Becoming an importer of record (IOR) is essential if you want to bring products into the country. However, there are numerous steps you’ll need to complete. As a new importer, you might find them difficult to grasp. To make matters worse, the slightest mistake can lead to severe penalties. That’s why we’re going to guide you through each step so you’ll know what to do.

Key takeaways:

We’re going to break these points down further to provide you with the guidance you need to become an IOR.

An importer of record is an individual or entity that’s registered with Customs and Border Protection (CBP) and is responsible for the entry of merchandise into the country.

Responsibilities of the IOR include:

While the importer of record is typically the individual or entity that purchased the goods, other parties can also fill the role.

This includes:

Regardless of who can become an IOR, each entity will have to follow the same procedures to gain IOR status.

Related: Importer of Record (IOR)

Becoming an importer of record is a pretty involved process. In the following section, we’ll break down the steps that you’ll need to complete.

Your first step is to obtain an Employer Identification Number (EIN). The EIN is assigned by the Internal Revenue Service (IRS) and they’re used by other government agencies to identify businesses.

CBP uses the EIN to accurately identify IORs when processing shipments that enter the country. The EIN is also essential for obtaining and submitting other documents like customs bonds and importer security filings (ISF).

If you’re importing as an individual, rather than a business, then you’ll need to use your Social Security Number (SSN). For non-resident importers, you’ll need to use a Customs Assigned Importer Number (CAIN).

Next, you’ll need to register as an importer with CBP by filling out a CBP form 5106. This document collects a variety of information about importers. The information on this document is used to identify the importer within CBP’s systems.

CBP also uses the information to track the importing history of a business and ensures they’re following all applicable laws. If you’ve already registered with CBP, but your importer information has changed, you’ll need to submit another CBP form 5106 with new details about yourself and your business.

Get your buisness registered with CBP with a few quick steps.

Your third step is to secure a customs bond for your import. This document is essential if your import has a value of $2,500 or if your goods are regulated by partner government agencies (PGAs).

A customs bond is also required for goods that are subject to trade remedies, such as:

You can choose between one of two bonds: a single entry or continuous bond. As the name implies, single entry bonds are valid for one import.

A continuous bond can be used repeatedly for any number of imports. It will automatically renew on the anniversary date they were purchased. However, you can cancel them at any time if you no longer require one.

Use your continuous bond to import any number of goods for an entire year.

When the anniversary date comes, it'll renew atuomatically!

As an IOR, you’ll need to set up an Automated Commercial Environment (ACE) account. ACE is CBP’s electronic trade processing system used for reporting imports and exports. You’ll use it to submit a variety of documentation, such as the CBP Form 5106. An ACE account will also help you with other importing responsibilities receiving refunds from CBP.

There are numerous benefits of being the IOR that you’ll be able to enjoy. For one, you’ll have more control over the importing process. You can choose your carrier and supplier, manage your documents how you see fit, and oversee customs filing.

If you want to hire a customs broker, which is highly recommended by CBP, you’ll have the ability to select the one that’s best for your business.

In addition to increased control over the import process, you’ll be able to negotiate better rates from your carriers and with other entities in the supply chain. The more you work with these parties, the more likely you’ll be able to negotiate better prices for yourself in the future.

While being the importer of record can be beneficial, it does pose a variety of challenges. Completing all the regulations that come with customs clearance is often overwhelming for importers. The slightest mistake can lead to the issuance of trade penalties from CBP.

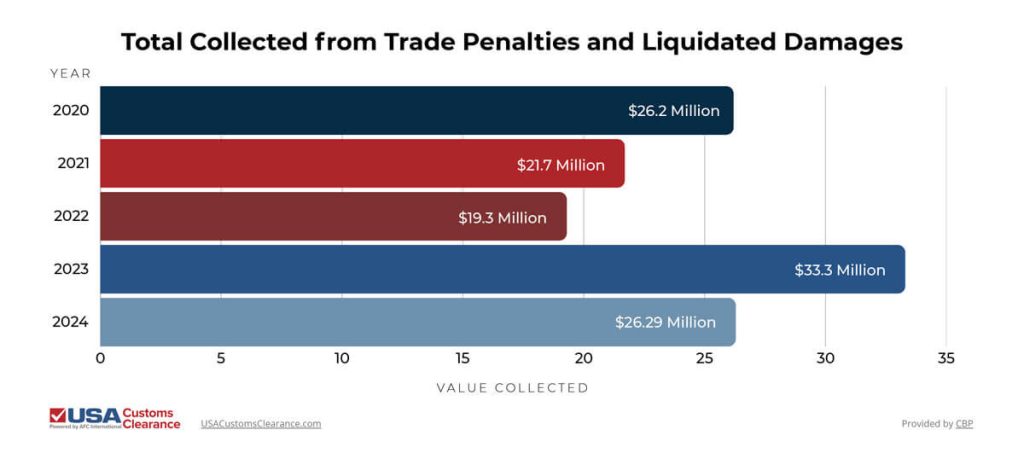

To show how seriously CBP takes trade violations, we’ve included some data showing their collection of trade penalties and liquidated damages over the past five years.

A customs broker can help you avoid being one of the unlucky importers that receives a fine from CBP. They have both the experience and resources to make the importing process much easier for you.

Here are a few ways they can help:

While hiring a customs broker is an additional expense, their services are much cheaper than the fines you could face from CBP.

Related: Do I Need A Customs Broker

Here at USA Customs Clearance, we have a team of experienced customs brokers and import professionals that are ready to offer their assistance. We’re licensed in all 50 states, which lets us manage imports arriving at any port of entry in the USs.

You can also choose from an assortment of services and products that will help you during your importing endeavors. This includes anything from consulting to IOR registration. If you’re ready to get importing help, then call our team at (855) 912-0406 or navigate to our contact page.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post