Copy URL to Clipboard

Copy URL to Clipboard

The Importer Security Filing (ISF) is one of the most important entry documents an importer submits when entering their U.S.-bound freight. Here are 7 things you need to know when preparing your ISF filing.

Key Takeaways:

I’ll detail exactly what you need to know about each of these ISF requirements and ensure you avoid fines or delays to your shipment.

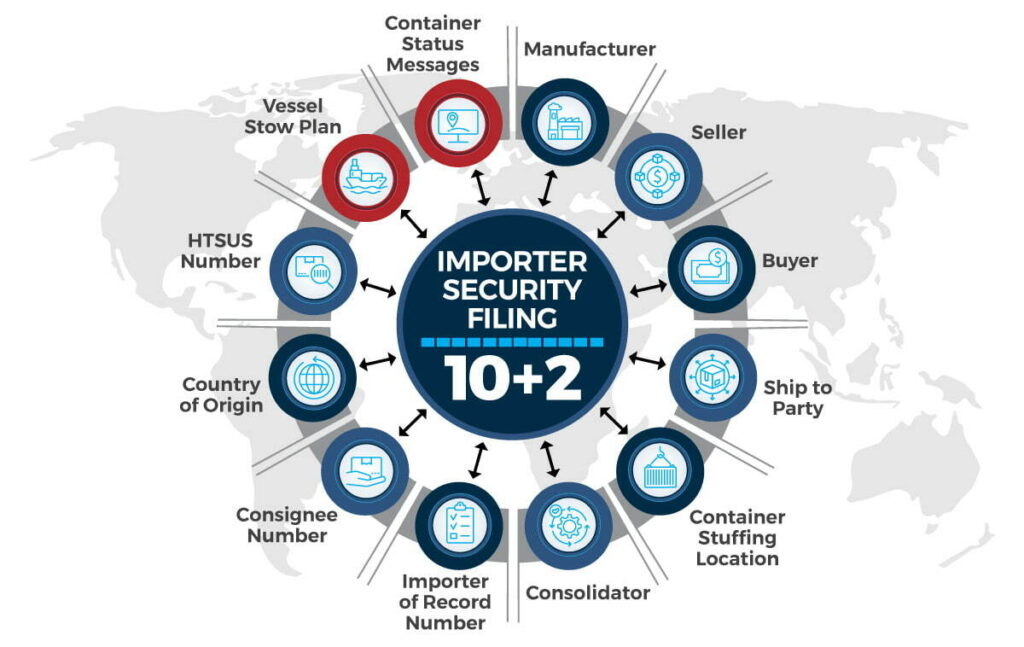

As the importer of record for your shipment, there are 10 pieces of information that you are required to provide on your ISF filing for all merchandise being imported at the most detailed bill of lading level. Additionally, there are two data elements that are needed from the carrier, hence another name for an ISF, the “10+2”.

The two pieces of information that the carrier must provide are:

CBP requires advance notice when an ISF is filed in order to screen the cargo effectively for security risks. A good rule of thumb is to have all of the information submitted 24 hours before your cargo is loaded onto a ship bound for the U.S. - however, some of the data elements allow for some flexibility.

The seller, buyer, importer of record number, consignee number(s), manufacturer (or supplier), ship to party, country of origin, and HTSUS number must all be submitted in accordance with the rule above.

The container stuffing location and consolidator, on the other hand, can be filed later. This information should still be submitted as early as possible, but the deadline for those is 24 hours prior to the ship’s arrival at a U.S. port.

Related: ISF Filing Deadline: When is It and How to File on Time

Any mistake made involving an importer security filing can cost an importer $5,000 per infraction, up to $10,000 per shipment. This includes inaccurate, incomplete, or untimely filings. Non-compliant cargo may also face holds, refusal of unlading, or "do not load" orders.

Related: Customs Penalties and Fines: Know Before You Ship

Learn How to Fill Out Your Importer Security Filing Correctly.

Our Licensed Customs Brokers Can Personally Guide You.

The ISF Importer is responsible for submitting the ISF in an accurate and timely manner. CBP defines the ISF importer as the party responsible for causing the goods to be entered into the U.S. This is typically the owner, purchaser, or consignee of the goods.

Alternatively, the importer can hire a third party, such as a customs broker, to file the ISF on their behalf. However, these agents must first be granted power of attorney.

Related: Is a Power of Attorney Required for International Shipping?

There are some shipment types that allow for exceptions to the typical ISF requirements. Most notably, an ISF is only required for imports entering the U.S. at an ocean port of entry. You do not need to submit an ISF for shipments entering by way of air or ground transportation.

Additionally, an importer entering bulk cargo is not required to submit an ISF. Similarly, importers of break bulk cargo, do need to submit an ISF, but they have until 24 hours before their freight arrives, rather than 24 hours before the freight is loaded.

FROB, IE, and T&E shipments also operate differently than a standard ISF (ISF Type 01). You can learn more about these in our article ISF-5 vs ISF-10: What’s the Difference? :

Any importer submitting an ISF must obtain coverage in the form of an import bond. Many importers will have already secured either a continuous or single transaction customs bond to cover their shipment. If you already have one of those, this will cover the ISF bond requirement as well.

However, if you have not already obtained a bond, you will need to purchase one of the following:

Many customs brokerages can sell you the ISF bond on its own. These bonds serve as guaranteed coverage for potential liquidated damages for any ISF violations.

Related: Customs Bonds: The Complete Guide to U.S. Import Bonds

ISF filings must be submitted electronically via the Automated Broker Interface (ABI) or the Automated Manifest System (AMS). Importers without direct access to ABI or AMS can hire a customs broker or a third-party logistics provider, like USA Customs Clearance, to file the ISF on their behalf.

Notably, if you’re submitting your ISF as the same time as your entry documentation, there is some information that you only need to provide once:

Related: How to Submit ISF to U.S. Customs Correctly

At USA Customs Clearance, our licensed customs brokers specialize in handling import documents, like the Importer Security Filing, on the importer’s behalf.

Don’t risk a $5,000 fine for even the smallest error. Let us handle the hard work for you, and you can rest easy knowing that your most important import documents are being handled by industry experts.

Fill out a customs brokerage request or give us a call at 855-912-0406 today to get started.

Learn How to Fill Out Your Importer Security Filing Correctly.

Our Licensed Customs Brokers Can Personally Guide You.

Copy URL to Clipboard

Copy URL to Clipboard

Please can you confirm if the ISF filing is required for Air and Sea Shipments going into the USA.

Secondly can you forward me the ISF Document to be completed. IF the customer (once off importer) is here in South Africa and buys goods whilst in SA can he apply online whilst here for the ISP Filing?