Whether you’re planning to resell for profit or use it for commercial purposes, importing paint can be a lucrative prospect. With that being said, importing any product into the U.S. requires strict adherence to a number of rules and regulations, and paint is subject to more of these than most commodities.

Key Takeaways

For more information on importing paint to the USA, read through our comprehensive guide below.

Paint is considered a chemical mixture according to the TSCA, which requires importers to submit a statement of positive certification to the United States’ Customs and Border Protection (CBP). The certification can be filed online via CBP’s Automated Commercial Environment (ACE) portal or submitted in writing.

A positive certification confirms that imported paint complies with sections 5, 6, and 7, of the TSCA. These sections lay out rules for importing toxic chemicals, including those which may contain lead.

While lead-based paint was banned by the federal government in 1978, some paint still contains trace amounts of the toxic element. The amount of lead in paint must not exceed 0.009% of the total content.

Importers of “general use products” (including paint) must apply for a General Certificate of Conformity (GCC). They must also support their GCC applications with tests of each product they import from a reasonable testing program.

Federal law requires importers to make their GCCs available at the time of import. The GCC must also be provided to any distributors or retailers selling the product.

You can fulfill this obligation by giving these parties access to the document online or sending it to them via email rather than providing a physical copy.

The import duty applied to paint depends on several factors, including:

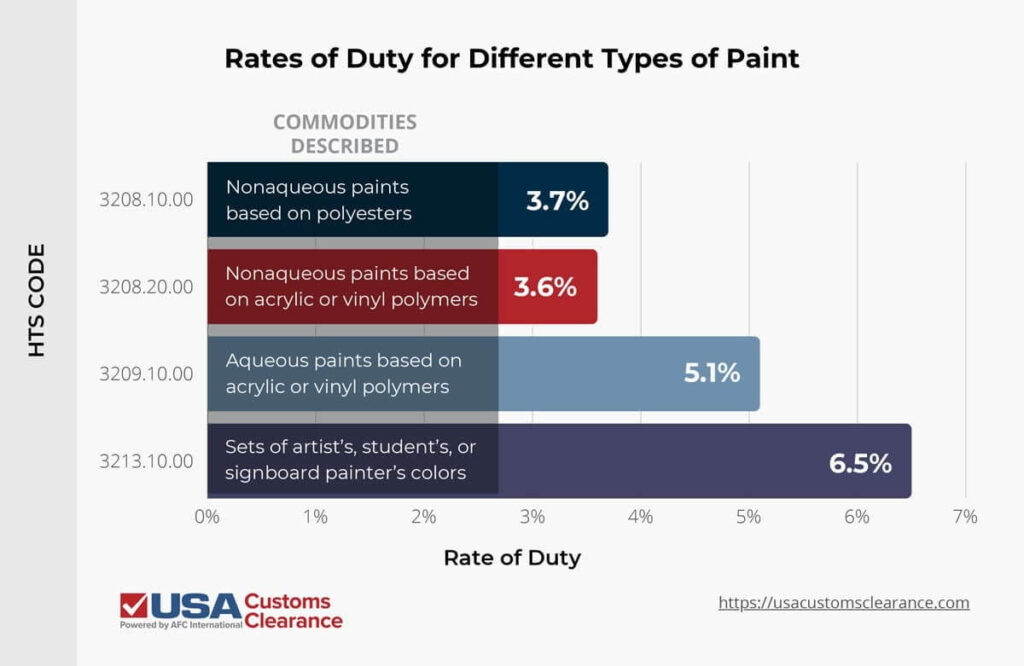

Duties on imported paint usually range between 3.7% and 6.5%. In the table below, I’ve compiled some common Harmonized Tariff Schedule (HTS) codes for paint products with their associated duty rates.

Source: https://hts.usitc.gov/

Imports of paint from China are also subject to a 25% Section 301 tariff. Alternatively, duty fees can be circumvented entirely by importing from a country with a U.S. free trade agreement.

Additional classifications exist for paints and varnishes for finishing leather or metallic powders for industrial processes. Each of these carry their own rate of duty.

Keep in mind that even with this knowledge, one of the biggest challenges in importing paint is ensuring that it is classified with the correct HTS code.

Thankfully, this is also one of the key benefits of consulting with our team of licensed customs brokers. During your consulting session, they can classify your paint with the proper code and duty rate, avoiding potential difficulties from CBP when your shipment arrives.

The 2020 COVID-19 pandemic resulted in shortages of many commodities, including paint. Recovery has been slow, but steady. In 2024, the shortage is not nearly as critical as it was at the beginning of the decade. However, some raw material suppliers have already sold through their stock and won’t have any goods available for the remainder of the year. It’s also worth noting that since petroleum is a component of many paints, the price and availability of crude oil has a direct impact on the price and availability of paint.

For importers, this means that planning ahead and ordering well in advance should be part of your business plan. It’s also important to diversify your pool of suppliers to avoid potential shortages from spikes in demand.

Customs bonds are usually only required for shipments valued at $2,500 or more. However, bonds are required for any shipment of goods regulated by a Partner Government Agency (PGA) of CBP. Since the Environmental Protection Agency (EPA) regulates paint imports, you will need a customs bond regardless of your shipment’s value.

Related: How to Get a Customs Bond: A Guide For New Importers

Importing paint into the US can be a complicated process. Fortunately, working with a licensed customs broker can simplify things, reducing stress for the importer. A broker will ensure that all necessary documentation for the shipment is properly submitted. They can also submit the required files and documentation to customs on behalf of an importer, cutting administrative costs and reducing risks.

Customs brokers at USA Customs Clearance have helped paint importers clear CBP for many years, and we can help you, too. Thanks to our comprehensive approach to the clearance process, we can handle a wide range of tasks related to importing paint and other goods into the U.S.

Our full list of services includes:

If you need help importing paint, call our team of customs experts at (855) 912-0406 or submit a contact form online. We have the knowledge and resources you need to cut through the red tape and make sure your goods comply with U.S. importing regulations.

Copy URL to Clipboard

Copy URL to Clipboard

I have some special exterior and interior wall coatings that I want to import from China to the United States, and I hope to find a partner who can solve the certification and government communication.