Japan has been a top trading partner of the U.S. for many years, supplying goods like vehicles, machinery, and optical and medical instruments. Like every other country, there are duties and tariffs imposed on their goods. So, before you start importing, you’ll need to be familiar with the expenses that come with importing from Japan.

Key takeaways:

I’ll take you through the expenses that you’ll need to be aware of when importing products from Japan.

The U.S. currently has a 25% tariff placed on imports of Japanese products. Both countries have come to an informal deal that would lower tariffs to 15%. However, the deal hasn’t been put into writing, which means it’s not official. If the deal is finally signed, it will ease the financial strain on importers who must pay the tariff.

The duties, taxes, and other fees you’ll have to pay when importing goods from Japan to the U.S. will depend primarily on the value of your products and whether your shipment qualifies as a formal or informal entry.

Products imported from Japan for personal use and valued at $800 or less can be imported duty-free, under most circumstances. This is referred to as the De Minimis value.

Additionally, many personal imports, and shipments valued less than $2,500, may be imported as an informal entry. In these cases, CBP will handle the paperwork on your behalf, including assigning your product’s tariff classification number and duty rate.

If you’re importing commercial freight, or cargo valued at $2,500 or more, you would have to file your shipment as a formal entry. A formal entry is much more likely to incur additional fees, such as customs clearance charges, customs bonds, importer security filing fees, and more.

Duties are taxes imposed on goods that cross international borders. In the U.S., Customs and Border Protection (CBP) is responsible for ensuring these expenses are paid.

If you want to find the duty rate for your products, simply consult an HTS Lookup Tool, or consult with a customs broker.

Some products from Japan can be imported into the U.S. duty free or at a reduced rate. This is signified by the “JP” marking under the assigned tariff rate and is thanks to a trade agreement between Japan and the U.S.

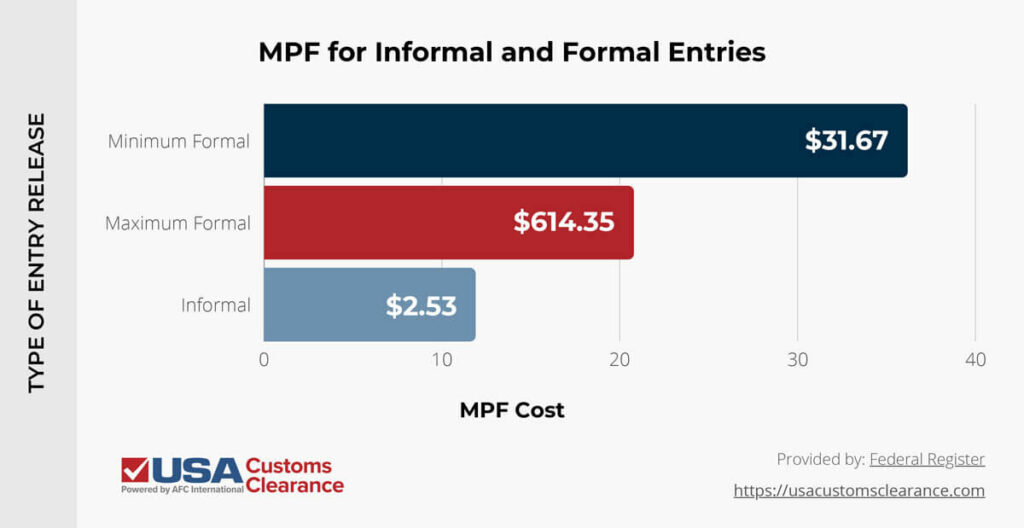

The CBP charges merchandise processing fees (MPF) on most goods that enter the country. It’s important to note there’s a cost difference for MPFs based on the type of entry. Informal entries are typically very cheap, while formal entries have a minimum and maximum charge.

On October 1st, 2023, CBP increased the amount of MPFs for informal and formal releases. I’ve provided the amounts for each one below.

The ad valorem rate for an MPF is 0.3464%. When importing from Japan, you’ll need to factor this extra cost into your budgeting.

A Harbor Maintenance Fee (HMF) will need to be paid if your Japanese products are arriving into the U.S. via vessel. This fee is 0.125% the value of your cargo.

You can avoid the HMF by bringing your Japanese goods into the country via air. However, air transport is exceptionally more expensive than vessel. It’s also not the best option for high volume shipments.

Speaking of modes of transport, you’ll need to pay the associated expenses to move your freight from Japan to a port in the United States.

For most online purchases or small parcel shipments, you’ll likely arrange shipping and transport costs with the purchasing platform’s shipping provider or an international postal service. In either case, your carrier should let you know what charges to expect.

