If you are looking to import speakers and headphones into the U.S., you should be aware of the unique rules governing their entry. Electronics are heavily regulated commodities, and if your speakers and headphones have wireless capabilities, they may require extensive testing prior to certification.

Key Takeaways:

From earbuds to 20-inch subs, we’re here to provide the information you need to successfully import loudspeakers and headphones into the United States.

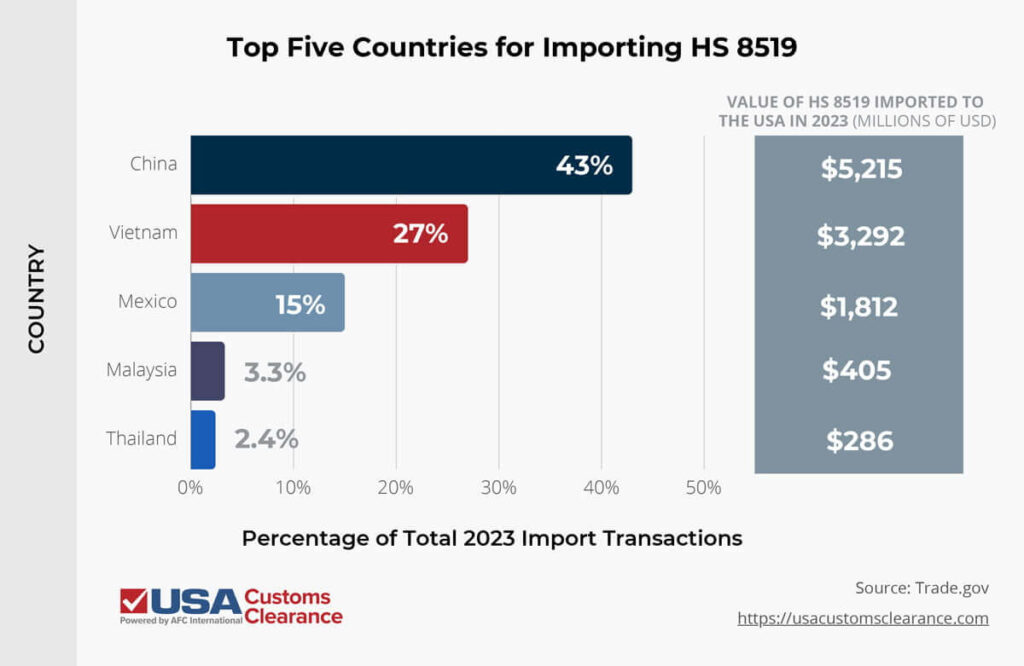

Whether it’s car audio, home theaters, or a reliable set of headphones for gym use, American consumers use plenty of speakers in their day-to-day activities. These devices are classified under the HS code 8519, which accounted for over $12 billion worth of imports in 2023. The top five countries who exported speakers and headphones to the United States for that year are listed in the table below.

Despite ongoing trade disputes between China and the U.S., the People’s Republic is still the most popular source of speakers and headphones for stateside importers.

There is a rising number of speakers and headphones now coming from Mexico too. Due to the proximity of the U.S. and Mexico and positive trade relations via the United States-Mexico-Canada Agreement (USMCA), importing products from Mexico to the U.S. is typically a smooth transaction. Consider this when deciding from where you wish to source your products from.

If you plan to import from them or any other country, you’ll need to make sure your goods meet requirements set by the FCC.

To understand FCC regulations with regard to speakers and headphones, you must first know the differences between what the commission refers to as intentional and unintentional radiators. The main differences are:

The FCC also designates some electronics as incidental radiators, but this does not apply to speakers and headphones.

Many modern devices incorporate multiple types of radiators into their overall design, so it’s likely your imported speakers and headphones will need to meet two standards: The FCC Supplier’s Declaration of Conformity (SDoC) and FCC certification. Let’s take a look at what each standard entails.

Unintentional radiators can be certified via this process. It involves providing a test report to the FCC stating that your product satisfies the commission’s definition of unintentional radiator.

The SDoC must include the following:

For intentional radiators, a more strict certification process is involved.

If your product is in part or in whole an intentional radiator, it will need to undergo FCC certification.

This involves the responsible party (in this case, the importer) submitting documentation and data about the product(s) to an FCC-approved Telecommunication Certification Body (TCB). The TCB will perform exhaustive studies of its own to ensure the product is safe for use by the public.

If it passes inspection and receives certification, you’re ready to continue. You can also opt for FCC Certification instead of using an SDoC on unintentional radiators, although certification is a more rigorous process.

The Electrical Product Safety Standards are voluntary guidelines to determine how safe your products are to use. These product safety standards are evaluated by independent companies, with the most well-known one being Underwriters Laboratories (UL) LLC.

Although it is not legally required for importing, UL has a solid reputation and certification from them can give your product an extra bit of credibility when it comes to resale and standing out from the competition.

In order for your products to become UL certified, you will be need to do the following:

Many public contractors will only install UL-certified devices, so your customer base will be larger if your products have been certified.

Different components of the product can be evaluated using different standards. For example, a Bluetooth speaker would require certification for its batteries, audio-video components, and any other features it may have.

In addition to FCC regulations, you’ll need to comply with the rules set forth by the U.S. Customs and Border Protection (CBP). These rules are fairly straightforward, but mistakes here can lead to delays, fines, or loss of your shipment. An experienced customs broker can help you understand the specifics of the individual requirements.

To import speakers and headphones into the U.S., you need to make sure that the country of origin is labeled on the device itself. It should be permanently attached to each product, not just the packaging.

In addition to that, you will also need to provide:

You will need also need to secure a customs bond regardless of shipment value due to these products being regulated by the FCC.

With USA Customs Clearance, you can apply for bond and receive approval the same day, keeping your business plans in motion.

Importing speakers to the U.S. is a big job, but with our customs experts on your side, the process is easier than ever! Our service to you goes “beyond the bond,” meaning we continue to serve you even after you’ve purchased a bond with us.

USA Customs Clearance offers several other valuable services for importers, including:

If you have additional questions, give us a call at (855) 912-0406 or contact us online. Our team is ready to assist you.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post