Tea can be found in nearly 80% of all U.S. households. Nonetheless, importing this product is a process that requires strict attention to detail and a full awareness of the rules surrounding customs clearance.

Key takeaways:

In this guide, we cover all the requirements you’ll need to know when importing tea so that your shipments can avoid delays and rejections at port.

The main federal agency that regulates the importation of tea is the Food and Drug Administration (FDA). Specifically, you’ll be required to follow the food safety standards outlined by the Food, Drug, and Cosmetic Act. In the following sections, I’ll outline the steps you’ll have to complete before your tea can enter the country.

According to FDA regulations, all Food Facilities need to register with the department and must agree to give advance notice of shipments of imported food.

This is due to the Public Health Security and Bioterrorism Preparedness and Response Act of 2002 (the Bioterrorism Act), which is focused on preventing attacks on the U.S. food supply, as well as protecting the food supply against other problems.

The FDA Food Safety Modernization Act (FSMA), which came into effect on January 4, 2011, brings in some additional standards. According to this amendment, facilities that manufacture, process, pack, or hold food intended for consumption in the U.S., also need to submit further details.

This additional information assures the FDA will be allowed to inspect the registered facilities. The FDA may suspend the registration of a facility on suspicion of potential adverse health conditions associated with its goods. Facilities will need to renew their FDA registration every other year.

Upon importation into the U.S., FDA and CBP agents will verify the imported goods have been manufactured, processed, and packed at an FDA registered facility.

You will need to provide prior notice before your tea products enter the country.

There are two ways to give prior notice:

Both of these systems require users to create and register an account to submit the necessary information. Most licensed customs brokers, including ours at USA Customs Clearance, already have access to these systems and can submit the Prior Notice on your behalf.

As an importer, you’ll have the responsibility of following the Foreign Supplier Verification Program (FSVP). Completing this program will prove to the FDA your foreign supplier has adequate preventive controls in place. This will ensure the tea they produce is safe for human consumption.

There are four primary FVSP requirements you’ll need to complete:

The hazard analysis is essentially an in-depth evaluation on any reasonably foreseeable hazards that could occur in your tea imports. You’ll need to assess this analysis and the performance of your supplier with regard to their ability to provide safe product.

Supplier verification requires you establish and follow written procedures that guarantee you only import tea from reliable suppliers. Finally, you’ll need to establish corrective action in the event your supplier doesn’t follow safety procedures.

Your tea products must adhere to the FDA’s labeling requirements to make entry.

The Nutrition Labeling and Education Act (NLEA), which amended the FD&C Act, dictates specific labelling requirements. However, regulations are frequently changed, and it’s the responsibility of the members of the food industry to keep themselves informed of the latest developments.

All new regulations are published in the Federal Register (FR) before coming into effect. These new regulations are compiled yearly in Title 21 of the Code of Federal Regulations (CFR). Answers to common labelling questions can be found in the FDA’s Food Labeling Guide.

Basic information that should be included on an FDA label for your tea includes:

You should also include the Name and address of either the manufacturer, packer, or distributor of your products.

Related: FDA Customs Clearance

To help the FDA more easily determine your tea abides by their requirements, you can provide Affirmation of Compliance (A of C) codes. Providing these codes will lower the chances that FDA will hold your shipment during their screening process. As a result, you might be able to enjoy an expedited importing experience.

While A of C codes are important, they’re not explicitly required for the importation of tea. Instead, the FDA permits you to use these codes at your discretion.

The FDA isn’t the only government agency whose regulations you have to satisfy. Customs and Border Protection (CBP) will want you to provide them with the necessary documentation for your tea.

Some documents they’ll be looking for include:

Documents like these are essential for all cargo coming into the country. Not including them can result in delays and even financial penalties.

Related: What Documents Do I Need To Import and Export?

Having the right Harmonized Tariff Schedule (HTS) code is essential when importing tea. This will ensure that you’re charged the correct duty rate for your shipment. That said, there are numerous HTS codes that apply to different types of tea.

The HTS code for tea and its variants can be found in the subheadings under 0902 in the Harmonized Tariff Schedule of the United States (HTSUS). Likewise, you can find HTS codes for tea extracts in the subheadings under 2101.

To find the specific HTS code for your tea imports, use our easy-to-use lookup tool! All you have to do is type in a single word or phrase and pick the result that best represents your goods.

Provide a simple description of your goods and let our tool take care of the rest!

