Importers and exporters use various documents in their international transactions. Customs officials will review their paperwork to ensure compliance with regulatory laws.

Key takeaways:

We’re going to use our decades of customs experience to inform you about the documents you’ll need.

Documents used in international trade contain important information that is necessary for buyers, sellers, customs authorities, and carriers. Failure to include the proper documentation with your imports and exports can result in fines and even seizure of your goods by customs officials in the U.S. and abroad.

When you start exporting and importing, you’ll find that specific documents will be needed for certain products. That is why it's essential to research your goods before purchasing them or shipping them to another country.

Related: The Complete Beginners Guide to Importing and Exporting

While importers and exporters use many of the same documents, how they use them is different. We’ll explain each type of paperwork and how both parties will put them to use.

The first document you should be familiar with is the pro forma invoice. This is issued when a seller and a potential buyer are negotiating terms. The pro forma invoice gives your potential buyer a quote for a shipment of goods.

Other pieces of information that can be found on a pro forma invoice are:

Since a pro forma invoice is technically an estimate, it’s not legally binding. You should send a pro forma invoice to a customer when they’ve committed to buying, but still need to work out some details of the purchase with you.

When the details have been settled, you will send a slightly altered document called the commercial invoice.

Unlike the pro forma invoice, the commercial invoice is a legally binding document. The commercial invoice lists information about the seller of the goods and the shipment. Once the goods reach the buyer, the commercial invoice can be used to inspect the cargo.

This document is used by the government to further assess customs duties and ensure that all the information is accurate. A government in another country can request that the commercial invoice be written in a specific language and request multiple copies.

If you’re importing, Customs and Border Protection (CBP) will want you to submit a commercial invoice for your goods. However, CBP will accept a pro forma invoice if this document is unavailable. While most federal agencies in the U.S. don’t require a commercial invoice for exports to leave the country, you should still provide one.

The document is legally binding and the custom’s officials in your buyer’s country will use it to determine duties and taxes.

Packing lists essentially provide a list of goods inside the package(s) being shipped. This document doesn’t have a specific formatting style, which means you can use a layout of your choosing if you’re the exporter.

That said, you should be including the following information in drafting a packing list:

Packing lists aren’t required by the CBP, but they do recommend using the document if it’s appropriate for the goods you’re sending. It can also give Licensed Customs Brokers helpful information about your import.

When exporting, you’ll need this document if you’re using a freight forwarder. Banks may also require the document to pay for your goods. Finally, customs officials in the destination country might use the document when checking over the contents of the shipment.

Typically, certificates of conformity are required by some countries if specific types of manufactured goods are entering. The certificate indicates that a product meets all standards of both the country of origin and the country it’s being imported to.

Usually, an importer will ask the exporter for a certificate of conformity in such cases. It falls on the exporter to ensure that the goods are tested and meet the safety standards outlined by the certificate of conformity.

Certain imported commodities will need a CO for entry into the country. For example, the EPA requires a CO when an imported vehicle is introduced into U.S. commerce. Customs officials in a foreign country may also require this document, or its local equivalent, as well.

Related: How To Get An Import/Export Licenses

You will need to submit an entry document to the CBP when you import. There are multiple documents CBP will accept based on your unique situation.

To use the document you’ll need, there are a few conditions you’ll have to meet.

Be sure to carefully review each form’s requirements before using. Doing so will ensure duty-free treatment and prevent delays for your cargo.

Bills of Lading (BoL) are essential documents that are required for all imports and exports. They can come in different varieties based on the mode of transport used to bring your goods into the country.

The ocean BoL is used for imports traveling on a vessel. Importers will need to sign off on this document once their goods arrive. If the goods haven’t been officially sold when they reach the importer, the BoL becomes a blank endorsement and is considered negotiable.

An inland BoL is used for shipments transported by rail, truck, or even inland waterway. It’s typically used before a shipment is transported outside the country via air or ocean. The inland BoL isn’t consigned to the importer. It’s typically handed over to the international carrier.

