Overcoming the unique challenges of importing dietary supplements to the United States can seem daunting. If you plan to import such a commodity, you need to be aware of the products, market trends, and regulations involved in the process.

Key Takeaways:

Our guide below provides importers with everything they need to know about importing dietary supplements into the U.S.

Our 45 Minute Customs Consulting Session Will Personally Guide You.

Supplements can be derived from a wide variety of natural sources and be manufactured in diverse forms including pills, teas, gummies, and more.

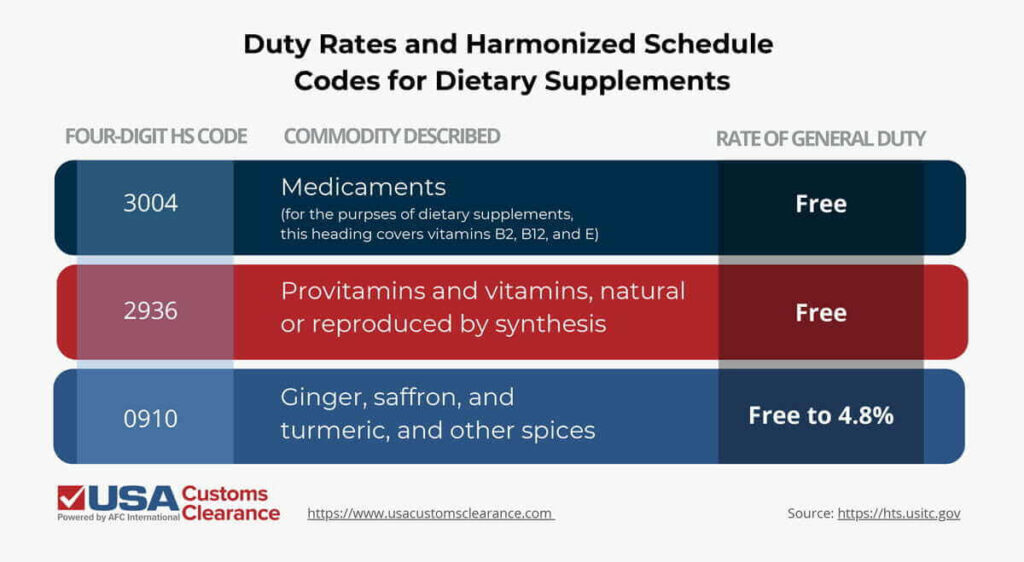

As such, Harmonized Schedule (HS) classifications for these goods are spread out across multiple chapters. I’ve included some of the most common four-digit HS codes for dietary supplements in the table below.

