While the commercial and the pro forma invoices might seem similar to one another, they’re unique pieces of paperwork used for different purposes. You’ll need to have a thorough understanding on how they work before you start bringing goods into the country.

Key takeaways

In our guide below, we will discuss further details about each document, their differences, and how important they are for importing.

The pro forma invoice is a document given by an exporter to an importer prior to the purchase of goods or services. It provides a cost estimate on the products and outlines the terms and conditions of the sale.

You can find the following information on a pro forma:

Importers and exporters use the pro forma to negotiate various aspects of the sale before the purchase is finalized. From there, you can figure how much money you need to budget for the products you’ll be purchasing.

A Pro forma might be required under specific circumstances. I’ve listed the potential scenarios when you’ll need the document.

Even if a pro forma invoice isn’t required, it may have information that you’ll need to provide on other import documents. Therefore, it’s best to always obtain this piece of paperwork just in case you need to look back on it.

Pro forma documents are also frequently used by businesses that import products in bulk. If you import goods in large volumes, then you should definitely use this document.

Related: Documents Needed To Import and Export

The commercial invoice tells how much an importer will need to pay after a purchase has been finalized. As a result, the document serves as a sales contract and legally binding agreement between you and the seller.

Like the pro forma, this document will be issued by the exporter of your products. While both pieces of paperwork contain much of the same information, commercial invoices may also include the agreed upon Incoterms® for your shipment.

Commercial invoices are the most commonly used document in international trade and are necessary to accurately account for the value of products entering the U.S.

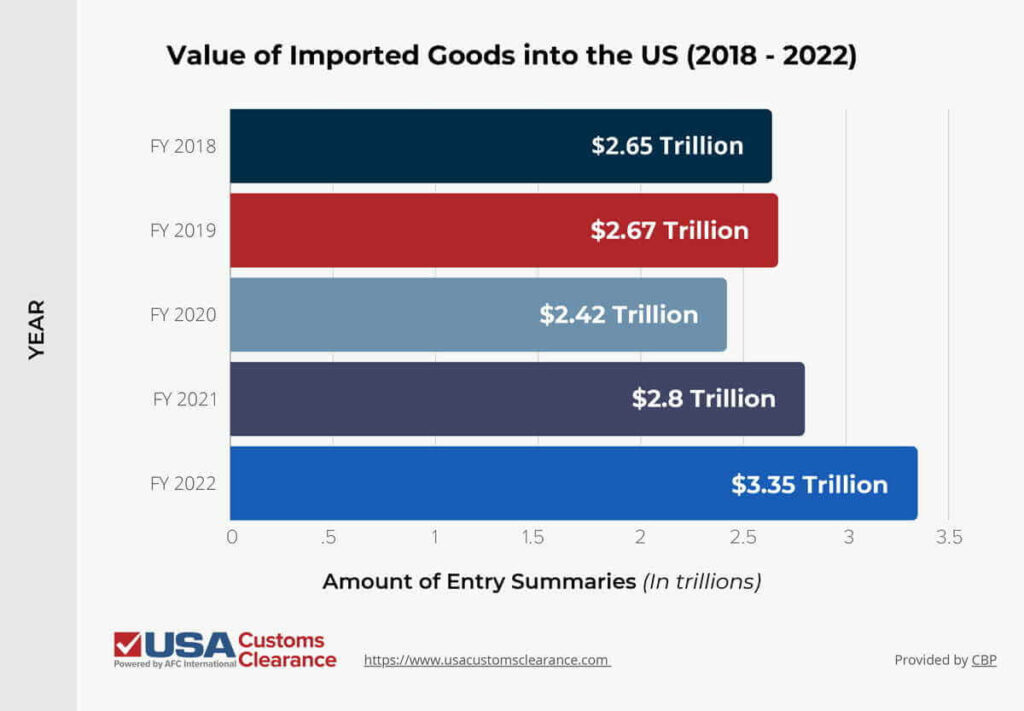

Without standardized commercial invoices, tables like the one here cannot be created and values would be harder to track. This is why each import must be accompanied by a commercial invoice.

