Did you know you can get a refund for fees paid on imported goods that you export or destroy? You can reclaim these costs with a duty drawback. Here’s what you need to know before you file one.

Key Takeaways:

We’ll explain these points further so you’ll know exactly what to do if your goods qualify for a customs duty drawback claim.

A customs duty drawback is a refund of tariffs, fees, and other taxes levied on goods that are later exported or destroyed. This allows you to recover up to 99% of the tax expenses you paid to import your products.

Both importers, exporters, and manufacturers can take advantage of duty drawback. You can also file different types of duty drawback depending on your specific needs. We’ll discuss these in the following section.

Related: A Guide to U.S. Import Taxes

There are numerous programs you can choose from when you file a duty drawback. Rather than go over all of them, we’ve listed the most common drawbacks.

If these duty drawback programs don’t seem applicable to your unique situation, then reach out to one of our Licensed Customs Brokers. They’ll help you identify the right one for your goods.

Meet with one of our Licensed Customs Brokers to discuss the intricacies of duty drawback and claim your refund today!

All drawbacks must be filed electronically through the Automated Broker Interface (ABI). There are three methods that Customs and Border Protection (CBP) will allow you to use when submitting your claim.

If you plan to file a drawback claim, make sure you submit it within five years of the date you imported your goods. You’ll also have to maintain accurate documentation and records of your products.

Not all imports qualify for duty drawback. For example, goods subject to Section 232 tariffs on steel and aluminum are ineligible. Due to International Emergency Economic Powers Act (IEEPA) fentanyl tariffs, imports from Mexico, Canada, and China are also disallowed from drawback as well.

You can avoid IEEPA tariffs if your imports from Mexico or Canada are compliant with the United States-Mexico-Canada Agreement (USMCA). However, duty drawback refunds are considerably reduced for USMCA compliant goods.

Finally, importers cannot claim duty drawback for goods subject to antidumping or countervailing duties.

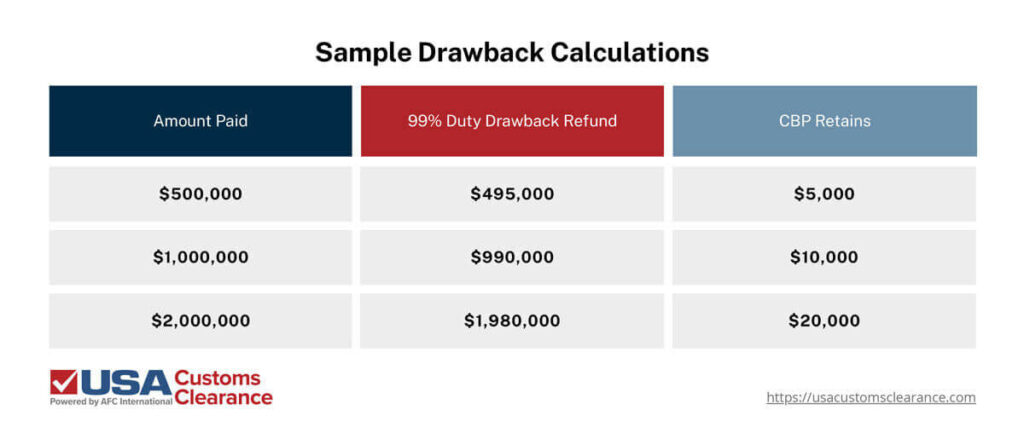

Unless there are extenuating circumstances, you can earn up to 99% of previously paid duties, taxes, and fees on imports you’ve destroyed or exported. We’ve provided a graphic with hypothetical duty drawbacks to show you how your refund will be calculated.

While a 99% refund is the norm for duty drawbacks, CBP will make the final determination on the amount you’re entitled to receive. Realize there may be other limits in place based on what the items are or where they come from.

One of our licensed customs brokers can help with these estimates during a consulting session.

Filing a customs duty drawback claim can be difficult to do alone. Here at USA Customs Clearance, we have licensed customs brokers and import specialists that can help you file one. They can also determine which drawback program is the appropriate one for your goods. In addition to this support, we can provide a multitude of other services.

Don’t put off your refund any longer. Start using USA Customs Clearance’s services today and get your money back. You can also call our team at (855) 912-0406 or reach out to use on our contact page.

Copy URL to Clipboard

Copy URL to Clipboard

I was wondering if this is something my company could take advantage of and recoup some tariffs. We import furniture from China into the US. it sits in our warehouse, but then we ship quite a bit across theborder to Canada to our end user customers.

We also, have scrapped some material over the year(s).

My name is Chris O'Dowd

number is 713-705-2865

and email is codowd@seidal.com