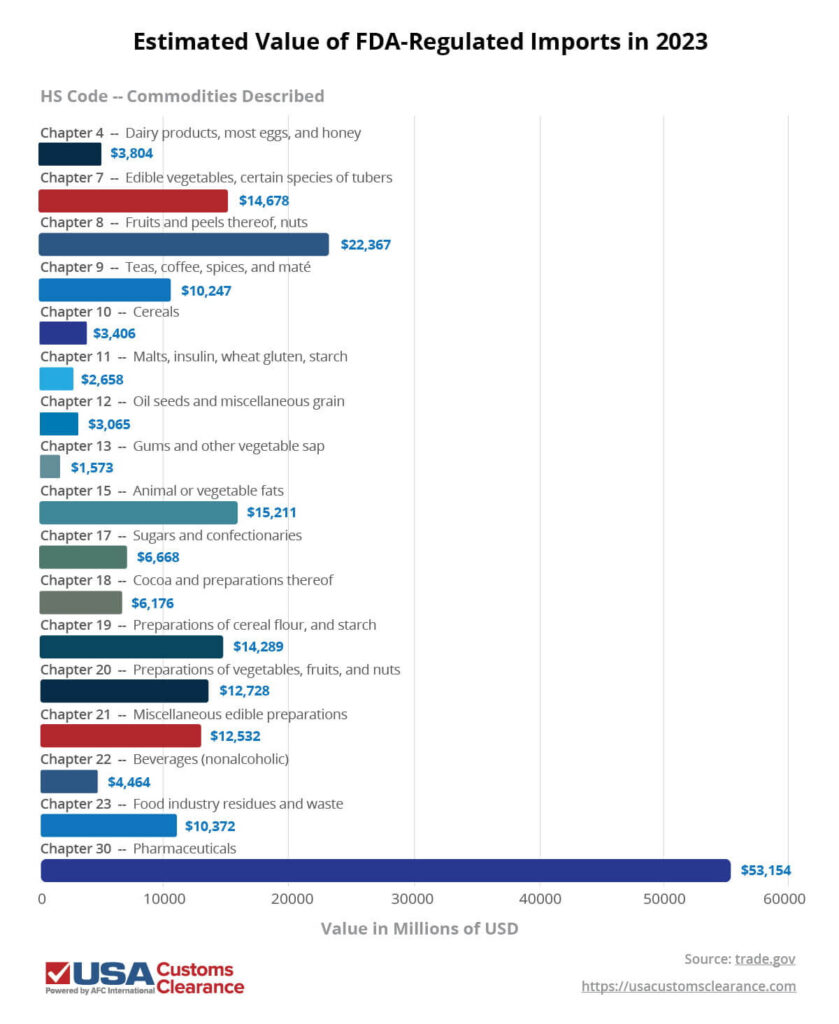

The FDA regulates approximately 75% of imported food and beverages, along with the vast majority of medicines, vaccines, medical devices, and other pharmaceuticals. To put the scope of their oversight into perspective, I’ve compiled import sales data from 2023 for these goods in the table below, including their estimated total value in USD and associated Harmonized Schedule (HS) chapter numbers.

All told, over $197 billion worth of FDA-regulated goods were imported into the United States in 2023 alone.

If you’re unsure whether your products are subject to FDA regulations, you can always check online at their official website. Generally, if what you are importing is to be consumed by humans or animals, it will require FDA approval.

There are several types of FDA of registrations based on factors like what products you’re importing or their country of origin, and you should be aware of these before starting the import process. Importers don’t always have to register with the FDA themselves, but the facilities from which they source their goods – and the goods themselves – usually do have to be registered.

Let’s take a look at registration requirements for some commonly-imported goods that the FDA regulates.

If you are importing any animal products which are to be used as drugs and other such items, you do need to register these with the FDA. Domestic and foreign drug manufacturers also have to list all of their commercially available products.

If you import drugs of any kind, you’ll need to register with the FDA via the Electronic Drug Registration and Listing System (eDRLS). You’ll also have to list all of your commercially available drug products. Certain personal care products qualify as both drugs and cosmetics, and they’ll be subject to the same registration requirements as dedicated pharmaceuticals.

Related: Importing Pharmaceuticals into the U.S.

You’ll need to file a prior notice of imported foods with the FDA if you plan to bring food into the country from a foreign source. This includes the import of beverages like coffee and bottled water. Alcoholic beverages are regulated by a different agency, the Alcohol and Tobacco Tax and Trade Bureau (TTB).

