In the United States, import/export business owners can purchase and resell almost anything they want on the domestic or international marketplace.

Almost anything.

If you’ve ever tried to export something only to find out you need a special license or permit first, you’ve already gotten a small taste of export controls. These rules are in place to ensure that only qualified individuals or business entities export and receive certain potentially dangerous goods from the US. However, importers must be mindful of them too, in addition to controls imposed by other countries on their own exports.

Key Takeaways

In this guide, I’ll review the basics of export controls, the most common controls the US uses on certain goods, and notable control efforts from foreign trade partners with whom you may do business.

Our 45 Minute Licensed Expert Consulting Will Personally Guide You.

Export controls are strict regulations placed on items with military or potential military – AKA dual-use – applications. These regulations are intended to limit who can export, re-export, and transfer these goods to vetted and qualified businesses, research labs, foreign governments, and other appropriate entities.

If you run an import/export business, particularly one where assembly takes place in multiple countries, you might discover that some of your goods are governed by these regulations. To help you recognize when this might be the case, I’ll start by going over two prevalent export controls used by the US government.

The following two export control regulations are mandated by US government agencies and may impact importers who bring goods into the country with the intention to re-export them later.

Export Administration Regulations (EAR): Administered by the U.S. Department of Commerce (DOC) via the Bureau of Industry and Security, EAR governs the aforementioned dual use items. These items are assigned an Export Control Classification Number (ECCN), which must be included in all relevant documentation.

International Traffic in Arms Regulations (ITAR): These regulations are set and enforced by the U.S. Department of State (DOS) through the Directorate of Defense Trade Controls (DDTC). ITAR governs the exportation of defense-related items.

In both cases, importers will need to apply for an export license to send these goods to other entities. The application portals for these licenses are:

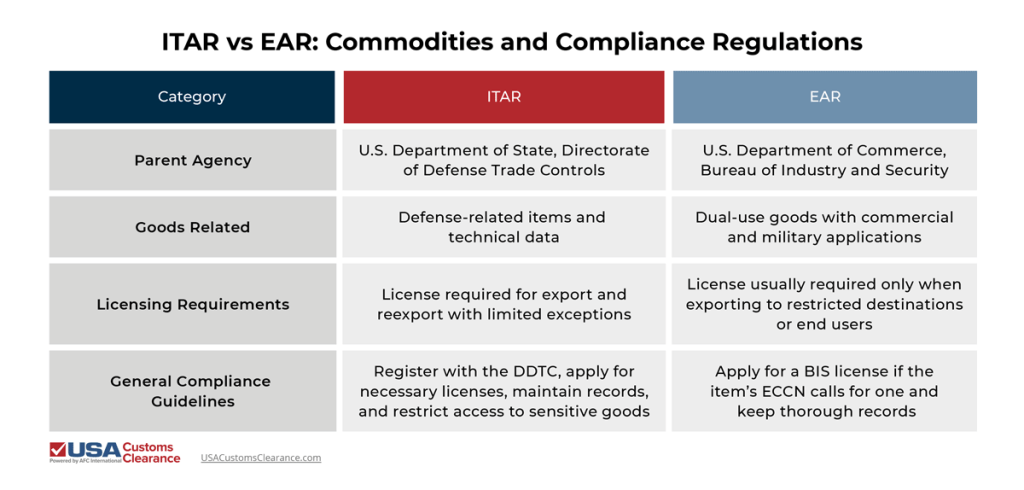

For further clarification between these two regulations, I’ve assembled the following comparison table for ease of reference.

Given the sensitive and potentially dangerous nature of these goods, there are significant penalties in place for those who try to deal in these goods without proper licensure. Everything from fines to imprisonment is on the table, so if you plan to make any of these goods part of your business dealings, make sure you get any necessary licenses first.

Related: How to Get an Import/Export License: A Quick and Easy Guide

The US isn’t the only country that exercises export controls for matters of security and political maneuvering. A notable example is China’s treatment of its enviable rare earth supplies.

During the 2025 trade war, one of China’s most common retaliatory tactics against US tariffs involved tightening export controls on rare earth minerals, which are instrumental to the manufacturing of everything from the phone in your pocket to the car you drive.

The deal reached between China and the US in early November involved a tariff reduction on goods imported from China on our side, with China once again relaxing export controls on rare earth minerals.

How This Affects Importers: Even with the trade deal reached between the US and China on November 1, 2025, importers of rare earth minerals should be prepared for the possibility that China will use this export control tactic for leverage in future negotiations.

Another trading partner in Asia with noteworthy export controls is Japan. Their Ministry of Economy, Trade, and Industry (METI) exerts export control authority through the Foreign Exchange and Foreign Trade Act (FEFTA). Some changes that went into effect on October 9, 2025 can have a significant impact on US businesses.

For instance, Japan has a dual-use categorization similar to our own, but it’s now divided into two subcategories: core goods and catch-all goods. The practical upshot of this recategorization was to establish stricter rules on certain dual-use exports, which now require Japanese exporters to confirm the intended end use of the goods in question.

Those exporters need a special license to deal with dual-use goods, and customs officials in Japan tend to scrutinize these shipments more so than in the past to support the updates to FEFTA.

How This Affects Importers: If you have routinely ordered dual-use items from Japan in the past and now find that the process has become slower or more difficult, this is probably a contributing factor. You should contact your Japanese suppliers to find out how these changes are impacting their business and what they’re doing to maintain compliance with their country’s export controls.

In the United States, goods such as those I just mentioned that require a license for exportation are sometimes referred to as deemed exports.

Related: Importing Computer Parts From China

The BIS uses the informal term “deemed export” to describe goods that require an export license from the bureau for purposes of international trade. The term is used because such exports are “deemed” to be an export to the recipient’s country.

Examples of businesses and other entities that often deal with these goods include:

While there are some exceptions to the deemed export licensure rule for protected individuals and US citizens, goods regulated under ITAR will require a license almost 100% of the time due to their strict defense applications.

If your business model involves temporarily importing goods designated as deemed exports for modification or repair prior to reexportation, you might wonder if a license is still necessary.

The answer to this question once again depends on if the goods you plan to export or reexport fall under EAR or ITAR regulations

If you’re not sure whether you’ll need any special licenses to import and export your shipment of goods, we’re here to help.

Given the wide scope of items with dual-use applications, it’s not uncommon for import/export business owners to encounter roadblocks when dealing with these items.

To get expert assistance with questions about export controls, deemed exports, and situations where you’ll need a license to import goods, call us today at (855) 912-0406 or fill out a contact form online.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post