The International Emergency Economic Powers Act (IEEPA) has been used to levy tariffs on multiple US trade partners. Importers who have paid these tariffs may be eligible for refunds from the government should the US Supreme court decide they were enacted unlawfully. There are a few different ways this could play out, but savvy importers are preparing now for the possibility of getting IEEPA tariff refunds. If refunds are allowed in the future, USA Customs Clearance can help.

Key Takeaways

Find out if you could be eligible for a refund of duties paid due to IEEPA tariffs, and how to apply for those refunds, in this article.

A 45 Minute Licensed Expert Consulting Session Can Provide That Information and More.

After taking office in January 2025, President Trump began levying tariffs on goods imported from most of the United States’ trading partners. These tariffs started at 10% and were made higher for countries with whom the US has a large trade deficit.

The tariffs were assessed using the International Emergency Executive Powers Act, which grants the president authority to “deal with any unusual and extraordinary threat, which has its source in whole or substantial part outside the United States”. They’re also known as reciprocal tariffs and Trump tariffs.

The justification for enacting these higher rates on practically every US trade partner was that the country’s trade deficit with multiple partners qualifies as a national emergency, and raising tariffs on imported goods would address that emergency and encourage more domestic production and sourcing.

The impact of the tariffs over the course of the 2025 fiscal year saw CBP collect total duties, taxes, and fees of $216.7 billion. To put this in perspective, 2023 and 2024 saw intakes of just $92.3 billion and $88.07 billion respectively.

Though the tariffs remain in place as of this writing, multiple lower courts have found that the use of the IEEPA to unilaterally increase tariffs is an overreach. The Supreme Court heard arguments from plaintiffs suing the government to have the tariffs paid under the act refunded, and is expected to make a decision this year.

Depending on the Supreme Court’s decision, importers could stand to recover millions of dollars paid in tariffs over the course of 2025 and early 2026.

Related: How Reciprocal Tariffs Impact Global Trade

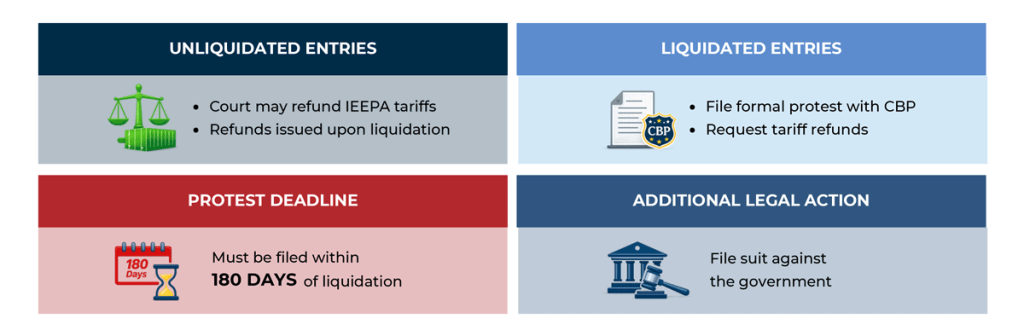

Per a statement posted to congress.gov, there are three potential mechanisms for acquiring IEEPA tariff refunds should the court strike them down:

You may also be familiar with the government’s drawback program, but this is used for destroyed or re-exported goods, and most likely won’t be an avenue to receive refunds on IEEPA tariffs.

If you do need to file a protest to recoup tariff costs associated with the IEEPA, you’ll find the easiest way to go about it is by working with a Licensed Customs Broker at USA Customs Clearance.

Our Licensed Customs Brokers spend a great deal of time filling out and submitting complex government documents, which gives them advantages you can make your own should you need to file a protest to claim tariff refunds:

If you think you qualify for an IEEPA tariff refund, our team of Licensed Customs Brokers can provide expert advice and file documents on your behalf. We cut through the red tape of bureaucracy to help you get your money back from the government.

Ready to get started claiming your potential refund? If so, call us at (855) 912-0406 or submit a contact form online. We have the knowledge and experience you need to claim your piece of IEEPA tariff refunds.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post