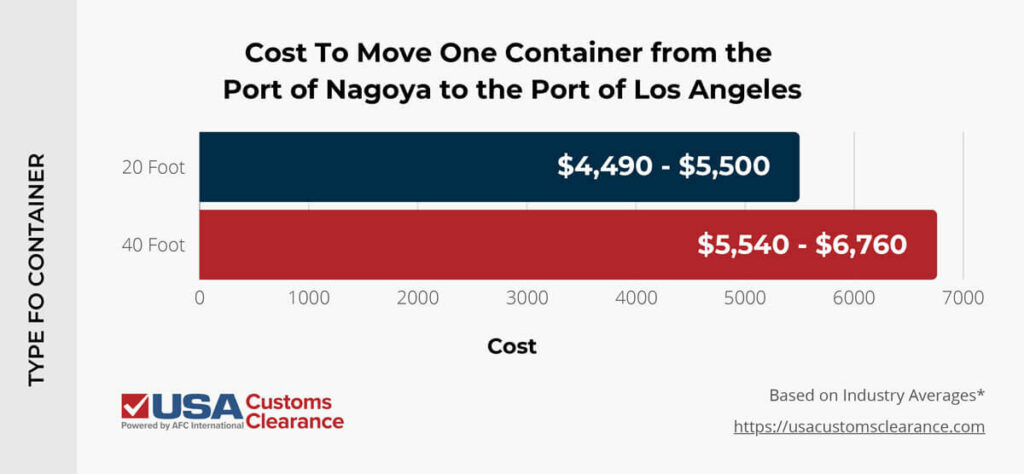

In the case of a larger shipment or palletized cargo, you’ll likely be looking at containerized ocean transport. Containers typically come in 20-foot and 40-foot options.

I’ve included some estimates on how much it will cost to move these types of containers from the Port of Nagoya in Japan to the Port of Los Angeles in California. I chose these ports due to the high amount of volume or cargo they receive and send.

There are two ways you can pay for a container shipment. You can pay for it as a full container load (FCL) or as a less than container load (LCL). If you select FCL, you will pay a flat fee for the entire container.

In the case of LCL, you’ll be able share a small portion of the costs for the container with the other importers using it. The best method ultimately comes down to how much cargo you want to bring into the country.

Notably, cargo arriving via ocean transport will require you to submit an Importer Security Filing and purchase a customs bond. The costs for these items vary, but typically fall between $50 and $500, depending on the customs brokerage you choose and whether they are combined.

Another way of importing from Japan is by international air. The Narita International Airport processes and the Los Angeles International Airport processes the highest volume of freight in Japan and the U.S. respectively.

To move one pallet of air cargo that weighs 4,600lbs between these two airports will cost between $11,350 to $14,210. Despite these extraordinarily high expenses, it will take around 10 hours for your freight to arrive.

Currently, the U.S. doesn’t impose any anti-dumping or countervailing duties on Japanese products. However, there’s a possibility this could change in the future. The U.S. began an anti-dumping investigation in 2023 on melamine from Japan and a few other countries. Melamine is a chemical that’s used in a variety of products.

Their preliminary determinations will be commencing on July 23rd, 2024. If anti-dumping duties are applied to this substance, you can expect a much higher duty rate for this product when importing it from Japan.

Related: Anti-Dumping Duty Rates

Thanks to the U.S. — Japan Trade Agreement (USJTA), certain Japanese goods might have a reduced duty or qualify as duty free. This can save you a considerable amount on your import costs. The agreement applies mostly to agricultural and industrial products. In total, 241 tariff codes are affected.

Some specific products include:

To be eligible for a reduced or eliminated duty rate, you have to follow the rules of origin specified in Annex II of the USJTA. Instead of hunting down the specific requirements yourself, hire one of our Licensed Customs Brokers to help.

Related: Importing Video Games from Japan

While import duties depend on the type of products you’re importing, we can show you how to calculate these costs when importing from Japan or any other country. The steps are as follows:

You can also use our free duty calculator and get your estimate that way!

You’ll follow a similar set of steps when finding out how much you’ll need to pay for the MPF.

The maximum MPF is $614.35, so if your total is higher than that, you will only be charged the maximum.

Calculating the HMF is mostly the same as the duty rate and MPF. The only difference is you’ll be multiplying the total value by 0.125%.

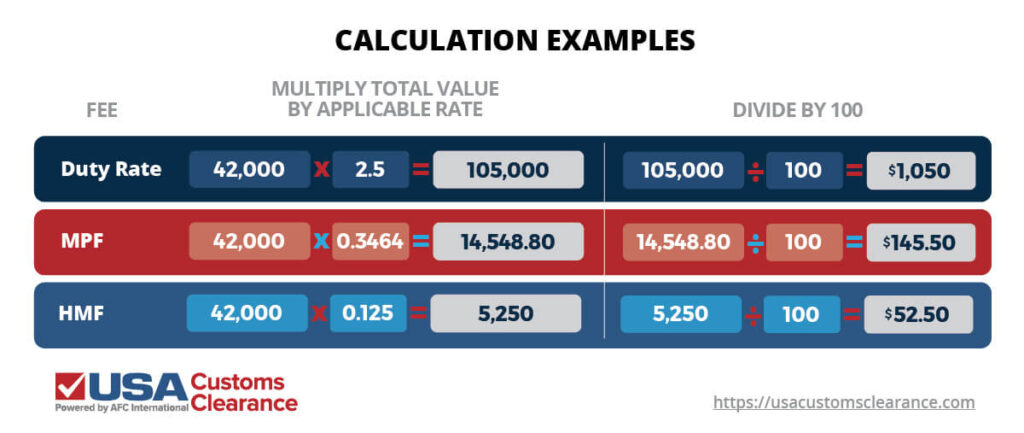

Now that you have an understanding on how import expenses are calculated, I want to give you an example that shows how to perform them using the total value of an import.