However, it could pass onto other third parties before the shipment is given to a transportation provider, including a:

Air waybills are for imports carried by plane. These BoLs are non-negotiable, which means the shipments can only be given to the person named on the document.

The International Transport Association (IATA) is responsible for making and distributing air waybills. There are two distinct kinds that can be used.

They’re essentially the same, except the neutral variant doesn’t have the carrier’s information pre-filled.

Regardless of which one you use, all BoLs serve as a contract between the shipper and transportation company, and as a receipt for the shipment. Each type of BoL includes much of the same information.

A unique feature of air waybills are the three-letter origin airport code and a three-letter destination airport code that has to be filled in.

Related: 5 Common Mistakes Made By New Importers

We work with you every step of the way to ensure a smooth and stress-free customs experience.

Insurance is an extremely important form of protection to obtain when you import and export. There are many dangers that can negatively impact a shipment. Having insurance when importing will ensure you’re financially protected.

You can prove you have insurance on your shipment using a certificate or some other applicable paperwork from your insurance provider. If the seller you purchased the goods from is going to offer insurance, they can provide you with documentation.

A certificate of insurance is required if you’re exporting and are responsible for providing coverage for the shipment. This document will communicate to the recipient of the goods that you’ll pay for all damages or total loss of the goods.

Related: Import Export Insurance.

When it comes to importing, CBP serves as the main administrative agency and in most cases, does not require you to have a license to import in general. However, one may be required by other federal agencies if you import goods that they regulate.

Partner Government Agencies (PGAs) frequently requiring specific licenses include:

If you’re planning on exporting, you’ll need to be familiar with the Bureau of Industry and Security (BIS) which is responsible for overseeing exported goods. That includes administering the Export Administration Regulations (EAR).

Export licensing is required if the goods you’re importing are under the U.S. Department of Commerce’s jurisdiction and listed in the EAR’s Commerce Control List (CCL).

Factors that place items on the CCL include :

Other government agencies that might require export licenses include the:.

Thoroughly researching your import or export will help you determine if there are any licensing requirements for your shipment.

Customs bonds will be required if your import is worth $2,500 or more or regulated by a PGA. There are two different customs bonds available.

Completing a customs bond yourself can be pretty challenging. You save yourself unnecessary stress by hiring a customs broker to help you out.

If you need to obtain a customs bond, visit our customs bond page or speak to our team of experts. Unlike some of the other documents we’ve discussed, a customs bond will only be necessary if you’re importing.

A certificate of origin (COO) isn’t necessary for every imported shipment. Importers mainly use COO’s when they’re applying for preferential tariff treatment under a Free Trade Agreement (FTA). The U.S. is currently a part of 14 FTAs with 20 different countries.

Most FTAs require importers to prove their goods originated in the country they’re importing from to be eligible for a reduced or eliminated duty rate. A COO will help you prove the legitimacy of these goods and lower your importing costs.

Exporters may also need a COO for their shipments. When sending goods to another country, you’ll need to provide one of two different types of COO’s.

A generic COO is required by foreign customs to verify the authenticity of the products. US-made goods often demand higher prices overseas, so proof of origin is important to sellers. However, this variant of the document will not grant preferential tariff treatment.

For that, you will need the second type of COO, designed for preferential tariff recognition, geared specifically for the nation you are exporting to.

You can find out which version of this document you need by researching the country your goods will arrive in, or by discussing the requirements with your buyer.

Whether you're an importer, exporter or both, having the proper documents needed to ship your goods is crucial. For one, your goods will have to clear customs when arriving into a country. Having the proper documentation will prevent any mishaps like fines or seizure of your goods.

Getting your goods past export authorities is just as important. Between meeting U.S. federal agency demands and foreign customs requirements, having a very clear paper trail makes transactions easier to manage.

