Importing copper is a fairly common occurrence in the world of international metal trade. If you want to get in on the lucrative benefits of providing copper to the markets in the U.S., then you’ll need to figure out how to import the commodity into the country. Fortunately, importing copper isn’t an extremely difficult task.

Key takeaways:

Importing copper might seem easy, but you’ll need to follow each step carefully to avoid any mistakes that could damper the importing process.

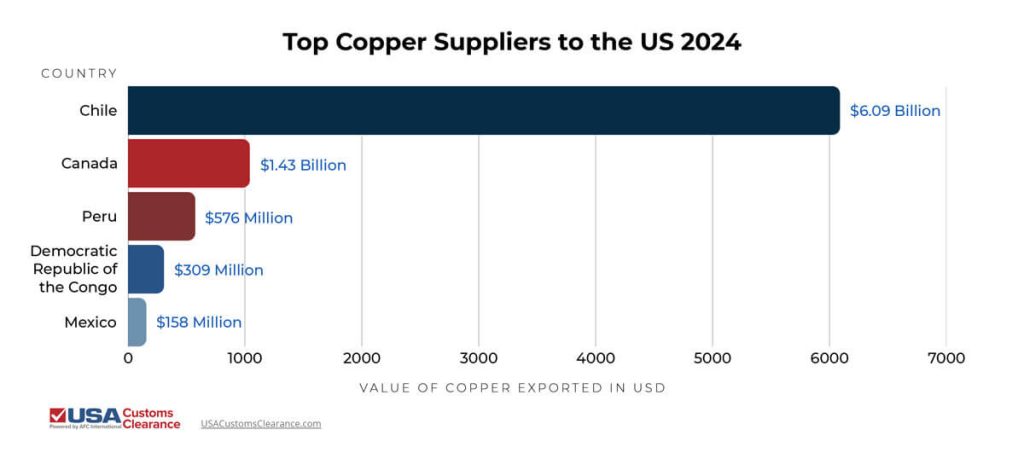

There are numerous countries that you can import copper from. That said, there are five countries in particular that are top suppliers for the United States. We’ve provided a graphic that shows the value imported by the U.S. in 2024.

All the nations listed in the graphic are known for providing quality copper, which makes any of them an excellent choice to source suppliers.

During a 45-minute consulting session, one of our reliable customs brokers can guide you through the regulations you'll need to follow when importing copper. With their support, you can count on a successful importing experience.

Now that you know about the different countries that copper can be imported from, you will need to know what regulations have to be followed when importing copper. While this commodity isn’t the most difficult to import, some procedures are unique to importing copper and require caution.

Your first order of business will be to get your essential import documents in order. All of these documents are required by Customs and Border Protection (CBP), regardless of what commodity you want to bring into the country.

The documents you’ll need include:

Filling out these documents is essential to clear your goods through a U.S. port of entry.

Despite its aesthetic beauty, copper can be considered hazardous if it’s contaminated with heavy metals and other substances. When it comes to handling hazardous waste, the U.S. abides by the regulations created by the Resource Conservation and Recovery Act (RCRA).

The Environmental Protection Agency (EPA) enforces these regulations when hazardous waste is imported into the country.

To stay in line with the RCRA regulations when you import copper, the EPA outlines the following requirements for importing hazardous waste:

If you’re importing hazardous waste copper, you and the exporter will need to abide by the Basel Convention. As with the RCRA, the EPA outlines and enforces the Basel Conventions requirements:

Lastly, keep in mind that when you import copper into the U.S., you will be subject to the RCRA hazardous waste standards. The details requirements that we’ve listed are detailed in the relevant subparts of Title 40 of the Code Of Federal Regulations.

A certificate of origin is required if you want your copper to receive preferential tariff treatment under a free trade agreement (FTA). This allows for a reduced or eliminated duty rate if your copper comes from a qualifying country.

Certificates of origin essentially prove your goods meet all rules of origin requirements, which make them eligible for preferential tariff treatment. It should be noted, the U.S. currently has a 10% baseline tariff on the nations it shares an FTA.

You can still import copper from Canada or Mexico duty free thanks to the United States-Mexico-Canada Agreement (USMCA). However, your goods must meet the USMCA’s rules of origin.

For other FTAs, this isn’t necessarily the case. If you need more assistance navigating FTAs in the current trade environment, then consider scheduling a consulting session with one of our customs brokers.

Our licensed customs brokers are well-versed in the U.S.'s 14 free trade agreements. They can guide you through the rules and regulations during a 45-minute consulting session.

Due to a proclamation signed by President Trump, imports of semi-finished copper products currently have a 50% tariff. This type of copper encompasses a variety of items.

This includes:

This 50% rate will be paid in addition to all other applicable duties and fees on your goods. The tariffs you pay on copper products should be submitted to CBP personnel at the port where your goods will enter the country.

To take advantage of preferential treatment afforded to copper imports from countries that the U.S. has FTAs with, you will need to apply the correct HTS code to your copper shipment. If you don’t, your copper import will be charged the standard duty rate.

Chapters 26 and 74 of the Harmonized Tariff Schedule of the U.S. (HTSUS) are where the corresponding HTS codes for copper imports are located. Chapter 26 is dedicated to various ores, slag and ash, while chapter 74 focuses on codes for copper in all its various forms that it can be imported. Some of these forms include:

Our article on HTSUS codes will help you better understand how to use them.

Getting copper into the country can be a real challenge, even for the most experienced of importers. At USA Customs Clearance, we make importing easier for our customers. With our team of experienced and friendly Licensed Customs Brokers, we’ll make your importing endeavors a success..

If you have any questions about the services we provide, call us at (855) 912-0406 or navigate to our contact page.

Copy URL to Clipboard

Copy URL to Clipboard

Copper wire millbery license

Is there a tariff on impored scrap copper from germany to Jacksonville, Floida