For this example, let’s calculate the expenses to import a Japanese SUV with a duty rate of 2.5%. I’ve listed the calculation for each cost.

As you can see, the steps to calculate these expenses are the same. The only major difference is what the total value is multiplied against. For the MPF, I rounded up after dividing by 100. This may or may not be necessary based on the math you’ll be performing.

Regardless of the total value of your Japanese goods, you’ll follow the same steps when figuring out each expense. Afterward, you’ll need to add the transportation costs to move your cargo. This will vary based on which one you choose.

Related: How To Import Cars from Japan To USA

Importing from Japan can be a regulatory nightmare, depending on which products you’re bringing into the country. At USA Customs Clearance, we have a variety of specialists that can provide you with the assistance you need to navigate these hurdles. We also have an array of services you can use to your advantage.

Start importing from Japan with one of our services or contact our team through the site to learn more. Our team members can also be reached over the phone at (855) 912-0406.

Copy URL to Clipboard

Copy URL to Clipboard

I am looking to buy a $300 recording device from Japan. What kinds of fees will I pay?

I'm thinking about buying a used leather motorcycle jacket from Japan, it was originally manufactured here in California in the 1950's, current asking price is $i,400.00, what will I have to pay Customs if I choose to make the purchase?

I am hoping to purchase four short legged rocking chairs (purchase price $2016). I’m told FedEx will only accept these as air shipping vs surface and the cost will be $2980 for shipping. Does that seem plausible? What might I expect to pay on arrival in the U.S. for these chairs?

I am looking to buy a motorcycle helmet for around 750-800usd. What would the costs be to bring it into Wisconsin ,from Japan? Thanks, Mike

I'm looking into buying a camera lens for personal use on eBay for around $500 USD. Will there be any import fees on this?

I'm looking to buy agriculture products from Japan how much will it cost in customs.

I want to buy a preowned handbag that will be for my own personal use. The bag was originally made in Spain and is selling around $1800USD. Will there be a customs tax and if so about how much would it be?

II am considering purchasing an audio amplifier from Japan. Item cost is 14,500 USD. What are the expected costs I would incur for Customs or any other fees.

I WANT TO BUY A RADIO TRANSCEIVER FROM JAPAN FOR $800 WHAT IS THE IMPORT FEE?

hello, if i buy a tube amp worth 400 usd from ebay from japan. do i have to pay custom tax if i ship to california?

I want to purchase off eBay a carved wooden carp the purchase price is $200.00 two hundred dollars. It will be in my apartment. How much would the duty fee be and when would I pay them?

I am interested in buying some used clothes from an online retailer in Japan. They would be for my personal use. Would I have to pay customs duty on them ( under $800)?

I cannot find an answer on any of these pages. Please advise. thank you.

Im looking to purchase a $25k watch from Japan to US - any idea what the import duties would be on that?

Thank you -

Ben

I would like to purchase five (5) golf clubs (irons 6-7-8-9-& wedge) from Japan. Can you give me a general estimate on import fees for these used clubs. The purchase price is $450. Thank you

I’m thinking of buying a used Roland cube amplifier from a seller in Japan. Cost approximately 170.00. Are there custom fees from Japan. If so what % fee would it be?

I want to purchase a Louis Vuitton watch for $882.64 . It is used and I want to purchase it from ebay ( japan) . I don’t know if I have to pay custom duty fees or extra taxes . Please let me know . Also I need to know where I have to pay it ? I have to pay in post office ? Please let me know asap. Thank you

Would there be a customs tax/duties on a Nintendo Switch OLED coming from Japan? And how much would it be?

trying to determine the possible customs duties/taxes on golf clubs costing $225 USD.

thx

I want to buy a 158.00 dollars necklace from eBay . The necklace is being sold from Japan . I need to find out what the import duties , taxes and charges are before I buy it

Can you give me a quote on the custom's tax for a used designer jacket shipping from Japan? the jacket is valued at $2,500 US dollars.

Thank you

Any idea at all about any tariffs on an item called an "usu"? It is for personal use, the cost is $800. It is made of stone and is a traditional way to make a food called mochi. I realize that this is not a commonly imported item, so no worries if there is not a clear answer available.

Are customs or VAT charged if I buy a pre owned Swiss watch from a seller in Japan with a value of around $3000US?

I am thinking of buying a watch from Japan. What costs

would I incur for Customs or any other fees. Thanks!

I have the same question. Did you ever get an answer?

Is there an Affiliate Support Channel to facilitate Import Trade Transactions among individual Clients?

Gary Moodie

GARY’s CARGO HANDLING SERVICE