When it comes to importing into the U.S., being fully compliant with import regulations can’t be overlooked. Even minor mistakes in following import requirements can lead to severe consequences and penalties for your business.

Key Takeaways

One of the most effective ways that importers can ensure they remain compliant is to create and maintain an import compliance manual. Let the experts at USA Customs Clearance create the perfect compliance manual for your business. Call us at (855) 912-0406.

An import compliance manual is a document that provides specific instruction for what a company should do during every step of the U.S. import process. Some imported goods are more strictly regulated than others, so no one manual can be comprehensive across the entire spectrum of items imported into the USA.

The manual should be written to address a business’s unique needs and products, clearly delineating the laws and regulations enforced by CBP with regard to imported goods.

Speaking of CBP, you may have found information about the bureau’s Importer Self-Assessment (ISA) program and its associated handbook.

To avoid any potential confusion going forward, the ISA Handbook is not the same thing as a compliance manual. The key differences are as follows.

While the handbook will probably have some impact on the content of your manual, the latter should be customized to your business needs for maximum effectiveness.

For reasons of economic and national security, importing goods follows a very specific set of steps. The manual is needed so that importing is done the same way every time, regardless of which member of your business handles the process.

If members of your organization don’t clearly understand what CBP requires, you’ll be setting your business up to explain to a customer why they’re being fined, or why their shipment is being delayed or outright rejected.

For instance, solar panels are growing in popularity among American homeowners. However, panels that are made in part or in whole in China must be heavily scrutinized since they’re not likely to comply with CBP importing regulations.

In short, a complete import trade compliance manual should fully lay out both your company’s overall responsibilities and that of your employees.

As far as U.S. regulations go, the importer of record (IOR) is responsible for compliance during the customs clearance process. However, a customs broker also bears responsibility for whatever occurs, since they’re a hired representative.

Even if the broker might not bear legal obligation to the U.S. government for everything that goes into import compliance, there is generally a contractual agreement that promises full compliance.

If you decide to work with a third-party IOR, they should have access to your compliance manual in order to produce consistent, trouble-free results.

The areas covered in an important compliance manual will include some or all of the following:

The introduction and conclusion can be custom-tailored to fit your company’s staffing at any given time. Sections 2 through 11 should focus more on laying out what the company’s overall responsibilities are in each area, and which employee roles are in charge of ensuring compliance every step of the way.

No, you do not have to have this manual in place before importing. However, we can’t recommend it highly enough.

Just like you wouldn’t put together a piece of complicated furniture without the instructions, a company shouldn’t take on CBP’s complex rules without a definitive document laying how to do it, and the responsibilities of each team member in the process.

This also helps show prospective customers that you have a well-thought-out plan for how to meet their needs while avoiding regulatory issues.

The company that has written or commissioned the compliance manual benefits because they have a documented plan on how to comply with every detail of their import process.

The company’s customers, who may be businesses themselves, also reap the rewards by partnering with an enterprise that makes compliance a priority and employs a clearly defined plan.

CBP might not issue companies a direct order to craft an import compliance manual, but any policies presented by one should be created with said agency in mind.

This manual should clearly demonstrate to others that you not only know exactly what to do, but that you’ll follow any and all CBP guidelines surrounding imports before, during, and after the customs clearance process.

CBP does play a role in terms of how the manual is constructed, but the bureau doesn’t mandate that every company has to have one.

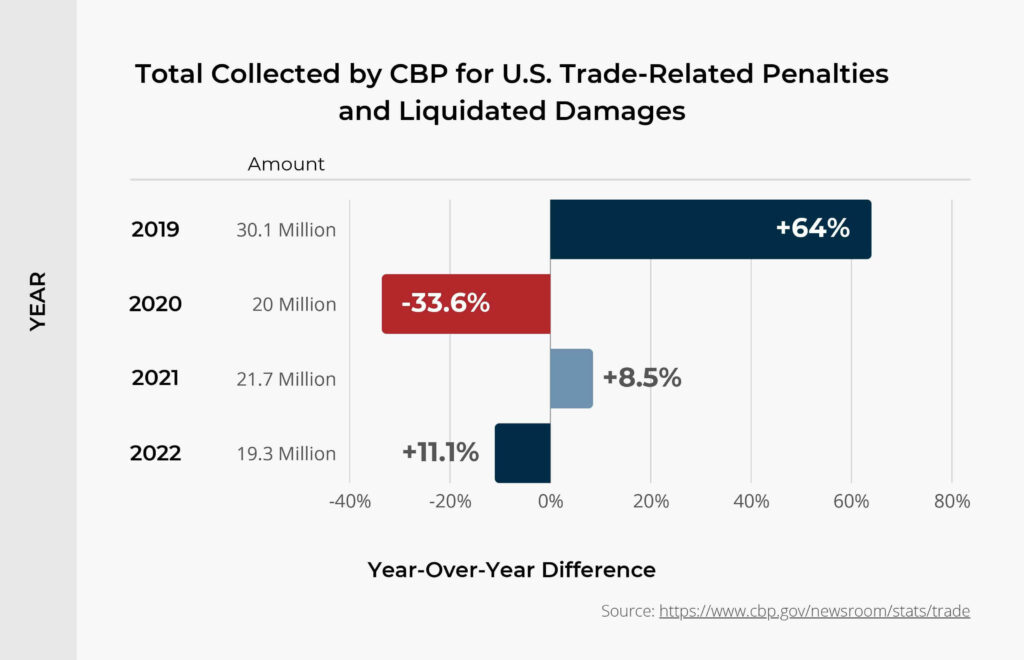

However, just because they don’t require companies to have one, doesn’t mean they won’t enforce rules and regulations on non-compliant goods. In the table below, you can see the expenses of trade related fines and damages from 2019 to 2022.

There are indeed templates available for import compliance manuals. Some companies will sell them to importers, making them highly customizable. This is so, with a bit of light editing, you can have a compliance manual tailored to your business without multiple employees spending hundreds of man-hours researching, writing, and revising it.

Companies that provide these templates tend to employ experts in customs clearance, usually licensed brokers. If you purchase one, it shouldn’t need much editing besides inserting the correct name or job title of the person responsible for certain tasks or aspects of the import chain.

As previously stated, it’s best to work with a licensed customs broker when you decide to purchase a compliance manual. Their experience will ensure that your manual is thorough and easy to follow.

Our own team of brokers has over a century of combined experience assisting importers with compliance manuals and other aspects of international trade. In other words: if you’re looking for an import compliance manual, you’re already in the right place.

Now that you understand the importance of an import compliance manual, let USA Customs Clearance provide you with a nearly completed document, written proficiently and requiring very little of your own time to customize for your business needs.

This manual is just one of the many services that USA Customs Clearance can provide to importers. We also offer:

Whether you’re just looking for a compliance manual or need additional services, contact us online or at (855) 912-0406. We’re standing by to help you take the guesswork out of import compliance.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post