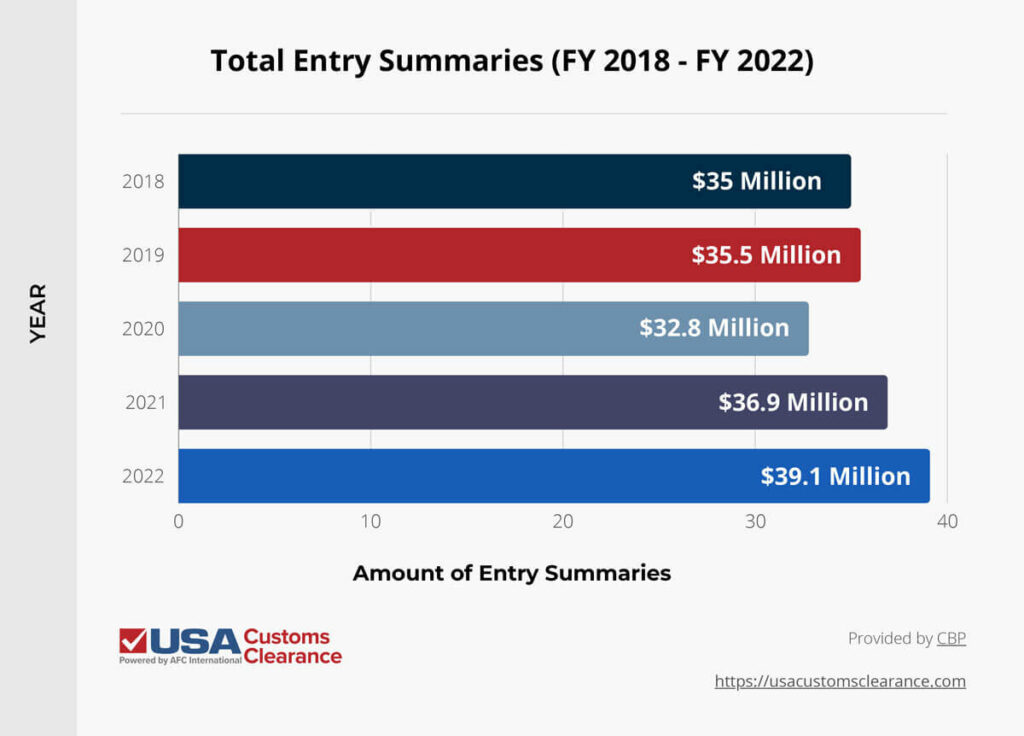

To show you how frequently import documents are used, take a look at how many entry summaries were processed by CBP between 2018 and 2022.

With each entry summary, import documents are submitted to the CBP. This data doesn’t account for the extremely high volume of exports going to other countries.

Import and export documents also help the shipping process go smoother. Providing all information about the goods being shipped helps establish transparency between the importer and exporter. This is especially helpful since face-to-face interactions are rare in the world of international trade.

Filling out import and export documents is a pretty straightforward process. Most documents will have empty fields where you fill out all necessary information. Some documents can be completed online, while others have to be sent in physical form.

The process of filling export and import documents can be very time-consuming because of the specific nature of the information. A great alternative is getting a customs broker to do it for you. A customs broker knows all relevant documentation needed for imports and exports and can fill out and submit all the paperwork for you.

Related: Importing from China

Finding and filling out the documents you need for importing can be hard to do. There’s a large amount of information that you’ll have to remember and report accurately on your paperwork. Instead of doing it alone, USA Customs Clearance can help you find the documents you require and show you how to fill them out correctly.

You can also take advantage of our other services:

At USA Customs Clearance, your importing success is our priority. Contact us through the site to get set up with the service you require. Our team is also available at (855) 912-0406 if you’d prefer to speak to us over the phone.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Copy URL to Clipboard

Copy URL to Clipboard

An auto was imported from Turkey to Florida. It was purchased by a friend and shipped cargo ship. The car I am told has my name, address, DL# assigned to it as me being owner. What is the process of getting legal registration and license plates, insurance?

I am told Title will be mailed to me. I fear I am getting scammed.

What govt entity do I contact about Title on car?

I want to understand this with examples.

Proper formats of these papers.

Explain this through short examples with proper working inside the formats.

Thanks

Would want to know more about international shipping, exports and imports documentation, etc.