An importer of record (IOR) is a business or individual who takes responsibility for moving a shipment through U.S. customs while ensuring all relevant regulations are followed. They play an important role in international trade, facilitating trouble-free customs clearance.

In this guide, we’ll explore the role and responsibilities of an IOR and clarify how they contribute to the customs clearance process in the United States.

Key Takeaways

If you need importer of record services, we can help! Call us at (855) 912-0406.

As noted above, the individual or entity responsible for ensuring import compliance is known as the importer of record. They assume legal responsibility for the imported goods and have temporary ownership of them during customs clearance.

While the Incoterms® of a shipment often dictate who is responsible for fulfilling the IOR role in a given transaction, that individual or business can still hire a licensed customs broker to act in their stead.

Brokers who act as professional importers of record often work with firms that have access to freight forwarders and other import professionals. This gives them an edge in moving shipments through customs quickly and compliantly.

There is a lot to know when it comes to Incoterms. For more information, take a look at our blog What Are Incoterms?

The duties and responsibilities of an Importer of Record are numerous and critical. With so many important tasks to be completed, it’s imperative to be aware of exactly what needs to be done.

Below are the responsibilities of an importer of record:

Failure to execute any of these tasks correctly can have severe consequences. Daily fines for held goods, harsh financial penalties for filing errors, and seized goods are just some of the problems that arise occur when these responsibilities aren’t handled properly.

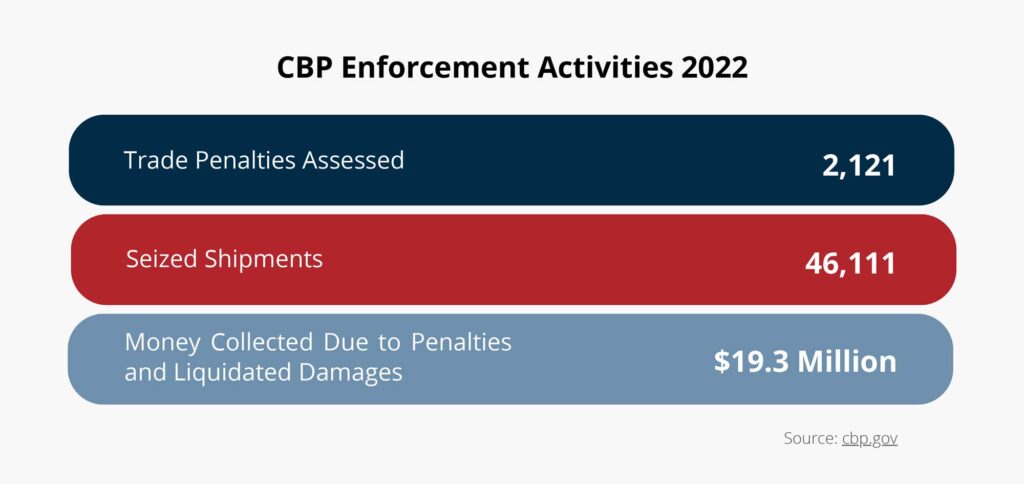

In the following table, you can see some of the penalties issued to importers by CBP over the course of the 2022 fiscal year.

Source: cbp.gov

If you’re acting as the IOR for your own shipment, be certain that you have a complete understanding of what’s required and needs to be done. If you’ve hired a third party, clearly communicate all the details of your shipment to ensure nothing is missed.

Need help navigating customs requirements? Our Customs brokers can assist you! They’re licensed by CBP and have extensive experience handling tricky government regulations.

While they can and sometimes do overlap, an IOR is not the same thing as a consignee.

The consignee of a shipment is the individual or entity that is the end receiver of the goods. It’s common for a consignee to hire an IOR, since consignees simply receive the imported goods after they have traveled through the U.S. port of entry.

In short, while the IOR is responsible for the goods at the time of import, the consignee ultimately receives the shipment.

Yes and no. The IOR always takes temporary ownership of imported goods during the customs clearance process. Once cleared, final ownership of the goods depends on a couple of different factors.

Since different individuals or entities can potentially act as an importer of record, deciding who should fulfill this role is one of the most important decisions you can make when importing goods.

This choice comes down to the specific details of the shipment and the needs of the parties involved. When making this decision, especially if you are considering being your own IOR, consider the following questions:

The first question is perhaps the most important. You might think you could act as your own IOR in the short-term, but can you also handle the required bookkeeping, or easily secure storage and transport for your goods? If not, an experienced IOR is well worth consideration.

Those questions are also useful if you plan on entering the import business as a professional IOR yourself.

When searching for a professional IOR, you’ll probably run across the terms “shipper” and “freight forwarder”. It’s essential to understand how these service providers fit into the import process.

A freight forwarder can take on some of the responsibilities usually handled by the IOR. However, they won’t be listed as the importer of record for a shipment. Only the owner or purchaser of the goods being shipped or a licensed customs broker can act as the importer of record

Within the context of importing, the shipper is the entity who sells goods to importers. A foreign business must have a Customs Assigned Importer Number to act as an IOR. Alternatively, they might employ or contract with stateside brokers who can act as importers of record for their customers.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Just because you can be your own IOR does not mean you necessarily want to be. If it is your company’s first time dealing with imports, you would be wise to employ the expertise of a customs broker and/or importer of record.

This is especially true if you plan on importing heavily regulated goods. These include:

These are just a few examples of goods and commodities that require special licensure and/or certifications to be legally imported.

To get an idea of situations that do and don’t call for a professional IOR, consider the following scenarios.

You Might Not Require a Professional IOR if:

You’ll Need An Experienced IOR when:

A reputable customs broker should be upfront with you during your initial consultation regarding whether you truly need an IOR service or not, and help guide you through any questions regarding the value of an IOR in your specific circumstances.

If you require door-to-door logistics or require a distribution center to hold your imported goods, working with an IOR can prove invaluable.

To learn more, read our article on foreign importer of record.

Whether you choose to act as your own IOR or decide to employ a professional, our team of customs experts can help. Our team of licensed customs brokers have over a century of combined experience helping importers like you with every aspect of the customs process.

Our full list of services includes:

Give USA Customs Clearance a call today at (855) 912-0406, or submit your question online to see how we can assist you in making sure your imports are handled professionally and dealt with in an efficient, secure manner. We can discuss any concerns you have and make importing goods into the U.S. a simple and hassle-free process.

Copy URL to Clipboard

Copy URL to Clipboard

Hello,

I'd like to ask your IOR Service.

I have a shipment to US from South Korea for Amazon FBA and eBay

please let me know your service and IOR fee.

thanks.

Good day,

We'd like to inquire if you provide IOR service for shipments from China to the US. We have a shipment coming to the US from Xiamen, China via Amazon Global Logistics. We are in need of IOR in the US as we are located in Spain, Europe. Please advise if this is a service you can provide as well as the cost quotation. Please see the shipment details below:

Description of goods: paper packaging materials

Total weight (lbs): 3133

# of pallets: 4

Pallet dimension: 1*1.2*1.1m

HTS code: 4819.10.0040

Thanks,

Maria

Hello I am looking for IOR service provider in United states

Pls refer some one who can help on this.

If we were to use a supplier as an IOR for material going over the CA border... since they will be the IOR, are they technically the owners of that material? Or can we still own the material that will be in their facility?

Hello,

I have a question about how to become the IOR for goods such as food and alcohol (bottled and bulk). My largest concern is if it is a flat fee or a recurring fee for every import we would bring into the US. To give you a bit of context, we are a distillery that partners with other distilleries that would import goods or bulk spirits from other countries to be brought into the USA.