Importers have used bonded warehouses to store goods sourced from foreign countries for centuries, taking advantage of deferred payment of certain import fees. While historically associated with the importation of spirits, modern bonded warehouses benefit importers of all types of goods. If you’re thinking of making bonded storage part of your import strategy, our licensed customs brokers can set you up for success.

Key Takeaways

In this article, I’ll cover the definition of bonded warehousing, the different types available to importers, and the benefits of storing goods in bond.

CBP defines a bonded warehouse as “a building or other secured area in which imported dutiable merchandise may be stored, manipulated, or undergo manufacturing operations without payment of duty for up to five years from the date of importation”.

This differs from a standard, unbonded warehouse chiefly because duties and tariffs would be due at the time of importation rather than as the goods are withdrawn.

The degree to which merchandise can be modified while stored in bond differs from one warehouse class to another. If you’re uncertain whether your goods should be stored in bond, we recommend scheduling consultation time with one of our experienced customs brokers.

Related: How Much Does a Customs Broker Cost? A Benefits Analysis

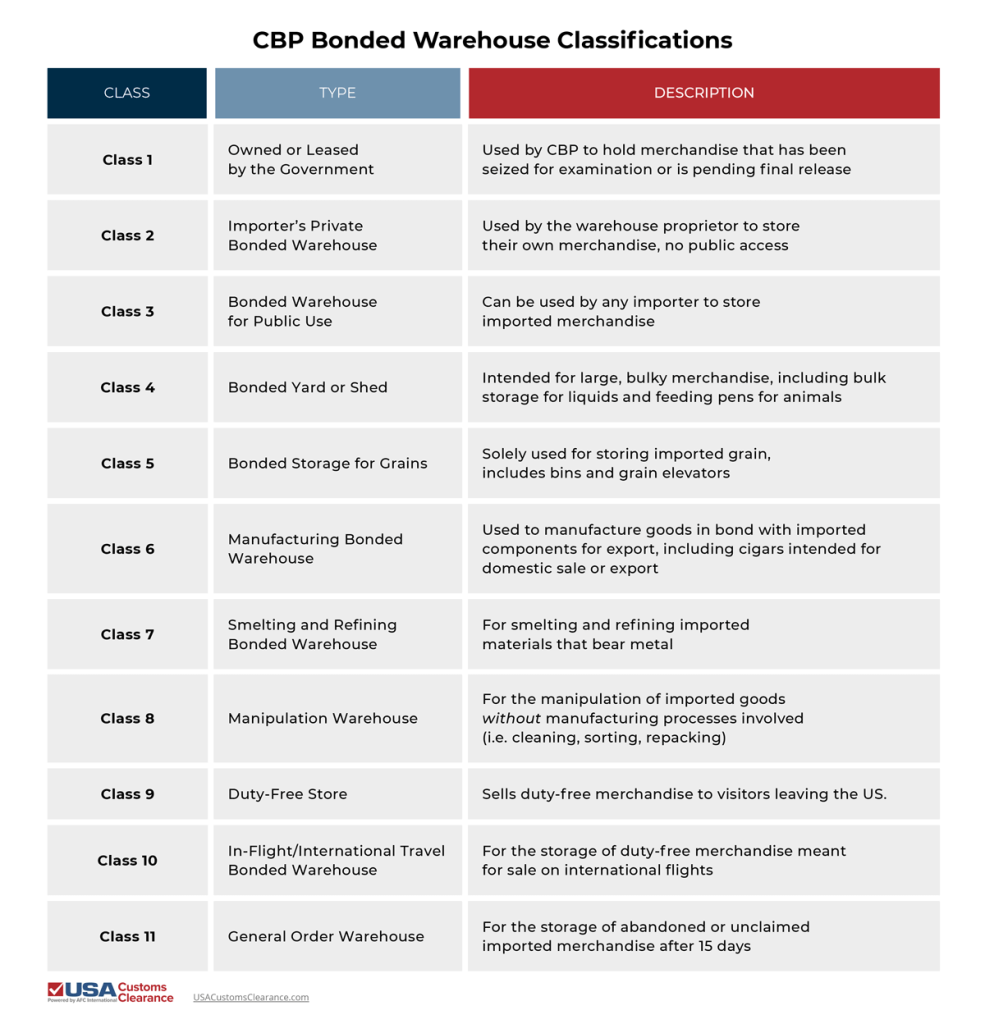

CBP separates different types of bonded warehouses into 11 classes based on factors such as their specific purpose and who owns the location in question.

While importers of all types of goods can store merchandise in a bonded warehouse, there are some goods that are held in bond more frequently than others.

Historically, consumables such as spirits, tea, and tobacco were the most common commodities stored under bond. This practice continues today, but bonded storage isn’t limited to any particular set of commodities.

Instead of focusing on the type of merchandise you choose to import, ask yourself these two questions:

Deferred payment of certain import fees is just one of the advantages bonded warehouses can offer to US shippers.

When you store goods in a bonded warehouse, duties and tariffs aren’t due until you withdraw the items for consumption in the United States. This is arguably the biggest benefit of bonded storage as it gives importers some leeway in when they have to remit these fees to CBP.

Many other benefits of bonded storage are linked to deferred payment of duties. For instance, goods that are heavily regulated by partner government agencies (PGAs) of CBP are often subject to more stringent scrutiny when they arrive in port than common household goods. If such an agency decides that your shipment requires a license or permit for which you haven’t applied, you might have to re-export or have your goods destroyed per CBP orders.

However, storing your goods in a bonded warehouse gives you up to five years to address issues of import permissibility. While your shipment is in bond, you can apply for missing licenses, PGA approvals, and submit or correct missing/incorrectly filled-out documents.

If a PGA does get involved, this application process can sometimes take months to accomplish, but your shipment will remain safely in bond. Assuming you get all of the necessary documents and permissions, you’ll then be able to withdraw your merchandise for consumption without issue.

Savvy importers sometimes use bonded warehousing to try “waiting out” high tariff rates all together. While there is no legal method of avoiding properly assessed duty and tariff payments, deferring those payments via bonded storage can sometimes lead to thousands of dollars saved, especially when economic policies seem to change every other week.

Related: An Importer’s Guide to Partner Government Agencies

To provide a real-world example of how storing your merchandise in a bonded warehouse can ease tariff turmoil, let’s start with one of the most popular commodities in the world: coffee.

One of the United States’ largest suppliers of coffee is Brazil. Between October 2024 and September 2025, Brazil exported over $2 billion worth of coffee to the US. However, coffee importers hit a stumbling block in late July as the White House raised tariffs on goods imported from Brazil to 40% ad valorem. Some importers chose to simply eat the rate increase, while others held their goods in bonded warehouses and waited.

Patience proved to be a virtue in this case. Just a few short months after the tariff rate increased, the president removed tariffs entirely on a number of grocery items, including coffee. Importers who stored their merchandise under bond were able to take advantage of the tariff removal since the fees weren’t owed until withdrawal for consumption. Instead of getting hit with the 40% rate, their coffee incurred no tariffs at all once the new order took effect in November.

You can see that under the right circumstances, bonded warehouses give importers options for deferring and mitigating one of the biggest fees associated with international trade. If you want to get started exploring this option for your business, we can help.

Our licensed customs brokers offer a full suite of services including consultations and customs brokerage, simplifying the complex world of international trade for shippers and importers like you. Reach out today at (855) 912-0406, or fill out a contact form online to find out how partnering with us can elevate your business.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post