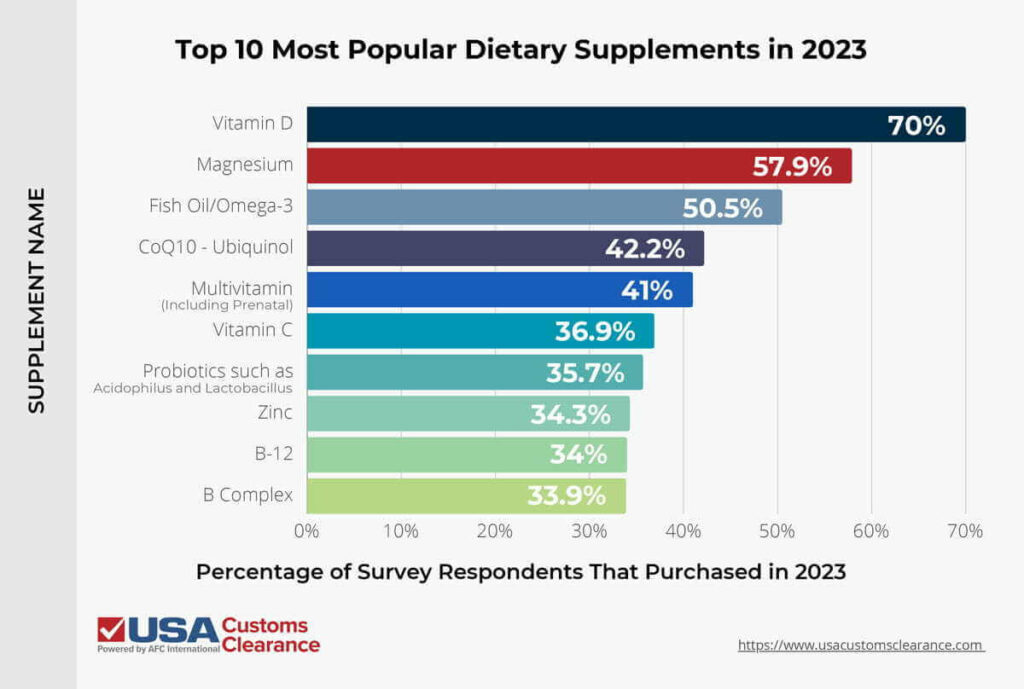

To get an idea of which supplements are most commonly sold in the U.S., we’ll need to drill down a little further into some more specific examples.

Knowing which supplements are in greatest demand is one of the first steps you should take before you begin importing them. The next step is finding a supplier.

While several countries export dietary supplements, importers in the United States sourced these goods from the following countries most often in 2023:

Out of these five countries, Canada arguably offers the best value to U.S. importers due to its proximity and the country’s participation in the United States-Mexico-Canada Agreement (USMCA). However, China still stands tall as an option due to low commodity prices, high availability, and capacity for production.

Given their perceived (and still somewhat accurate) status as a top exporter of goods to the U.S., it’s worth examining the current state of trade relations with China country before deciding to source goods from them.

Section 301 tariffs are specifically levied against many products sourced from China. This is due to the U.S. government’s determination that many businesses in China receive subsidies from their own government to fund manufacturing operations, which reduces their costs to the point that U.S. manufacturers can’t realistically compete.

While these tariffs do impact many Chinese goods, supplements classified under the aforementioned 3004 and 2936 HS codes are not affected as of September 2024, while those under 0910 are subject to an additional 10% duty.

Importers should always check for increased or newly implemented tariffs when importing from China due to the currently volatile trade relationship between the two countries.

Regardless of your choice, your supplier’s goods will need to comply with regulations set by the FDA.

Related: A Guide to China’s Section 301 Tariffs

The FDA doesn’t pre-approve every shipment of dietary supplements that enters the U.S. Instead, the organization establishes and enforces regulations that all manufacturers, importers, and distributors must follow.

The responsibility for meeting FDA guidelines rests with the company that introduces a product to market. When products meet those standards, it may be acceptable to say they have FDA approval.

Companies must ensure that the available information is correct and not misleading. The rules enforced combat fraud, false advertising, and mislabeling.

In much the same way they don’t approve shipments, the FDA doesn’t issue permits either, though there is a registration process for importers and manufacturing facilities.

There is a caveat here that importers should be aware of. If you’re importing raw materials from plants and/or animals to manufacture supplements in the USA, you may need a permit from the USDA’s Animal and Plant Health Inspection Service (APHIS). Otherwise, as long as the supplements have met FDA standards, you’re good to go.

Related: The Complete Guide to FDA Customs Clearance

The FDA has specific regulatory requirements for importers of drugs, including dietary supplements. These exist in conjunction with more generalized rules that apply to all imported goods.

Let’s take a closer look at some of these requirements.

Several documents need to accompany shipments entering the United States, including the following:

Learn more about general import documents in our article, “What Documents Do I Need to Import and Export?”.

These standards are in place to ensure foreign suppliers align their manufacturing practices with those that American manufacturers must follow. GMP acts as further insurance against substandard and potentially dangerous products entering the country.

These practices are laid out in title 21, subchapter B, part 111 of the Federal Code of Regulations. It’s an exhaustive list, but the key takeaways are listed below.

