Cleaning products account for nearly $2.5 billion in U.S. imports annually, but require navigating a complex web of regulations when entering them into the country. Whether you’re looking to import household cleaners or industrial-strength solutions, understanding the necessary steps is crucial to avoid costly delays and penalties.

Key Takeaways:

This guide will walk you through everything you need to know, including key regulatory requirements and how to classify your products.

The U.S. government enforces strict regulations to ensure the safety of cleaning supplies for consumers and the environment. These regulations are governed by several federal agencies, each with its own requirements.

The EPA regulates the majority of sanitizing products that enter the U.S. market due to the fact that many contain chemicals and are used for antimicrobial purposes.

To start, the Toxic Substances Control Act (TSCA) governs the regulation of chemicals used in cleaning products. All chemicals must be listed on the TSCA Inventory before entering the U.S. market. If a product contains a new chemical, a Premanufacture Notice (PMN) must be filed with the EPA before importation.

Related: Importing Chemicals Into The US: TSCA Compliance and More

Additionally, the EPA classifies products that kill viruses and bacteria on surfaces as antimicrobial pesticides. As a result, these products need to comply with the Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA) when they contain antimicrobial agents, such as disinfectants or sanitizers.

Most general cleaning products that do not make claims about disinfecting or killing germs are not regulated by FIFRA. However, if a product advertises that it can sanitize, disinfect, or kill bacteria and viruses, it is considered a pesticidal product. These products must go through EPA registration to ensure they are effective and safe for both the environment and human health.

To stay compliant:

It’s also important to know that disinfectants with specific uses for COVID-19 have been added to List N, a list of disinfectants which must be registered with the EPA before they can be imported or distributed in the US..

This list contains many popular disinfectants, including:

You can use the EPA’s tool to determine whether or not your product falls under this list.

The CPSC oversees the safety of household cleaners to ensure that they do not pose risks to consumers.

Cleaning products that contain hazardous chemicals, such as strong acids or flammable substances, fall under the Federal Hazardous Substances Act (FHSA). This law requires specific labeling and safety measures to protect consumers from potential harm.

Products that are toxic, corrosive, or pose any other type of hazard must have clear labeling to inform users of the risks. This includes warnings such as “poison,” “flammable,” or “corrosive,” depending on the product's chemical composition. The labels must also provide instructions on safe use, first-aid measures, and proper storage and disposal.

To stay compliant with CPSC regulations:

Failing to comply with CPSC regulations can lead to product recalls, fines, or even the detention of your shipments. It’s important to verify that your merchandise is properly labeled and safe for consumer use before importing them into the U.S.

The FDA regulates certain cleaning products that come into contact with food surfaces or are used to clean items that come into contact with food, such as dishwashing detergents or kitchen sanitizers.

Under the Food, Drug, and Cosmetic Act (FD&C Act), the FDA ensures that these products are safe for use and do not contain harmful chemicals that could contaminate food.

Household cleaners intended for food-contact surfaces must meet stringent safety standards to ensure they are non-toxic and effective. In some cases, the FDA may require testing and documentation to demonstrate that the product is safe for use in environments where food is prepared or consumed.

To stay compliant with FDA regulations:

If your product is classified as a food-contact substance, compliance with FDA standards is critical. Failing to meet these guidelines can result in product detentions, rejections, or other costly penalties.

Related: The Complete Guide to FDA Customs Clearance

Once you’ve ensured regulatory compliance, the next step is to classify your goods and make sure you’re paying the correct import duties.

Most cleaning products fall under Chapter 34 of the HTS, which covers "Soap, organic surface-active agents, washing preparations, lubricating preparations, artificial waxes, prepared waxes, polishing or scouring preparations, candles, and similar articles."

More specifically, most household cleaners can be classified under the following:

While these products may fall under similar categories of categorization, each can carry very different rates of duty. For example, non-bar soap (i.e. liquid soap), classified under the HTS code 3401.20.00, and certain liquid skin washing products, 3401.30.10, have different duty rates - 0% for the former, and 4% for the latter.

