Import challenges are a fact of life that can frustrate even the most experienced businesses. From calculating tariffs to ensuring compliance with trade regulations, each step brings its own set of issues. Knowing where things can go wrong allows businesses to have contingency plans in place.

Key takeaways:

Don’t let import challenges overwhelm you. In this guide, we’ll review common import business risks and challenges, and how to beat them.

Every importer starts out with a vision of bringing goods into the U.S. to grow their business and meet consumer demands. The way forward doesn’t exactly run smooth, though.

Uncertain economic conditions, complex regulations, and shipping difficulties are just a few examples of importing problems. In importing and exporting, these challenges are referred to as trade barriers.

Trade barriers come in many forms, and importers must keep a vigilant eye on them to maintain import compliance. If overlooked, they can result in fines and disruptions to your business.

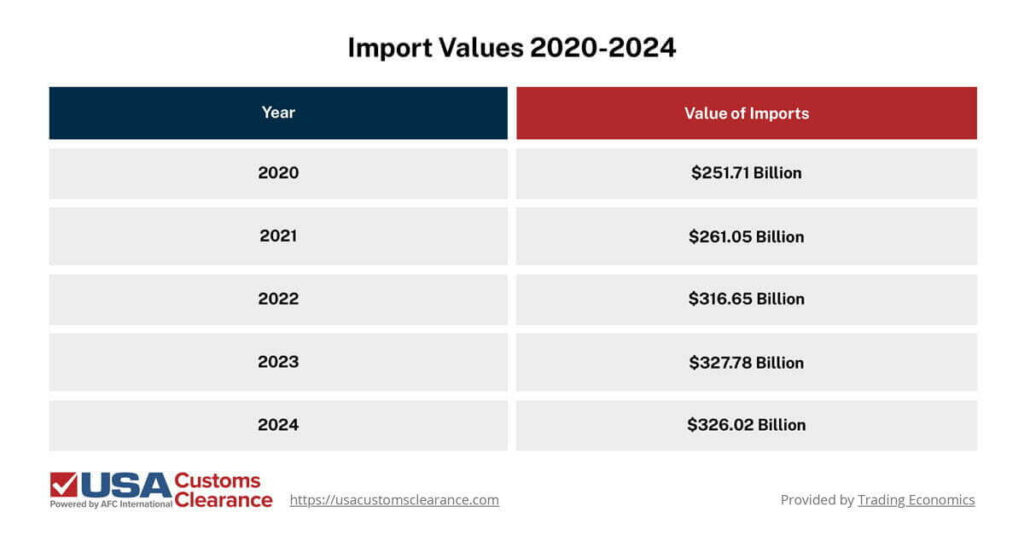

Although import values have shown steady growth, as indicated, that does not mean challenges have gotten any easier to deal with.

The value of imports grew between 2020 and 2023, with imports falling slightly in 2024. Recent efforts to increase U.S.-based manufacturing could be a sign that these values would drop further.

A closer look at the challenges most likely to impact trade will be discussed in the next sections.

Duties are taxes on imported goods and services. Duty rates, usually calculated as a percentage of value, vary by product and country of origin, affecting your bottom line. Most duties are determined by a product’s Harmonized Tariff Schedule (HTS) code, and can stay consistent for years.

Tariffs, although the term is sometimes used interchangeably with duties, are a more direct tax. These rates can frequently change due to new trade agreements, executive policies, or to combat foreign trade practices, making it harder to predict costs long term.

Related: Guide To Imports and Exports

The financial impact of duties and tariffs is direct: they add to the cost of goods, reducing profit margins. For example, a sudden tariff hike on coffee from a popular source might increase the cost of a shipment by thousands of dollars. This cost either cuts into the importer's profit or is passed on to consumers, making the product less competitive.

Importers currently face a series of fees impacting individual commodities and sources. Some are put in place intentionally to discourage high volumes of certain products. Others are simply there as standard fees.

Aside from standard rates of duty based on HTS codes, here are other fees and tariffs to watch out for:

A recent example of an EO resulting in unexpected fees were the 25% ad valorem duties applied to goods out of Canada and Mexico. These affect imports that don’t meet the FTA origin standards, allowing for free or reduced duties when entering the US.

Related: How to Complete a USMCA Certificate of Origin

All these fees add up to raise the cost of doing business. They aren’t stopping you from importing, but might require you to re-examine your trade strategies.

To lessen the impact of tariffs and other costs, importers can:

Doing your research before committing to a purchase is essential to avoiding certain high tariff rates. Beware of certain online suppliers who can make it easier to buy a wide variety of products, but won’t warn you about attached fees or things like trade mark laws.

This is especially true when importing from places like China, whose goods are subject to Section 301 tariffs.

Related: A Guide to China's Section 301 Tariffs (2025 Update)

Navigating tariffs can be a real challenge when you're an importer. Our Licensed Customs Brokers will show you which ones apply to your goods.

Non-tariff trade barriers are restrictions that countries use to control and regulate goods and services across their borders. They can take many forms and create challenges for importers by limiting what goods that can be brought into a country or requiring extra steps before entry that could result in delays if not handled correctly.

Unlike tariffs, these barriers are often regulatory or procedural in nature. While inconvenient for importers, they can serve to protect consumers, the environment, and local economies.

Such barriers aren’t limited to what the US imposes. Countries can limit exports of certain products, as an example.

Here are some examples of non-tariff trade barriers that U.S. importers may encounter:

These barriers require importers to be well-versed in the regulations set forth by U.S. government agencies, particularly the ones overseeing the products being entered.

If you are unsure of which agencies may regulate your products, consulting with a licensed broker can provide you with the needed contacts.

Since so many of these non-tariff barriers involve product regulation, let’s review the possible consequences.

When importing goods into the United States, you’re expected to meet all legal requirements. The various regulatory agencies have standards in place to ensure safety, compliance, and fair trade. If your goods fall short of these standards, the repercussions can be severe.

Here's a snapshot of potential penalties.

Understanding and adhering to all U.S. standards and regulations will save you from most of these issues.

Beyond specific trade barriers, whether tariff-based or otherwise, working within the international trade industry takes the challenges all businesses typically encounter and compounds them.

Some of these challenges are:

These risks affect all businesses at different levels. However, as with trade barriers, doing your research ahead of time and working with the right partners can save you money and peace of mind.

While importing goods to the USA can be challenging, it’s also a great opportunity for entrepreneurs seeking profitable opportunities. With an complete customs brokerage services on your side, these opportunities are easier to realize.

At USA Customs Clearance, we offer a number of services to assist importers, including:

Don’t let import challenges affect your business. Give us a call at (866) 989-3538, or contact our team of customs experts online. With over a century of combined experience, our brokers can help you overcome import obstacles while you focus on your business.

Meet with one of our Licensed Customs Brokers for a 45-minute consulting session. They'll help you overcome any challenge by showing you the correct steps to follow.

Copy URL to Clipboard

Copy URL to Clipboard

Add your first comment to this post