GMP is a cornerstone of the FDA verification program for businesses that export food and pharmaceuticals to the USA.

The FSVP’s goal is to establish accountability for foreign suppliers. Essential requirements include:

Imported dietary supplements are subject to FDA inspection when arriving at any port of entry. The FDA may hold or seize shipments that do not comply with U.S. regulations, such as those that establish labeling requirements. We’ll go over FSVP specific labeling needs in the next sections.

The FDA has strict requirements for medicines of all kinds. The label format should include the following:

The consequences of violating the rules and regulations of the FDA can be crippling to any importer. Violations lead to seizure, detention, or even refusal of admission.

Related: Customs Penalties and Fines

The FSVP requires importers to verify that their supplier analyzes potential risks. The program ensures that FDA standards are in place for cultivating and harvesting certain vegetables and fruits used in dietary supplements.

Color additives used in dietary supplements need to be verified in terms of FDA compliance. These additives need to be pure, and clearly stated on the product’s label.

You can view the FDA’s current list of approved color additives to determine whether your supplement complies with agency standards.

The facility of origin must follow a set of parameters for exporting goods. Manufacturer facilities are mandated to register and maintain FDA standards. Along with these assurances, they must permit the FDA to inspect the facility if needed.

Facilities must renew their registration every other year. If there are any health risk scenarios, the FDA can suspend an active registration. The federal government creates new laws annually, so checking for the latest changes is always essential.

As an importer, it is not your responsibility to register the food facility. They will need to go through the certification process before they can distribute products in the U.S. You can use the FDA’s list of approved facilities to find out if your supplier is already registered.

To register as a manufacturer, the following data is needed:

Ensuring that a food facility is registered with the FDA is critical for importing goods regulated by this agency. The FDA Industry Systems (FIS) was instituted to carry out submissions, including registrations and listings. This service is publicly available 24 hours a day.

Worried about the Strict Regulations?

Our 45 Minute Licensed Expert Consulting Session Will Personally Guide You.

As you can see, the process of importing dietary supplements takes multiple steps. Working with an experienced customs broker will help you avoid significant fines and delays. That’s where we come in.

The licensed customs brokers at USA Customs Clearance have years of experience assisting businesses and individuals like you with every aspect of the importing process. We can ensure that your shipment of supplements is properly documented with all the correct HTS codes and paperwork required by the FDA and CBP.

Our full list of services includes:

Give us a call at (855) 912-0406 or submit a contact form online today. We have the know-how and expertise to supplement your importing business.

Copy URL to Clipboard

Copy URL to Clipboard

Google is changing how it surfaces content. Prioritize our high-quality guides and industry-leading coverage in search results by setting usacustomsclearance.com as a preferred source.

Hello,

I am planning to import dietary supplements form India and I want to ask if the manufacturer require to have FDA approved manufacturing facility ? Also, please send me step by step process to import these supplements.

Hi, I am willing to import dietary supplements from India. As a distributor do I need to mention the manufacturer name and address? How I can avoid that? Also can you please guide us step by step process to import in IS

I am planning to import dietary supplements form Poland/European Union and I want to ask if the manufacturer require to have FDA approved manufacturing facility ? Also, please send me step by step process to import supplements.

My company wants to import Vitamins/ dietary supplements from Bangladesh.

Please advise me step by step process.

Thank you

Ahmed

My company is planning to import dietary supplement from japan, can you guide me step by step what do i need to do and all document i must have. Thank you!

Tina

Hello,

I am planning to import dietary supplements form India and I want to ask if the manufacturer require to have FDA approved manufacturing facility ? Also, please send me step by step process to import these supplements.

Hi there!

My company is planning to import dietery supplements from Norway. How can I start?

Does my supplier need any docu ? Please send me step by step info. Thank you!

yours,

David

What importing veterinary Dietery Supplements (Dogs,Cats)?

Very well written, thank you!