Food importers who meet certain criteria and are willing to pay a user fee can register for the Voluntary Qualified Importer Program (VQIP). Participation in the VQIP greatly reduces the likelihood of delays when importing food for humans and animals into the U.S.

These qualifications include:

Importers must also be free of CBP penalties for a period of three years before attempting to qualify for the VQIP.

Overseas facilities that export food to the U.S. need to be registered with the FDA. Make sure your exporter fulfills this requirement before initiating any transactions.

Update: The Food Traceability List (FTL)

As part of the Food Safety Modernization Act (FMSA), the FDA has determined that certain foods should be subject to enhanced traceability standards and record keeping requirements. The goal is to make it easier to identify and remove contaminated foods before they make it to market.

Two key components of this act are:

Food importers should take time to familiarize themselves with these new FMSA requirements prior to the implementation deadline of January 20, 2026.

Owners or operators of business which produce or distribute medical devices for use in the U.S. are required to register with the FDA. Generally speaking, medical devices meet one or more of the following criteria.

Understandably, medical devices are subject to strict regulations. This includes radiation-emitting devices such as ultrasound machines, which are regulated via the Center for Devices and Radiological Health (CDRH). We advise consulting with a customs broker before importing these goods to ensure your shipment won’t incur delays or fines.

Related: Importing Medical Devices Into the US: FDA Rules and Requirements

It probably comes as no surprise that tobacco is subject to a slew of regulations regarding how it’s harvested, processed, labeled, and marketed. In addition to following these rules, those who wish to import tobacco must register with the Alcohol and Tobacco Tax Trade Bureau (TTB).

Facilities that produce tobacco must also be registered with the FDA, which works through the Center for Tobacco Products to create and issue rules about the production and distribution of tobacco. “Produce” has a much wider definition than usual for administrative purposes, and includes any of the following actions regarding tobacco products.

Keep in mind that the Federal Food, Drug and Cosmetic (FD&C) Act gives the FDA regulatory authority over all tobacco products, including smokeless forms and those which contain nicotine derived from non-tobacco sources.

Related: How to Import Tobacco

Within the FDA, the Center for Biologics Evaluation and Research (CBER) is the entity charged with regulating and approving biological products. These include:

It’s the responsibility of the manufacturer to submit information about their goods to the FDA for approval. As an importer, you’ll want to make sure all the following information is correct in your entry transmission to the administration and CBP.

If you’re acting as the IOR for your shipment, it’s your responsibility to ensure you’re registered with CBP. For more information, check out our article on the role of Importer of Record.

Aside from the prices of the commodities themselves, the following factors contribute significantly to the import costs of FDA regulated goods.

You can estimate what your duty rates will be by using an import duty calculator, such as the one provided on our site. It provides estimated costs based on the item’s Harmonized Tariff Schedule (HTS) code and country of origin.

A smart way to reduce costs when importing FDA regulated products is to see if they can be sourced from countries that hold an active Free Trade Agreement. Take a look at our article on U.S. Free Trade Agreements for more information.

From time to time, you might have a shipment held or detained by the FDA as a part of their customs clearance process. This can occur due to random selection or result from any number of errors, including:

If your shipment is selected for an FDA customs hold, you must maintain professionalism and respect while corresponding with the administration. Shipments are often released after random inspection if agents don’t find any issues. However, mistakes such as the ones mentioned above can lead to longer detention times, fines, and other forms of censure.

Even if you didn’t partner with a broker for your import transaction, you might consider consulting with one if your goods are detained. They can provide advice that may expedite the approval process and help get your goods back on the road.

Related: FDA Customs Hold: How To Set Your Goods Free From Captivity

Whatever FDA-regulated goods you’re importing, you need to make sure to comply with any rules set by the administration. Customs brokers are a vital asset when it comes to import compliance.

Specifically, a broker can:

An experienced customs broker can assist you with your questions or concerns about any aspect of customs clearance.

Given their oversight over such a wide variety of goods, many importers get frustrated when dealing with the FDA’s rules for importing. We’ve helped hundreds of importers comply with FDA regulations, and we can help you too.

We offer a wide range of services related to FDA customs clearance and customs brokerage in general, including:

Give us a call at (855) 912-0406 or submit a contact form online today. Our team is ready to help your FDA-regulated goods clear customs.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post