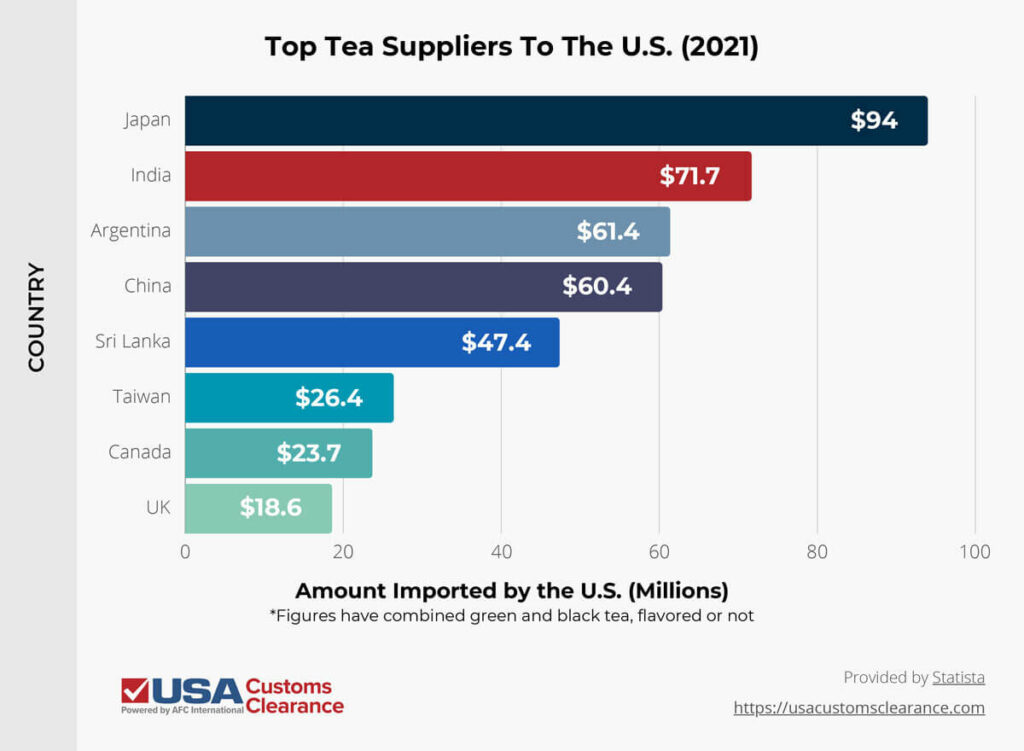

Finding a country to source your tea from is extremely important. Fortunately, this is quite easy due to the large amount of countries that produce their own unique assortment of tea products. To help you narrow down your search for suppliers, I’ve provided data on the top countries that supply the U.S. with these goods.

Each of these countries are well known for the quality of tea they produce. Japan in particular produces quality tea that many U.S. consumers enjoy. If you choose to import your tea from Canada, you’ll be able to take advantage of the United States-Mexico-Canada (USMCA) Free Trade Agreement (FTA) to receive a preferential duty rate or even avoid paying duty altogether.

While the other countries listed don’t have an FTA with the U.S., most have a positive trade relationship overall. They all provide quality tea products that are worth researching and importing.

Before finalizing your business deals, be sure to review which set of Incoterms® you and the seller will agree to. Find out more in our article, 11 Types of Incoterms: International Trade Terms Explained.

Incoterms® (short for “International Commerce Terms”) are mutually agreed conditions for the international shipping of commercial goods. They are published and managed by The International Chamber of Commerce (ICC).

Each rule within the Incoterms outlines specific obligations and responsibilities for international buyers and sellers. When importing your tea, you’ll need to pick a term that’s best suited for your needs.

There are 11 different types of Incoterms® you can select. Seven of these terms can be used when moving your cargo by any mode of transport, while only four can be used specifically for vessel transport.

If you plan to import tea to the U.S. for resale, you might fall into the trap of focusing all of your attention on the process of sourcing your tea and getting it passed through customs successfully. However, that isn’t where the journey ends.

Once your tea has arrived in the country and has successfully cleared through U.S. Customs, you’ll still need to move it out of the port. This means your tea must be properly transported, warehoused, and conveyed to the outlets that will be responsible for selling it.

At USA Customs Clearance, we can handle all of these needs along with the customs clearance portion. This ensures a smooth transition through each phase of the logistics and supply chain journey.

If you require help importing tea into the U.S., then look no further than USA Customs Clearance. Our team consists of Licensed Customs Brokers that have the expertise you need to bring these goods into the country. Other members of our team can help you obtain a variety of documents that you’ll need to import.

Start importing your tea with USA Customs Clearance by contacting our team through the site. You can also call our team at (855) 912-0406 to learn more about the services and documents we offer.

We work with you every step of the way to ensure a smooth and stress-free customs experience.

Copy URL to Clipboard

Copy URL to Clipboard

Hi,

I'm currently setting up an online website (based in Taiwan) to sell tea from Taiwan direct to US retail customers. Would it be feasible to just use FedEx to deliver direct from Taiwan facility to US retail customers so I won't need to stock up in a US warehouse since it's hard to predict how much tea I can sell at the beginning?

And once I get the business up and running, could you please provide a quotation on how much it'll cost to appoint a Licensed Customs Broker to handle the importing, and how much for the warehousing and logistics by R+L Global Logistics?

I need help with importing tea from India, certified organic green tea and black tea by a award winning company which has been engaged in exports to Canada and Colombia, I am in San Francisco, CA.

Could you please recommend any company who handles this process.

I am going to be importing tea from India (from a vendor already exporting to the U.S.A.) to Chicago, IL. The above article is very confusing. Will you please contact me with quotes and what you do on our behalf and what we need to do to get this going. We'll be making our order shortly.

Hi,

I would like to get a quote on handling importing teas from India from a reputed company which has been engaged in exports to New Jersey, USA.

I am looking at selling Kenyan tea in America. I have some samples here as I recently brought them from the Makomboki Tea Factory. I have represented their tea in the past and would like to do it again. I need to understand the full costs. I currently have a DUN# but am told I may need a SAM# for another $600 and a custom Bond for $275. Is this true? Also, what other costs am I looking at. The tea is straight black with no additives. I can have it shipped from Kenya to me in Oregon, or directly to the customer. Additionally, I had it in stores before. I can do that two. Based on what I have told you, can you please other costs so I can plan ahead. thank You.

I’m an importer based in Ohio. I am interested in importing Kenyan tea leaves. Can you please contact me via email at LEWI41@yahoo.com

hello there, i want to get the details about launching tea ecommerce business. Do you have experience with that?

Hi , the rectrictions are the same when the tea comes from Canada?

I would like to get a quote on handling importing teas from India from a reputed company which has been engaged in exports to USA. I am located in San Francisco / Bay Area, (Walnut Creek) CA.

Does your company provide an agent who handles this process? And what are the details?

Hi Paramita,

We can absolutely help you with this! One of our import experts will reach out to you shortly to assist you. We look forward to working with you!

Hello, I want to sell my products to the United States and other regions. Can you help me?