At first glance, you wouldn’t think there’s much of a difference between these two products, as one could reasonably assume that liquid soap could qualify under both codes; but without the right classification, you could end up paying more duties than you actually owe, or even be fined for classifying your product incorrectly.

The easiest and most accurate way to classify your products is to consult with a licensed customs broker.

When most people think of household cleaning products, they’re thinking of disinfectants, detergents, and other household sanitizers. Most of these fall under HTS subheading 3402, which also happens to be the largest category of cleaners imported into the U.S. annually.

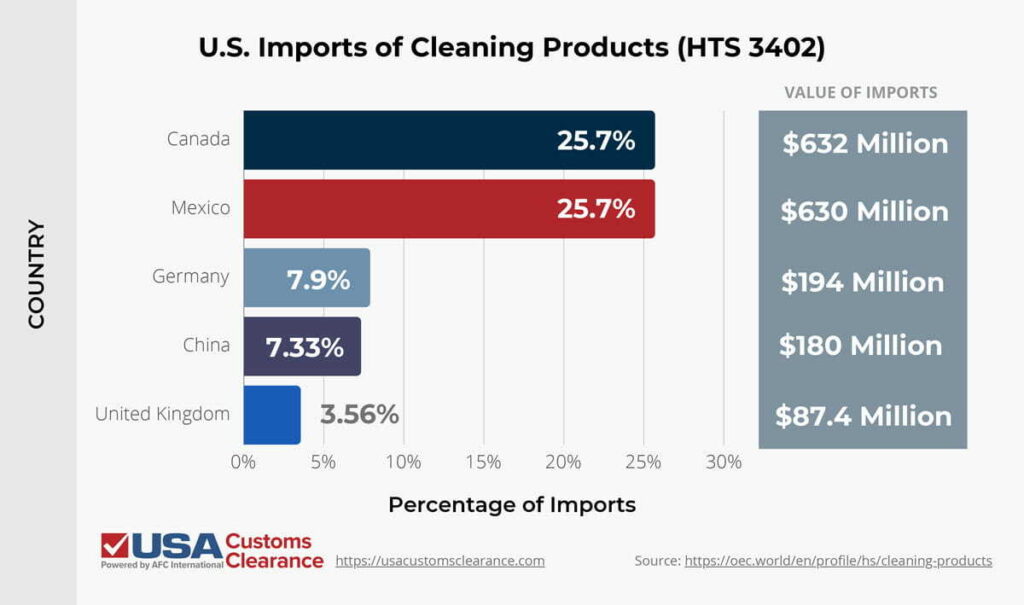

According to OEC, the U.S. is the second largest importer of cleaning products globally, importing $2.45 billion worth of the products in 2022, the vast majority of which come from Canada and Mexico.

Yes, you will need a customs bond when importing most cleaning products into the United States. A customs bond is required for any shipment valued at $2,500 or more, or for any shipment containing goods regulated by a government agency.

Because almost all cleaners are regulated by either the EPA, CPSC, or FDA, any shipment, regardless of value, will require that you obtain a customs bond.

Importing merchandise as heavily regulated as cleaning products can quickly become a complicated process. That’s why we’re here to help.

USA Customs Clearance can offer you a team of licensed customs brokers that can guide you through the importing process, handling all of the regulatory paperwork on your behalf. Schedule a consultation session or give us a call at (855) 912-0406 to learn more or get started today.

Copy URL to Clipboard

Copy URL to Clipboard

Hello,

I represent Berhlan USA LLC and Berhlan de Colombia, company that Imports to USA and Exports from Colombia different products like softteners, detergents, multi purpose cleaners, dish washers, etc.

We are actually looking for a Consulting company that can give us some services related to EPA and FDA compliance.

Thanks.

Hi there, We are looking for an opportunity to explore our products in US market. Our products are Eco Friendly made of 100% natural ingredients without any artificial chemicals for home care applications such as hand wash, surface cleaner, Dish Washer liquid so on so forth. Need your advise to find out right channel partners in US and the on importing in to US These products are need of the our which re chemical free. These products are made in India