From makeup to lotions and everything in between, consumers in the USA spend billions of dollars a year on cosmetic products so they can look and feel their best. Demand for these products is consistent, but the process of importing them into the U.S. can be surprisingly complicated.

Key Takeaways:

Our comprehensive guide below provides you with everything you need to know to safely and legally import cosmetics to the U.S.

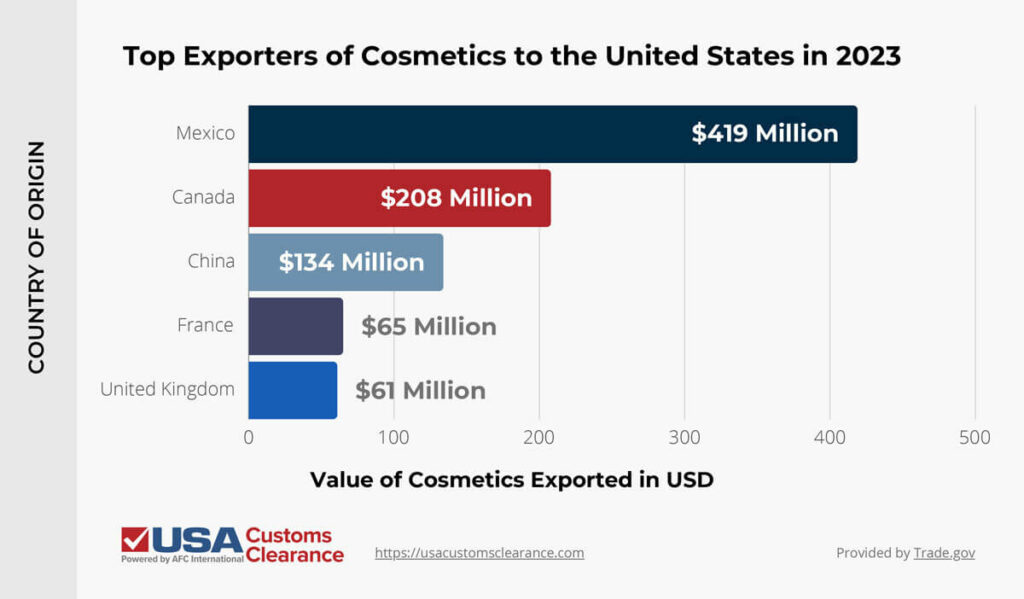

While domestic manufacturers produce a formidable supply of cosmetic goods, the U.S. did import over one billion dollars worth of these products in 2023. In the table below, I’ve listed the five countries from which the U.S. sourced most of its imported cosmetic products for that year.

Before you begin any import transaction involving cosmetics, it’s important to determine whether the items in question will have to meet regulations set by the FDA.

Not every cosmetic product requires approval from the FDA before it can be imported. However, some do.

Cosmetics containing color additives fall under FDA jurisdiction. All color additives used in cosmetics must be approved by the administration prior to importing, and they must be on the list of permitted color additives.

Additionally, all color additives must be used for their intended purpose. For instance, you can’t always use the same additives in lipsticks that you could use in eye shadow. Make sure to consult that list to see if the additives in your imported cosmetics are used in an approved manner.

Many cosmetic products are also considered drugs. If a product is marketed to be able to cure, treat, or prevent any kind of disease or condition, then it is also considered a drug by the FDA.

Some products that fall under this classification are:

If your imported cosmetics are also considered to be drugs, they will need to be approved by the FDA.

Perfumes are also considered cosmetics, but do not require FDA pre-approval for import.

Cosmetics that contain prohibited ingredients, or those that are known to cause health problems, will never receive approval and cannot enter the U.S. legally.

When you fill out paperwork for your imported goods, you will need to know their Harmonized Tariff Schedule (HTS) codes. This allows you to determine the duties that will be due on your shipment once it arrives in the U.S.

General rates of duty for cosmetics usually range from 4.9% to 5.8%. These rates can fluctuate based on factors such as the country of origin. For instance, cosmetics imported from countries with which the U.S. shares a free trade agreement (FTA) won’t incur any duties. This includes Mexico and Canada, two of the top suppliers mentioned earlier in the article.

Most cosmetic goods fall under the HTS heading 3307. You will need to use the appropriate subheading to classify your specific product. For example, personal deodorants and antiperspirants are classified as 3307.20.00.00.

Duty rates can change over time, so it is always best for you to consult the HTS yourself to ensure you get the most accurate, up-to-date information regarding your product.

Working with a customs broker is also a good way of making sure you use the correct code and pay the right amount in duties and taxes. Brokers are experts at classifying shipments, and they deal with importing a variety of different types of products from all over the world.

The most important thing to keep in mind when labeling cosmetics is the correctness of the information on the label. The Federal Food, Drug, and Cosmetic Act of 1938 prohibits deceptive information on labels to ensure the safety of the public.

If statements anywhere on the label can be deemed as misleading, false, unclear, or confusing, then your shipment is likely to be detained at customs. Be sure to verify all statements made on the label to ensure they are clear, correct, and straightforward to prevent any snags in the importing process.

When creating a label for a product, you will need to include:

If your product contains an ingredient that has not yet been adequately tested for safety, then you will need to include a warning as per the Code of Federal Regulations (CFR) section 740.10. This warning must state, “Warning – The safety of this product has not been determined.” Otherwise, the FDA will treat your product as if it has been misbranded.