You won’t be the only person that uses this document when you bring goods into the country. Commercial invoices are required by various entities involved in the import process.

This includes:

Accurately filling out the commercial invoice is imperative to get your shipment on time and avoid long shipping delays.

Putting inaccurate information could also result with you paying the wrong duty rate. This means that you could be overpaying or underpaying the duty of your import.

Related: Foreign Importer of Record

According to the International Trade Administration (ITA) commercial invoices are always required when importing goods into the United States. The exporter and importer each need to have a copy so that products can be cleared by their respective customs officials.

They’ll also use the commercial invoice to determine and apply the correct duty rates on your imported goods. Importers in particular can use the document for tax and accounting purposes to keep track of their sales revenue.

Commercial invoices will need to be sent to CBP while a physical copy travels with your import. You’ll need to access CBP’s Automated Commercial Environment (ACE) to send the document electronically.

Once inside ACE, you can use the Document Image System (DIS) to submit your commercial invoice and other documents related to your import. They should all be in a PDF, JPEG, or other electronic format.

The exporter of your products will be responsible for including a physical copy of your commercial invoice with the shipment. Any partner government agencies involved may require this document as well.

This includes:

Each of these agencies have their own trade processing systems where you can submit the document electronically. If you are unable to produce a commercial invoice, a pro forma invoice is acceptable by CBP.

Related: The Complete Guide To FDA Customs Clearance

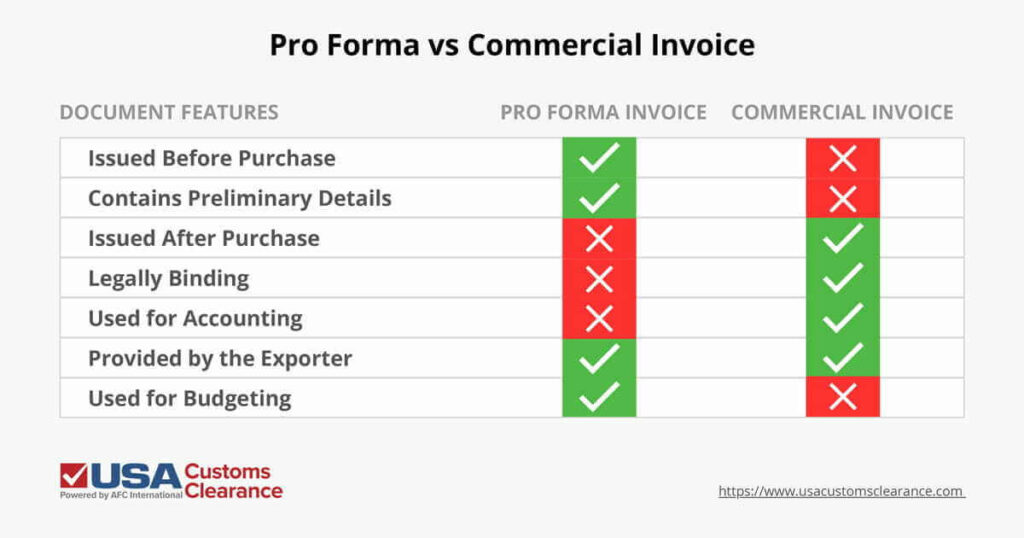

If you’re still struggling to understand how these documents work, then have no fear. I’ve provided a graphic that will help you visualize the variations between a commercial invoice and pro forma.

As the graphic shows, the only feature these documents have in common is that they’re issued by the exporter. It’s important to keep these variations in mind when importing to ensure you don’t misuse either document.

If you’re having trouble figuring which customs documents your import should have, then USA Customs Clearance can help. Our Licensed Customs Brokers and import specialists can assist you with identifying the required paperwork for your goods. They’ll also show you to fill them out and show you where they have to be sent.

We also offer other import services that you can use:

Get the assistance you deserve with USA Customs Clearance. Start with one of our services or call our team at (855) 912-0406 if you’re ready to get started.

We work with you every step of the way to ensure a smooth and stress-free customs experience.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post