Customs bonds are a guarantee that importers will pay applicable duties and taxes for their goods. There are a specific set of requirements you must meet when obtaining one. The slightest misstep can complicate the importing process. Here at USA Customs Clearance, we’ve helped many businesses complete their application to obtain a customs bond. We’ll draw on this experience to explain the requirements you should know.

Key takeaways:

Now that we’ve covered the basics, let’s look at the requirements that come with customs bonds.

There are multiple requirements you’ll need to meet to apply for a customs bond.

This includes:

First, let’s take a look at the information you’ll have to provide for your business:

Your historical import history should also be included if you’ve imported in the past. When obtaining a continuous bond, you’ll need to calculate your projected duties, taxes, and fees for the next 12 months.

Next, you’ll provide information about the items you’re importing:

The surety company or customs broker providing your bond will want you to prove your financial stability. This helps them determine the risk of you defaulting on your financial obligations.

Information that proves the stability of your company includes:

If you have a limited credit history or you’re at higher financial risk, a surety or customs broker might ask you to provide collateral. This can be anything from a cash deposit, to a letter of credit.

Get your continuous bond today and import as many goods as you want in an entire year.

Customs and Border Protection (CBP) require a customs bond in the following circumstances:

A PGA is another federal agency that works closely with CBP to regulate imports. This includes agencies like the Food and Drug Administration (FDA) and the Department of Transportation (DOT).

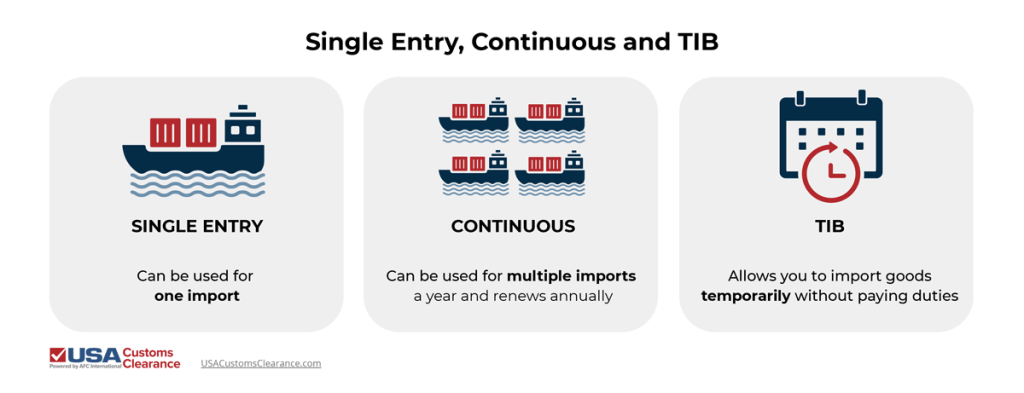

There are a variety of customs bonds that you can use based on the needs of your business. However, there are three in particular that are frequently used by importers in the US. We’ve listed them and laid the requirements for their use in the following graphic.

For single entry bonds, the amount required should be equal to the value of the products in your shipment, plus any import duties levied by CBP. The required amount for a continuous bond is typically 10% of the taxes and tariffs. Starting amounts are usually set at $50,000

A single entry bond is great if your business doesn’t import very often, while a continuous bond is the better option if your business frequently imports goods from other countries.

The TIB is can be used in a variety of situations, such as:

Most TIBs require goods to be destroyed or exported one year after the date of their importation. However, extensions up to three years may be granted by CBP.

Related: Continuous Bond vs Single Entry Bond

When you purchase a customs bond, you’re required by CBP to take one of two routes.

First, you’ll need to purchase your bond from a surety company that’s licensed by the US Treasury Department. The second is to purchase one from a licensed customs broker.

Typically, large and established companies go to a surety. Smaller companies or individuals that import use a licensed customs broker. The added benefit of using a broker is they can help you through the customs clearance process and monitor your import activity for potential increases needed for your bond.

Any other method of obtaining your customs bond is strictly forbidden by CBP.

Here at USA Customs Clearance, we provide continuous customs bonds for all our customers. With this important electronic form, you’ll be able to import any number of imports for an entire year. We also offer a variety of other import services like consulting sessions with Licensed Customs Brokers.

If you’re ready to get the importing services that you need, then give our team a call today at (855) 912-0406. You can also reach us through our contact page.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post