It is also important to keep in mind that if your product claims to treat or cure disease or mitigate symptoms of a disease, then the FDA will need to verify those statements before you can import said product. Otherwise, it will be deemed misleading.

FDA regulations can be difficult to navigate.

Our Licensed Expert Consultants Are Here to Help.

The FDA is not the administration in charge of regulating organic products; instead, that responsibility falls to the U.S. Department of Agriculture (USDA) and their National Organic Program (NOP).

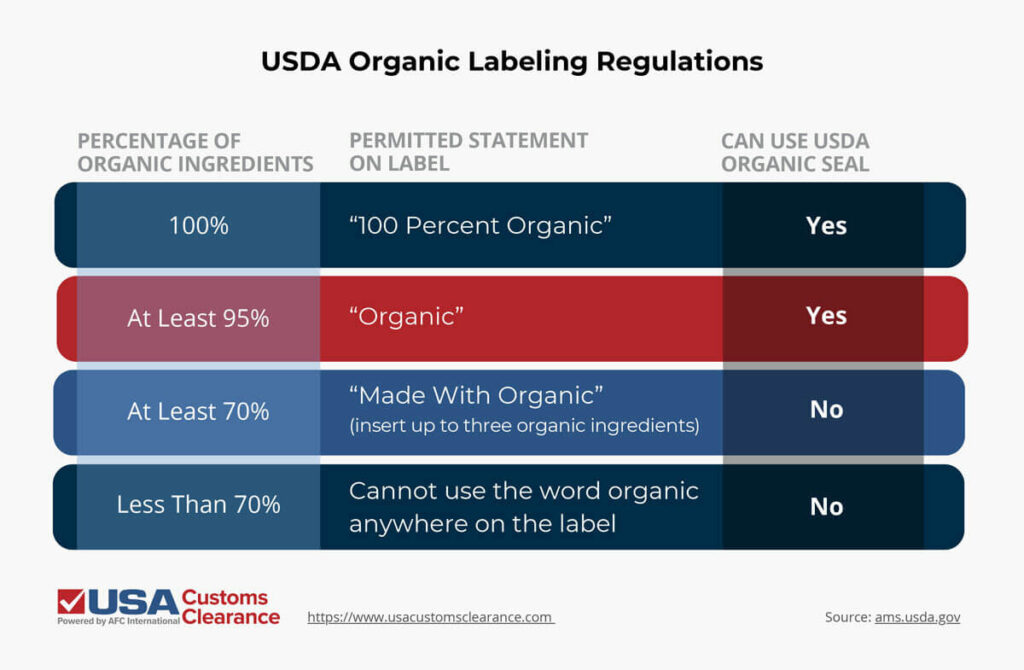

In order for you to include the USDA organic seal on the cosmetic's label, the ingredients must meet the department’s standards for organic ingredients. The finished product must then be certified by a USDA agent.

To be considered organic by the USDA, cosmetic products and ingredients must be produced, handled, and packaged only by USDA-certified facilities. Even if your product doesn’t contain 100% organic ingredients, you might still be able to market your product as organic.

Here are the four organic labeling categories that your product could fit into.

In all of these cases, salt and water may be excluded from the total percentage of ingredients.

There is an exception to organic labeling requirements, but only for producers who bring under $5,000 worth of products to market per year. These goods may be marketed as organic without an agent’s certification as long as they meet organic production and handling requirements. The USDA organic seal may not be used under this circumstance.

Related: Importing Organic Food Into The US: The Definitive Guide

Importing goods from China has gotten increasingly complicated since the implementation of Section 301 tariffs in 2018. These tariffs were imposed in retaliation to unfair trade practices from China. Cosmetics and beauty products can complicate the issue further due to health and safety concerns.

However, importing cosmetic goods from China can still be a lucrative business endeavor. You may have to do extra due diligence in ensuring your goods meet FDA standards (if applicable), but otherwise, the general instructions in this article are applicable to importing Chinese cosmetics as well.

Worried about unexpected fees when your shipment arrives?

Our Licensed Expert Consultants Will Personally Guide You.

In most cases, yes. Any shipment valued at $2,500 or more will require a bond, as will a shipment of any value containing goods which are regulated by a government agency, such as the FDA or USDA.

Related: How to Get a Customs Bond: A Guide for New Importers

At USA Customs Clearance, our brokers can take up full responsibility for your shipment, communicating with customs and handling paperwork on your behalf. Even if you consider yourself an experienced importer, a customs broker can lighten your workload and remove a lot of the stress associated with successfully clearing customs.

Our services include:

Give us a call at (855) 912-0406 or fill out a contact form online. We’ll help you build a strong foundation in importing cosmetics to the U.S.

Copy URL to Clipboard

Copy URL to Clipboard

Hi! What do I need to import functional cosmetic products from South Korea to the USA?

Thank you for this very informative article!

Are labels in English needed when shipping B2C internationally to the US? For example, one bottle of shampoo to a customer in Boston.

Thank you!

Good day,

We are an American cosmetic startup, which is looking for an agent or a firm which helps us legally ship to the USA from Turkey and the UAE: ready organic health supplements and cosmetics in a bulk.

Please let us know about what are first steps required and your services fees from A to Z.

Thanks

Hello!

How and what do I need to import shea butter to the USA

Thank you,

Yvette

Hi Yvette,

One of our customs experts will reach out to you shortly to assist you. We look forward to helping you!