Most businesses have learned to accept a certain amount of taxes as the cost of doing business. However, current spikes in tariff rates have many importers looking for clarity into what tariffs actually are: is a tariff just another business tax, and if not, how does it differ?

Key Takeaways

Join me as I explain the differences and similarities between tariffs and more conventional taxes.

To answer this question, we’ll need to enter the exciting world of textbook definitions.

In The Merriam-Webster Dictionary, tax is defined as “a charge, usually of money, imposed by authority on persons or property for public purposes”. For instance, many states and cities in the US impose a sales tax on retail goods to raise funds for maintenance and improvement requirements. Businesses buying goods for company use or resale can often negate sales tax by having a tax exemption certificate on file with their vendor(s).

Since a tariff can be thought of as a specific type of tax, it’s not accurate to say that a tariff is the same as a tax: it’s more accurate to say all tariffs are taxes, but not all taxes are tariffs.

Tariff calculations, HTS code lookups, and more services available.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

A tariff is an additional charge assessed by the US federal government on certain imported goods based on factors like the specific goods in question, their country of origin, and the availability of similar goods from domestic suppliers.

Where sales taxes are paid directly by end users, tariffs are usually paid for up front by the party importing the goods themselves. For example, if a company imported $100,000 worth of clothing at the current base tariff rate of 10%, that company would owe US Customs and Border Protection (CBP) $10,000 just in tariffs, and there’s no legal way to avoid them. This does not include other import fees such as duties, which I’ll discuss later in the article.

It’s worth noting that just because you haven’t tariff charges on your store receipts, doesn’t mean you don’t play a part in paying them as a consumer. Tariffs can increase seemingly overnight in some cases, and importers have to pass those costs on to retailers and/or end users to maintain profitability.

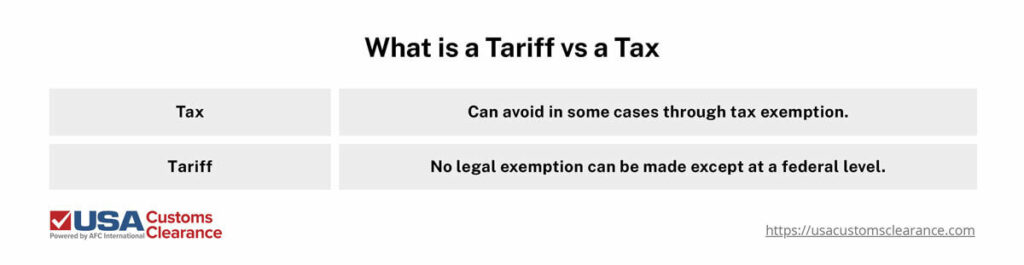

From a business perspective, the biggest difference between a tariff and a traditional tax is as follows:

You can also think of a tariff as more of an economic and trade tool than a moneymaking strategy. Where taxes are almost exclusively used with the end goal of directly generating revenue, a tariff can be used to exert political pressure or prevent one country from undercutting a trade partner’s domestic production by offering goods at below-market prices.

Related: Antidumping and Countervailing Duties: Balancing World Trade

Another import fee that gets lumped into taxes and tariffs is referred to as a duty. Duties are usually calculated as a percentage of the shipment’s value, a process called ad valorem. For instance, if you ordered 100 monitors at $50.00 a piece with a 2.4% duty rate, you’d owe Customs and Border Protection (CBP) $120.00 in duties.

Duties are usually changed only after years of review by the federal government. Tariffs can be implemented much more quickly, and tend to be higher than duties, since they’re often intended to dissuade trade of certain commodities with certain countries.

For instance, if our monitors were sourced from China, they’d be subject to the current 30% tariff on most Chinese goods. On top of the $120.00 in duties, you’d also owe CBP $1500 in tariffs.

One of the best ways to appreciate the differences between these different fees is to see how they impact three vital stages in the supply chain: importer, retailer, and consumer.

Related: A Guide to U.S. Import Taxes: Duties, Tariffs, and Other Fees

To get a concrete idea of how these charges have distinct effects on certain positions in the supply chain, let’s see how an importer, retailer, and end user (consumer) would be affected by a percentage increase in each fee.

For the purposes of this scenario, we’ll be dealing with three individuals and/or business entities:

Let’s say the county in which Field Day is located passes a 1% sales tax increase for three years to fund improvements to local highways. The impact would be as follows:

The key here is that since Bob’s only sells wholesale, their initial customers (usually retailers) are tax-exempt. Only the end user is on the hook for the 1% tax increase. Since Jim knows this is a county-wide increase, he knows there’s no point shopping elsewhere in town to try avoiding it.

Now, let’s assume that the duty rate on golf clubs increases from 4.4% to an even 5%. This is going to impact all three of our hypothetical parties, starting with the importer:

Since the increase occurs at the importer level, if disseminates throughout the entire sales channel: the importer, retailer, and consumer all face a small price increase. Jim might shop around for a lower price, but since duties apply evenly to any country without a free trade agreement, he’s unlikely to find one.

For our final exercise, let’s say Bob’s Emporium imports its golf clubs from a supplier in China. This means I can apply the current (as of this writing) general tariff of 30% on most goods imported from China on top of the 5% duties.

Like the duty increase, the impact is felt across the sales channel. However, it’s felt much harder due to the higher ad valorem increase.

A savvy consumer who has been comparing prices for a while before making a decision will almost certainly notice a price jump of this magnitude. They may decide to continue shopping elsewhere, which in this case could prove fruitful for them. Tariffs are not as high on other countries as they are on China right now, so they could find a lower price on a similar product with a different country of origin.

For shippers and importers in the United States, knowing which taxes can be avoided and/or reduced goes a long way toward maintaining profitability.

When it comes to importing goods into the US, the fees we’ve discussed only make up part of the picture: harbor fees, processing fees, and other charges must be taken into consideration as well. To get the most accurate estimate of how much you can expect to spend on an import transaction, it’s best to work with a licensed customs broker, such as those here at USA Customs Clearance.

Our services include:

Get the expert assistance you need to cut through the red tape of customs clearance. Call us at (855) 912-0406 or fill out a contact form online today!

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post