Import costs from Vietnam include a variety of charges, which can fluctuate based on market or political conditions, making it a challenge to accurately anticipate the total expenses. Mistakes or deliberate attempts to avoid these fees can lead to stiff penalties from the U.S. Customs and Border Protection (CBP).

Key takeaways:

If you want to learn how to import from Vietnam, join us as we examine the fees associated with your imports.

The U.S. and Vietnam have maintained healthy trade relations since the 90s. That said, you’ll still have to pay a variety of imports costs when you purchase goods from Vietnam. Let’s start by taking a look at customs and port-related expenses.

In addition to those listed above, there are two types of duties worth specific mention: countervailing and anti-dumping duties.

Collectively known as AD/CVD, they are used in two particular situations:

AD/CVD import duty rates are usually higher than average and sometimes subject to special conditions, such as total units imported within a given time frame. Both duties are intended to maintain fair and competitive trade between suppliers in the USA and those in foreign countries.

Be warned that there are currently 30 active AD/CVD orders impacting products from Vietnam, with another 10 currently under investigations initiated by the International Trade Administration (ITA).

In addition to costs inflicted by customs authorities and ports, you’ll also have to take transport expenses into consideration.

Here are some common shipping costs that importers may encounter:

Of course, shipping costs are just one facet of import expenses from Vietnam. Customs charges, such as tariffs and duties, make up a significant portion of overall import fees regardless of the country of origin.

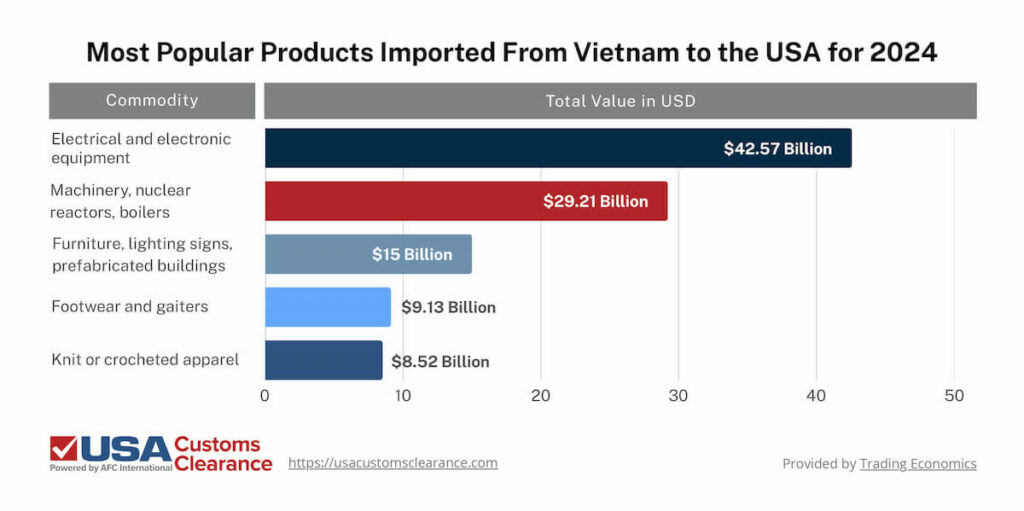

In 2024, the United States received $135.88 billion USD worth of imported goods from Vietnam. The lion’s share of that value belongs to the following five commodities.

In recent years, as companies have attempted to move production and sourcing out of China due to Section 301 tariffs, Vietnam has made itself an attractive alternative. Provided that high reciprocal tariffs can be kept low, it remains a good option.

Importing from Vietnam is a lucrative opportunity for stateside businesses. However, to make the most of that opportunity, you’ll need a deep understanding of the relevant costs.

Aside from the standard duty owed based on a product’s HTS code, you’ll have to pay a 20% reciprocal tariff on all imported goods from Vietnam. There is an additional 40% tariff that will be applied to Vietnamese goods that are transshipped from China.

Aside from that, just be aware of that duties are usually charged as a percentage of a shipment’s total value. That percentage changes based on a number of factors, but the two most significant factors are the previously mentioned HTS code and country of origin.

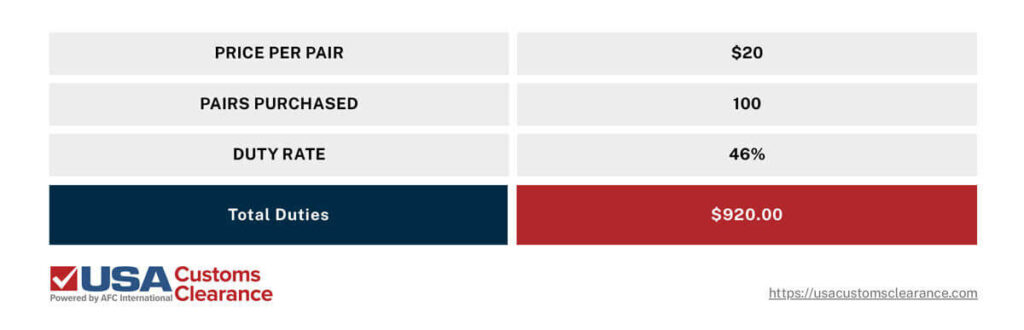

To provide an example, we can calculate duties on a common export from Vietnam: footwear.

Let’s say you’re an importer in the USA and you plan to import sneakers made in Vietnam.

You’ve consulted a customs expert or used an HTS code look up tool to find the tariff classification for these shoes is 6402.91.90.05. Since there’s no FTA with Vietnam, the shoes are subject to a flat 20% duty rate plus the 10% reciprocal tariff.

Assuming a quantity of 100 shoes valued at $20.00 per pair, the duty calculation would work as follows.

Keep in mind that this is a simplified example meant to illustrate the basics of duty calculations. For businesses importing large quantities of varied goods, the process becomes far more complicated and subject to penalty-producing errors.

The fines an importer can face for incorrect paperwork submission or duty calculation are substantial, even as high as $5,000.00 for a single, crucial error. Importers can significantly reduce the risk of these errors by working with trained customs brokers to ensure all information and fees submitted to CBP are on-time and accurate.

The fees associated with importing goods from Vietnam are numerous and difficult to calculate for those without the proper training or certifications. To avoid these issues, importers frequently work with customs clearance experts, such as ourselves.

The USA Customs Clearance team has over 100 years of combined experience helping stateside and foreign-based importers to clear the complicated U.S. customs process.

Look to us for expert assistance with services such as:

Don’t play guessing games with import costs from Vietnam. Call us at (855) 912-0406 or drop us a line via our website. We have the resources and know-how to help you with any and every aspect of the importing process.

During a consulting session, one of our Licensed Customs Brokers will walk you through your responsibilities when you import from Vietnam.

Copy URL to Clipboard

Copy URL to Clipboard

Hi

I came across your site while doing a web search. You mentioned the following about the tariff changes on April 9, 2025:

"On April 9th, 2025, Donald Trump decided that he would pause the 90-day reciprocal tariffs on all countries, except for China. For the next 90 days, Vietnam will receive a flat 10% tariff."

I’d like to clarify — previously, the duty on Knit Top (HS Code 6109.90) was 33%. Does this mean the duty will be reduced to 10% for 90 days? Or will the 10% be added on top of the existing 33%, making it 43%?

Thank you.